Should traders double down on their Bitcoin accumulation?

Bitcoin’s price endured quite a few price corrections after it touched its most-recent ATH around the $42,000-mark. Corrections would be an understatement, perhaps, since Bitcoin’s price has fallen by over 15 percent in the last three days alone, with the cryptocurrency trading at $31,181 at press time.

Understandably, BTC’s performance has fueled speculations that the king coin’s bull run might be at an end, especially since at press time, Bitcoin’s trading price was lower than yesterday’s opening price.

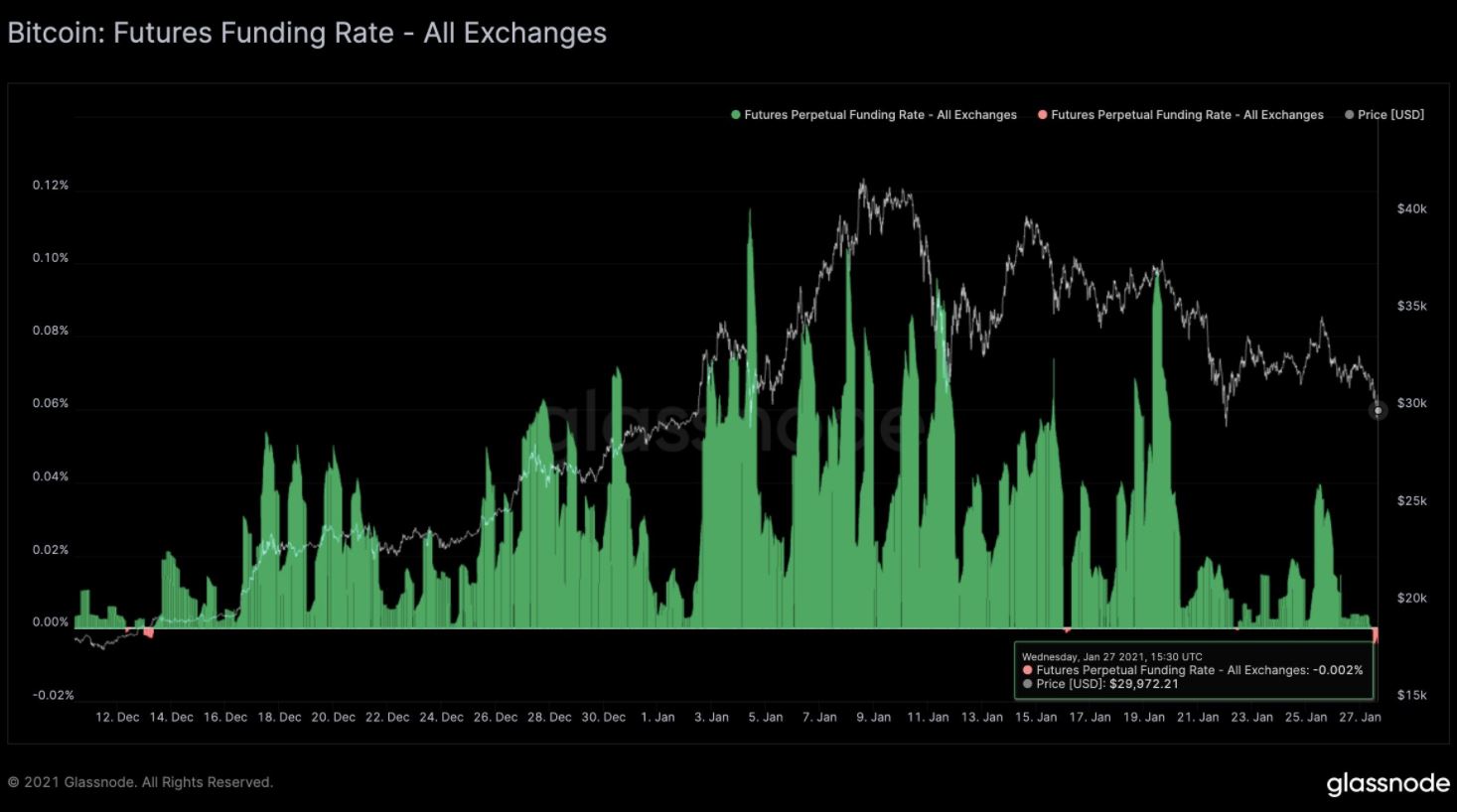

Source: Glassnode

While Bitcoin’s price performance is important, it alone isn’t enough to identify the trending market sentiment. Bitcoin Futures funding rates have always been a key metric in determining investor sentiment, as well as the overall direction of the market. According to market data provider – Glassnode, BTC’s funding rates fell into the negative zone, a development that suggested that short-sellers are dominating Bitcoin’s market.

Funding rates have always noted a correlation with market sentiment. In the case of Bitcoin, if the funding rate is too high, then the market may experience a bit of volatility, with traders paying a premium to go long. On the contrary, when the funding rate is low and in this case, in the negative zone, the market can be understood to be cooling off, with the crypto likely to trade within the confines of a narrow range.

Given that Bitcoin’s price kept registering new ATHs just a few weeks ago, the current consolidation phase coupled with price corrections does seem like an eternity. However, while it may not be fully warranted to argue that Bitcoin’s price is going to see a rapid rise in the short-term, there is more than one reason why Bitcoin traders can be optimistic in the long run.

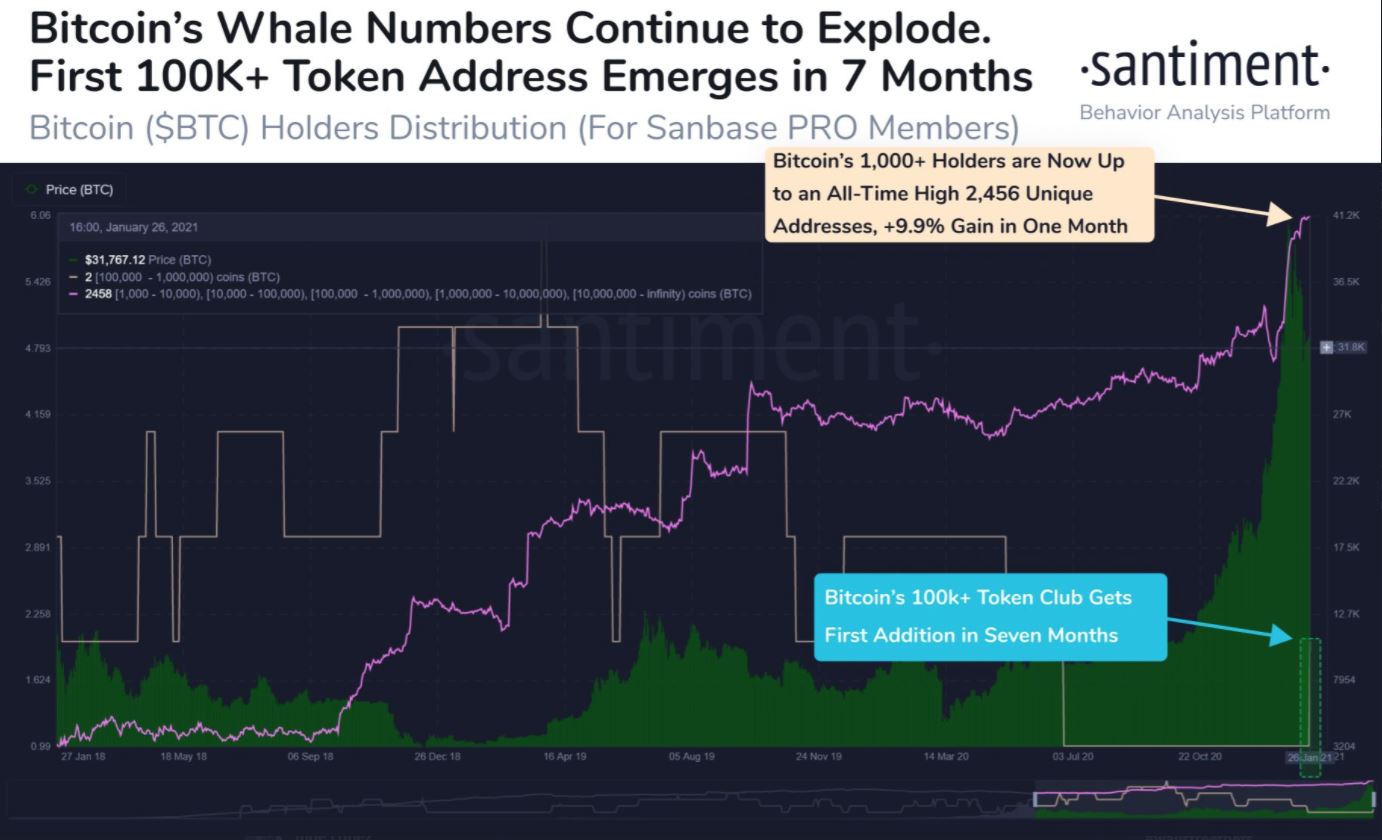

Source: Santiment

For starters, whale addresses for Bitcoin have continued to grow. According to Santiment, there are around 233 addresses with over 1000 BTC in each of them, along with another address that is reportedly holding over 100k Bitcoins in it. Ergo, despite the current market sentiment, long-term investors continue to back Bitcoin.

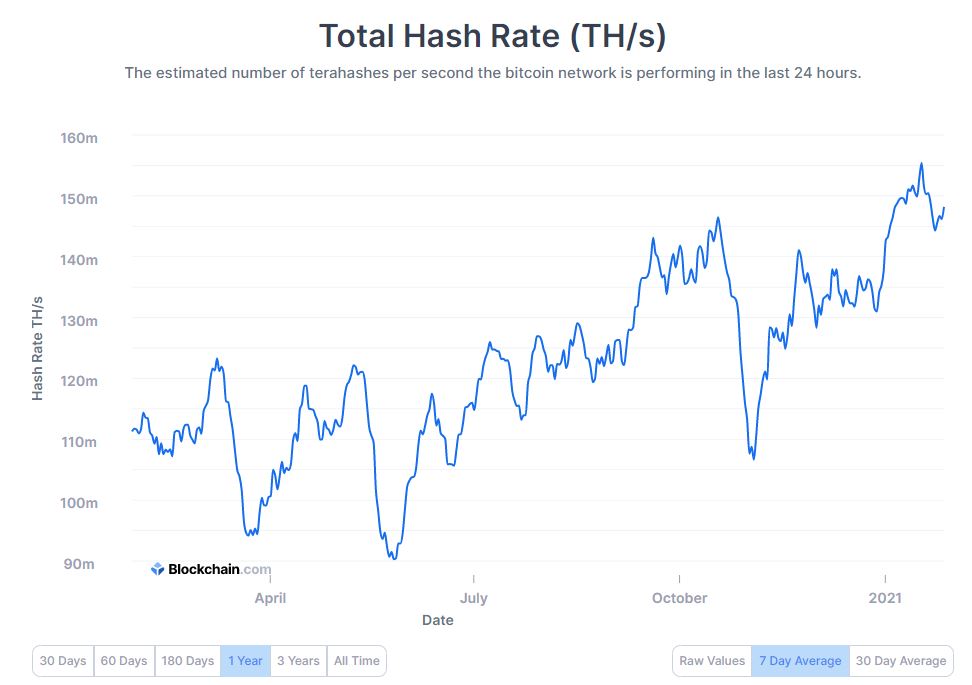

Source: Blockchain.com

The hash rate of Bitcoin has also been another promising metric. After establishing an ATH on 17 January, Bitcoin’s hash rate (7-day average) is continuing to head north. This is promising for the long-term prospects of the coin as it shows that there are enough resources contributing to its network security and robustness.

While funding rates for Bitcoin have gone into the negative zone, traders can take this in their stride and see this as a key opportunity to accumulate more Bitcoin. Given its potential long-term price trajectory, accumulating more BTC at this level may not be such a bad idea after all.