Despite a 50% drop in TVL, here’s SushiSwap differentiating factor

Rallying to the $10.90 level, SUSHI’s price was up nearly 6%. The trade volume has dropped to the 16%, however, the price has resisted selling pressure. The concentration by large HODLers was at 89%. SUSHI’s rally is leading DeFi’s bullish narrative for summer 2021. Following the drop during the dip, SushiSwap facilitated its highest 7-day volume despite a 50% drop in its TVL.

Source: Twitter

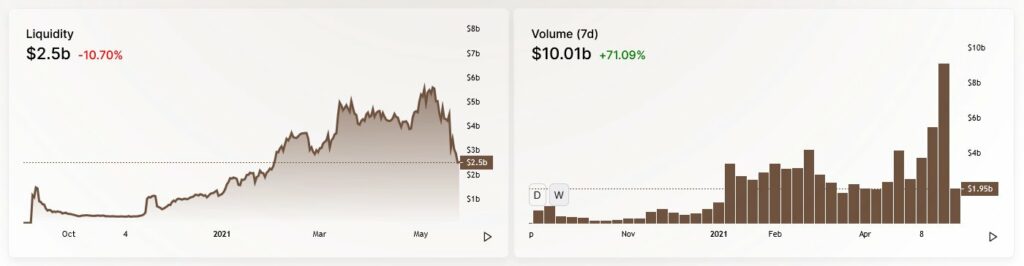

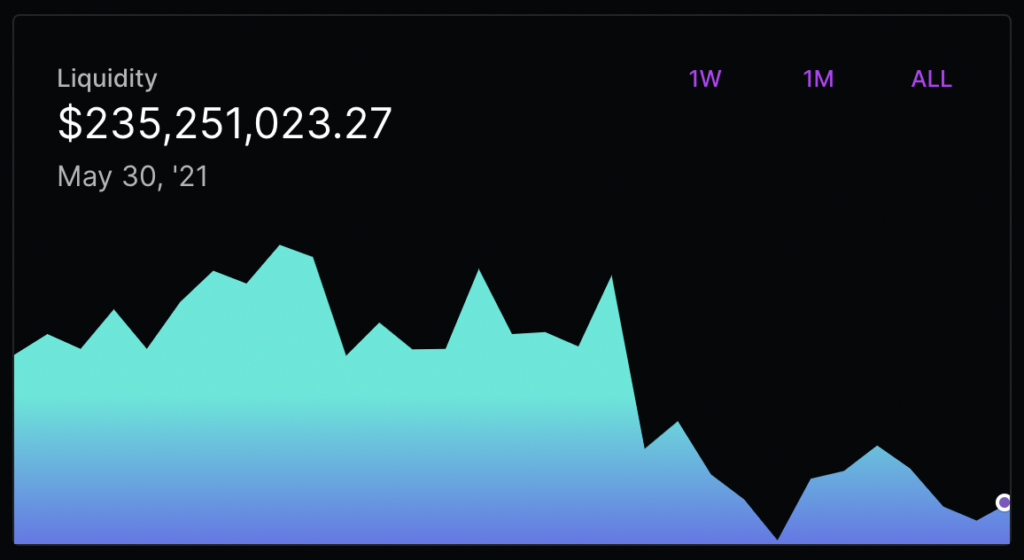

Based on the above chart, despite a drop in liquidity, the volume is up over 70% in the past week. As of May 30, 2021, the liquidity is $231 Million based on data from SushiSwap Analytics.

SushiSwap Liquidity | Source: SushiSwap Analytics

At the current liquidity of SUSHI, at the $10.91 level, only 28% HODLers are profitable. Concentrated in large wallets, SUSHI has 89% HODLers and nearly 75% have held SUSHI for less than a year, however, longer than a month. The network has witnessed over $2 Billion worth of transactions in the past week alone, and the increasing network activity fuels SUSHI’s bullish narrative.

The on-chain sentiment is also bullish according to data from intotheblock. The price remains over 50% away from its ATH, however, despite that the liquidity is recovering. The trade volume is at the same level as the first week of May 2021. Among other top DeFi tokens, SUSHI has led the way and offered users borrowing and lending protocols, yield farms, staking opportunities, as well as an “app store”. The new yield farms on SUSHI on Polygon are bringing in more tokens than chains, and Sushiswap’s latest partnership with Lever Network for liquidity mining is key to SUSHI’s bullish narrative.

As the second DeFi protocol that generates more fees than Bitcoin, SUSHI’s rally has already started its recovery from the $7.27 level.

Source: Twitter

Despite ranking below top 50 cryptocurrencies based on market capitalization, increasing demand is likely to increase the price and the market capitalization. Since a % of transaction fees is returned as staking rewards and the lucrative incentives are increasing the network activity, SUSHI’s bullish narrative is fueled by these metrics.

What differentiates SUSHI from other projects is that it is the most productive major asset in DeFi and with over $3 Billion in DEX volume ($2.80 Billion on Ethereum, $345 Million on Polygon and $27 Million on Fantom). Trading fees beats the competition from ETH’s L2 scaling solutions and that’s a $1.60 Million in protocol revenue as of May 2021, $579 Million in a year.