Who benefitted the most from Bitcoin and how?

Bitcoin, the world’s largest cryptocurrency, finally sustained a breach of its 2017 ATH on the 16th of December on the back of exponential price appreciation on the charts. However, it wasn’t done, not by a long shot. In fact, at the time of writing, BTC was valued at just over $34,000 on the charts, having risen to as high as $64,000 less than two months ago.

Now, while the degree of corrections in the said case has been understandably significant, the fact of the matter is Bitcoin, at press time, was still giving YTD returns of over 35%, with the 1Y change v. USD as high as 246%.

What this means is that brushing aside the obvious, exaggerated complaints of volatility, Bitcoin has once again proven its credentials as a store of value asset. This narrative is particularly powerful for crypto-holders in countries where citizens might not necessarily have access to high-performing assets.

It is in the context of the same that it’s worth looking at who benefitted the most from the world’s largest cryptocurrency’s bullish boom, with the same being the subject of Chainalysis’s latest report. Here, it’s worth noting, however, that the said report only looked at 2020’s realized gains. In light of the fact that 2021 saw BTC climb even higher, one can expect the figures for the same to be even higher.

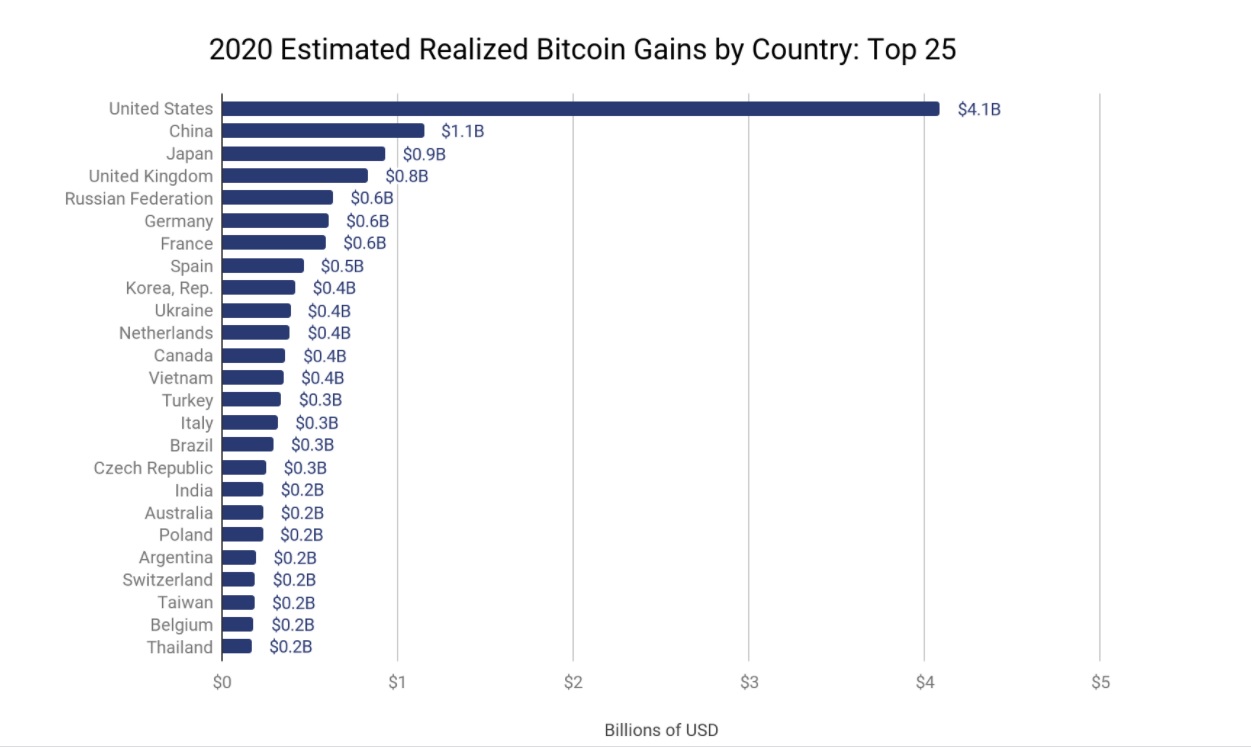

The aforementioned report found that investors based in the United States made over $4 billion in realized Bitcoin gains over the course of the year, over 3x more than China, a development that probably came on the back of U.S-based exchanges noting huge inflows in the early part of the year, most of which appeared to have been realized by the end of it.

Source: Chainalysis

The more interesting findings, however, were down the charts. While everyone expected the United States and China to lead from the front, what wasn’t really expected was the contradiction in well-to-do economic metrics and Bitcoin investments, and by extension, Bitcoin realized gains.

Consider this – according to Chainalysis, countries like Vietnam and the Czech Republic are punching above their weight. Vietnam, a low-middle income country, while ranked 53rd on the GDP charts, was ranked as high as 13th for Bitcoin investment gains with figures of $351 million. Similarly, while the central European country was 54th on the GDP charts, it was 18th when realized Bitcoin investments were looked at.

On the contrary, there was some variation to this juxtaposition too, with India being the prime example. The world’s fifth-largest economy with a GDP of $2.9 trillion was ranked a “lowly 18th.” Chainalysis attributed the same to,

“This may be a result of the Indian government’s historical unfriendliness to cryptocurrency.”

Here, it should be underlined that such unfriendliness was seen in countries like Turkey too, with the Erdogan-led government and the central bank regularly cracking down on crypto-holders and entities dealing with them. Even so, the nation-state was ranked 16th with respect to realized Bitcoin gains for 2020. It can be assumed that this might not be the case in 2021, especially since recent actions have shaken the local community’s confidence in the asset class.

The aforementioned findings should be read in the context of recent development, however – El Salvador’s decision to make Bitcoin a legal tender.

The Central American country doesn’t have strong GDP figures to boast of, with the same growing by over 3% just twice this century. What’s more, a World Bank report last year hypothesized that the country’s economy could contract by almost 9% on the back of the COVID-19 pandemic.

For such a country, especially a country where financial inclusion is a struggle, the acceptance of Bitcoin as legal tender is a huge step, one that underlines the value associated with the world’s largest cryptocurrency.

With the aforementioned Chainalysis report also doubling down on BTC’s credentials as a credible store of value, given the fact that the crypto is expected to hike even more, these realized gains are likely to grow greater this year.