How did Bitcoin lending become so popular?

The rising valuation of Bitcoin witnessed the growth of several sectors involved with the digital asset. The crypto lending market has exhibited extraordinary growth as institutions-focused Genesis registered a 245% growth in their outstanding loans in 2020.

While the BTC lending market is young, its swift adoption has created a billion-dollar industry, which is one of the benchmarks of development for the current Bitcoin ecosystem.

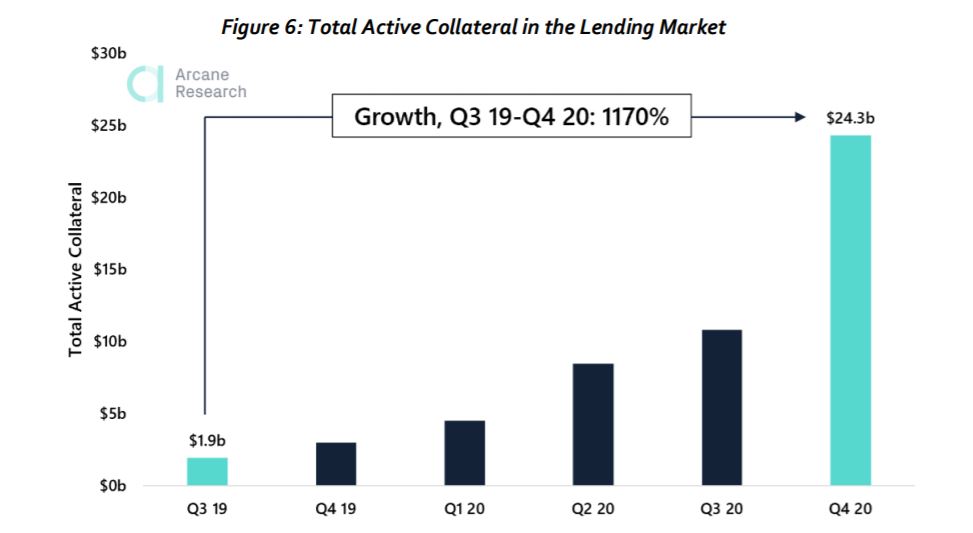

Total Bitcoin collateral grew by 1170%

According to Arcane Research’s recent Banking on Bitcoin report, the total active collateral in the BTC lending market has increased to ~$25 billion from $2 billion in 12 months. It was estimated that the number of Bitcoin used for collateral at the moment is around 420,000 BTC, however, this estimation is based on a modest evaluation that only 50% of the active loans are backed by Bitcoin collateral, whereas various industry experts believe it could be close to 70-80%.

While there are various Bitcoin lending companies in the current market, the impact of the institutional lending organization such as BlockFI and Genesis have been vital.

As mentioned earlier, Genesis’ active loans outstanding improved from $649 million in Q1 2020 to a whopping $3,821 million in Q4 2020. From Q3 to Q4, the growth was roughly 80%.

BlockFi registered similar impressive numbers, with a 50x increase in retail loans BTC collateral from Q4 2018 to Q4 2020; from $10 million to $500 million.

Bitcoin lending’s popularity grows

There are multiple factors that played into the expansion of the BTC collateral market. Over the past 12 months, the asset has received significant recognition after recovering at a rapid rate following the March 2020 crash. However, some of the most common reasons include leveraging on an existing position, arbitrage plays, and covering operation costs without selling any crypto holdings.

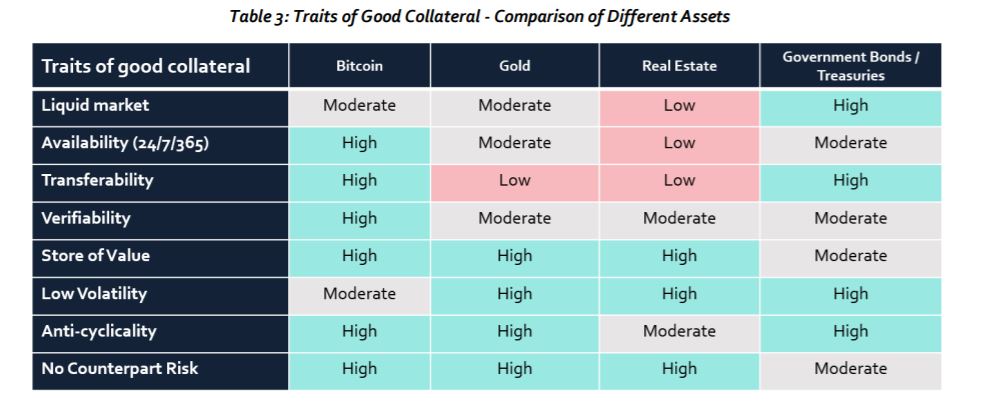

Some of its innate properties have improved over the few months. Bitcoin’s market has a 24/7 availability, which can be traded all year round and it is easily updated. Other assets such as Gold are only trading during the working days of the week, which is close to 30% less than Bitcoin.

Its store-of-value credentials have also improved drastically, with 75% of Bitcoin remaining in profit throughout its history.

However, one of the major reasons involves the ease at which BTC loans can be processed. Traditional loan methods require a certain amount of credit score, a tediously long process, and a lot of paperwork.

With Bitcoin, users do not need to establish a relationship with their banks to get a loan and they can easily lend from the emerging borderless Bitcoin lending market.