Why Bitcoin hitting $100,000 seems more likely than ever

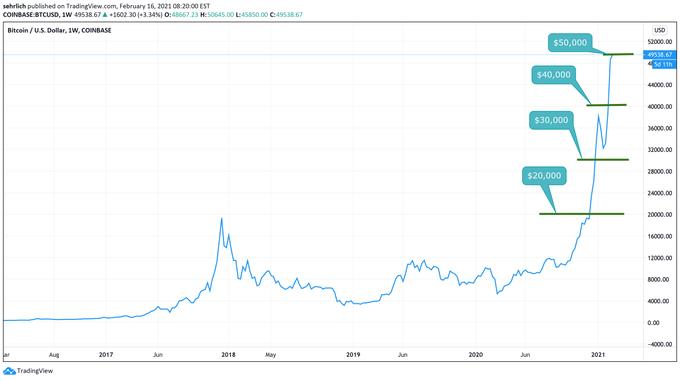

The possibility of Bitcoin hitting $100,000 is as real as it ever was, with the cryptocurrency crossing $50,000 on exchanges over 24 hours ago. Now, Plan B and his top two models – S2F and S2Fx – had predicted that Bitcoin would cross $100,000 by April 2021. However, based on data from Unfolded, the probability of Bitcoin’s price hitting $100,000 now stands at 14 percent.

In fact, on-chain analysts are skeptical in the short-term, seeing how we are in a phase of extreme greed in Bitcoin, with the same likely to put selling pressure on the asset.

Source: Twitter

However, some would disagree with such an assessment. In fact, according to Steven Ehrlich, Director of Research at Forbes, each time Bitcoin passes a psychological hurdle, it makes the next one even easier to clear. In a recent tweet, he said,

“There is still work to go, but $100,000+ seems a lot more feasible than it did 6 months ago.”

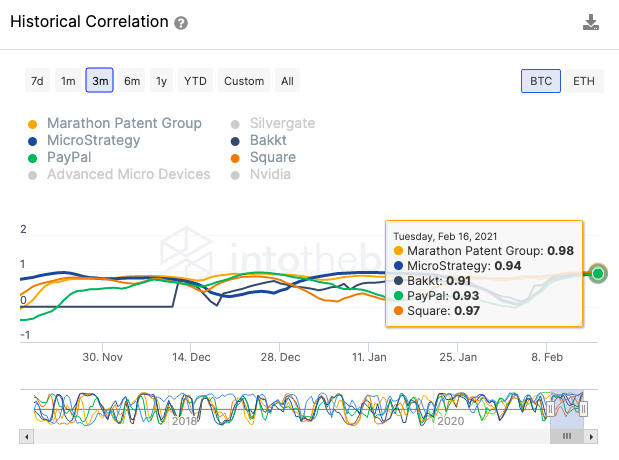

Besides, crypto-experts and technical analysts couldn’t agree more as the 30-day correlation between historical market stocks of PayPal, MicroStrategy, Bakkt, and Square all point towards further bullish developments.

Source: IntoTheBlock

The correlation in stocks of the institutions that have recently bought Bitcoin off their balance sheets is at its peak. Here, what’s even better is that their stocks are performing way better than expected. MicroStrategy’s stock MSTR, for instance, was up by 66.4 percent in the past month alone, at press time. With shareholder value increasing following the firm’s Bitcoin investment, the situation is currently bullish for BTC as more institutions are drawn to the cryptocurrency.

Further, on-chain data from IntoTheBlock seemed to suggest that widespread institutional interest may have arrived already. The average transaction size recorded on the Bitcoin blockchain hit a record of $4,40,000. The average transaction size is up 16 times in a span of 12 months.

Finally, apart from widespread institutional interest and the correlation in stocks of top companies, another bullish metric are the annualized premiums on the March Futures on platforms focused on retail investors. In fact, premiums have increased further this week, with the average standing at 44 percent.

The annualized funding rate was well above 1000 percent, at press time. Post two weeks of wild price swings, the levels seemed to be back to higher than average. These key metrics all point towards $100,000, and the price level seems closer than ever, despite BTC crossing $50,000 only briefly. The price rally may continue to march towards $100,000 in the following weeks and months of 2021.

Source: Coinstats