Three reasons why traders can expect this with AAVE in their portfolios

AAVE, at the time of writing, was consolidating in the buy zone at a price level of $268.31, based on CoinMarketCap. What’s more, AAVE’s market capitalization was $4.2 billion, with the altcoin among the market’s top 30 too.

At 80% of its circulating supply, AAVE had over 25% profitable HODLers at the said price level. In fact, this altcoin was observed to have a high concentration by large HODLers, 87%, and this has been a driver for AAVE’s rally. Here, it’s also worth noting that the highest percentage of HODLers have bought AAVE and held it for less than a year, further supporting the narrative of high short-term ROI.

Over the past week, the number of large volume transactions on the AAVE network has increased, hitting $555 million, and this is another metric that supports both the long and short-term bullish narratives. What’s more, the Polygon DeFi summer rally is on, with over $85 million in liquidity rewards for Aave’s Polygon Markets. AAVE’s 30,000 users have over $7.5 billion locked in value on Polygon and this makes AAVE one of the most widely used liquidity protocols on Polygon.

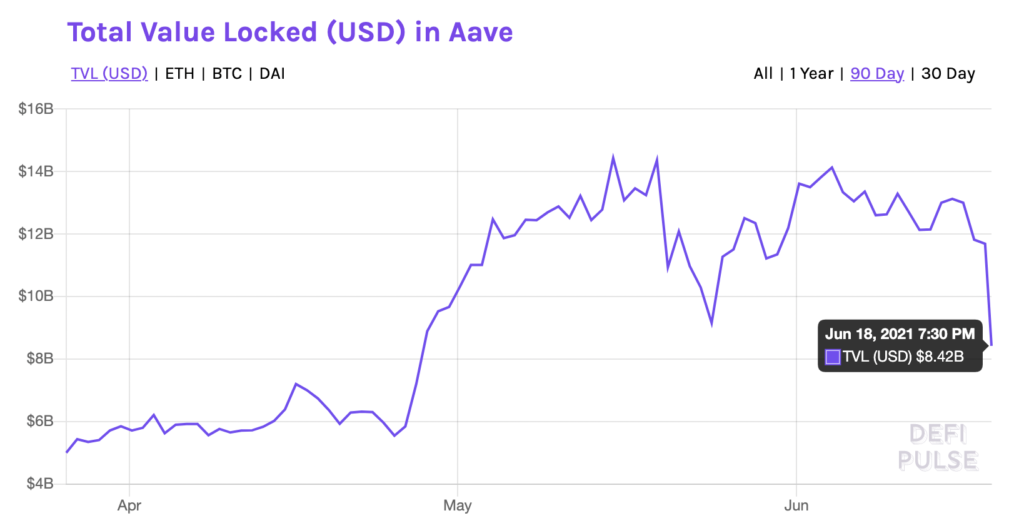

AAVE’s dominance in DeFi too continues to remain above 15% and as a lending protocol, the DeFi project remains among the biggest in the category, despite its TVL falling dramatically recently.

AAVE TVL | Source: DeFiPulse

AAVE has $85 million worth of rewards on offer for traders, increasing the number of interested traders and investors. Projects like DeFi legos being built on top of AAVE Polygon markets provide a low-cost, high-speed, complementary solution to Ethereum’s deep liquidity markets for top DeFi projects. This is further supporting the bullish narrative for AAVE since DeFi’s need for deep liquidity is large.

Over the past week, the social media mentions and social volume for AAVE have dropped. A drop in social volume usually corresponds with an increase in price, and a peak corresponds with a drop. Based on this trend, it is likely that AAVE may rally soon and it is likely to offer high returns in 2021, relative to other DeFi projects.

ETH L2 scaling solutions may pose as competition in terms of trade volume and trader interest, however, AAVE’s rewards and partnerships are likely to boost the returns in the short term, warranting higher investment inflows and a price rally.