You need to know about rug pulls and its effect on Ethereum and DeFi

Among hacks and malicious maneuvers plaguing the DeFi ecosystem, rug pull is currently top of the list. With several recorded instances in the past six months, rug pulls have thrived on DEXes. The top 3 DEXes have over $5 Billion in USD locked on based on data from DeFiPulse. Rug pulls have thrived on DEXes because DEXes are the types of exchanges that allow users to list tokens for free and without audit, unlike in centralized cryptocurrency exchanges.

With more and more rug pulls, more DeFi project tokens slip into the hands of malicious actors. What’s the effect on retail traders? A rug pull, just like any other malicious activity that leads to a drop in liquidity; the tokens are pulled out of circulation and may flood exchanges at a later date, having a significant impact on the price.

This impact on price is unpredictable both in timing and magnitude. There is an impact on the ETH network and ETH HODLers as well. Proof of Stake does not dilute holders. Once they have 32 ETH, it remains the same. But Proof of Work leads to the creation of a competitive market. Innovating and upgrading the project are the only two choices, or DeFi projects may be kicked out of consensus. There is no such system in Proof of Stake.

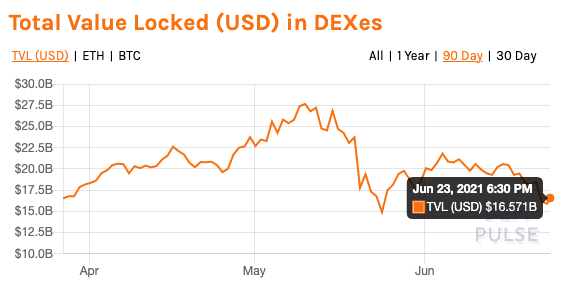

The current impact of this on DeFi’s TVL can be witnessed in the 90-day TVL.

DeFi projects TVL 90 days || Source: DeFipulse

The rug pull raises several issues that affect the price and in turn affect traders and HODLers, through nondilutive consensus, MEV seniorage, hack/theft of large deposits, and exchange validators. All these factors lead to the centralization of the consensus which should have been decentralized in the first place, considering that is the focus of Defi projects and the ecosystem of a DEX. The same decentralization that makes it lucrative for traders, makes it lucrative for hacks with malicious intent.

According to Analyst Checkmatey on Twitter,

PoS shouldn’t end up permissioned, but it may, following these incessant rug pulls

In terms of the impact on price, DeFi projects have consistent demand owing to the incentives and rewards, rewards that come from staking. Rug pulls are likely to negatively impact the demand and the staking, leading to a drop in price, as an immediate effect. This unknown variable of hacks is likely leading to a drop in the value of portfolios of, since the frequency of hacks has increased in 2021.

![Uniswap [UNI] price prediction - Traders, expect THIS after altcoin's 14% hike!](https://ambcrypto.com/wp-content/uploads/2024/12/UNI-1-400x240.webp)