Another key metric has this to forecast about Sushiswap’s price

Projects that were rangebound earlier are now rallying. Sushiswap emerged as a food/meme coin that happens to be a DeFi token which got listed across top exchanges. Traders who lost the opportunity to book unrealized profits in previous rallies have another opportunity with Sushiswap.

On crypto Twitter, Sushi has emerged as the next Doge. There are several reasons for it, it’s easy to buy Sushi, it ranks in the top 5 DeFi coins, and the second biggest meme coin following Doge on Robinhood and Coinbase.

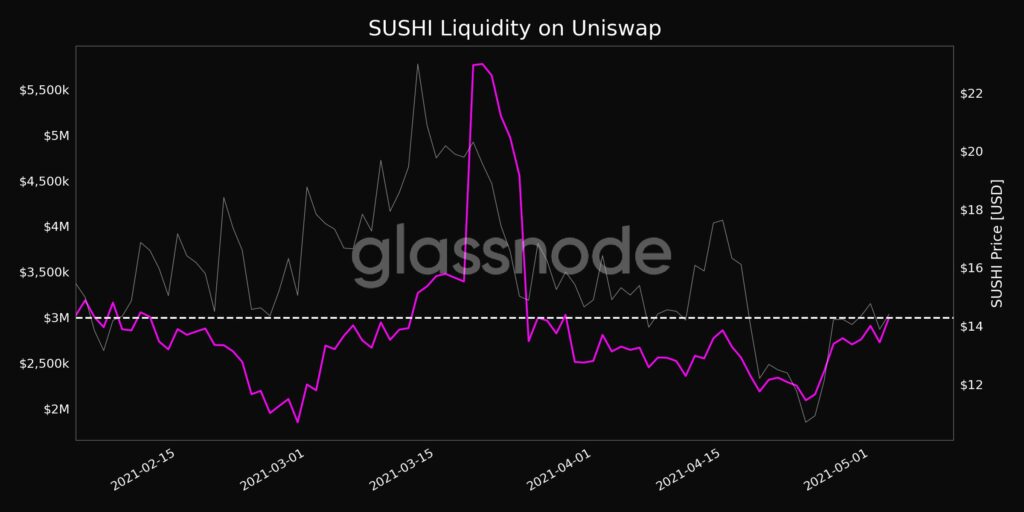

Traders have anticipated that Uniswap’s V3 rally will be followed by Sushiswap. The current metrics of Sushi support the bullish sentiment. Sushi’s liquidity on Uniswap has reached a 1-month high of $2.99 Million. The previous high was hit less than a week ago, based on data from Glassnode. The market capitalization is currently $1.8 Billion and the trade volume is up nearly 17%; the sentiment is bullish for SUSHI.

SUSHI Liquidity on Uniswap || Source: Twitter

The number of transfers’ 7-day moving average has hit a 1-month high of 286, based on data from Glassnode, and despite that, the price is nearly 40% away from its ATH. There is room for SUSHI’s rally.

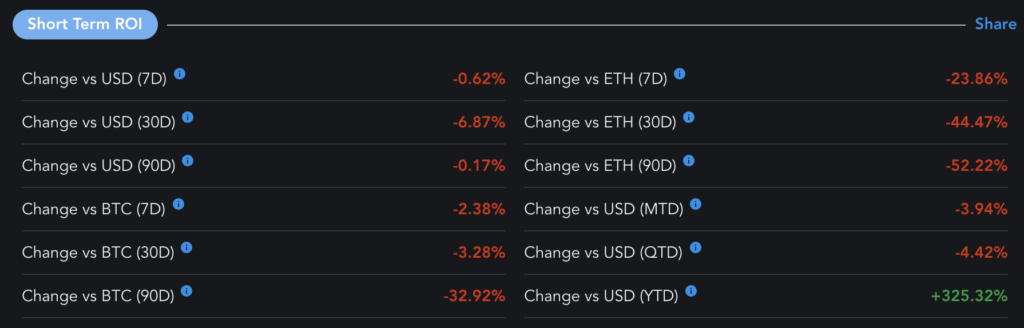

Though the price remained largely rangebound from $12.78 to $14.89 in the past week, SUSHI’s concentration by large HODLers has hit 90%. This is another metric key to SUSHI’s price rally. Overall, the on-chain sentiment is bullish and the inflow of investment is up 13% based on data from intotheblock. SUSHI has emerged as a profitable DeFi investment for traders since the beginning of 2021, and with a low short-term ROI and high long-term ROI, several profit booking opportunities seem to be available for traders.

Source: Messari

YTD, Sushi’s ROI is 325.32% against USD, it is largely negative in most other cases. It is likely that with the ROI and on-chain analysis, Sushi may lead a DeFi rally.