Here’s what pushed Litecoin’s SegWit usage to 90%

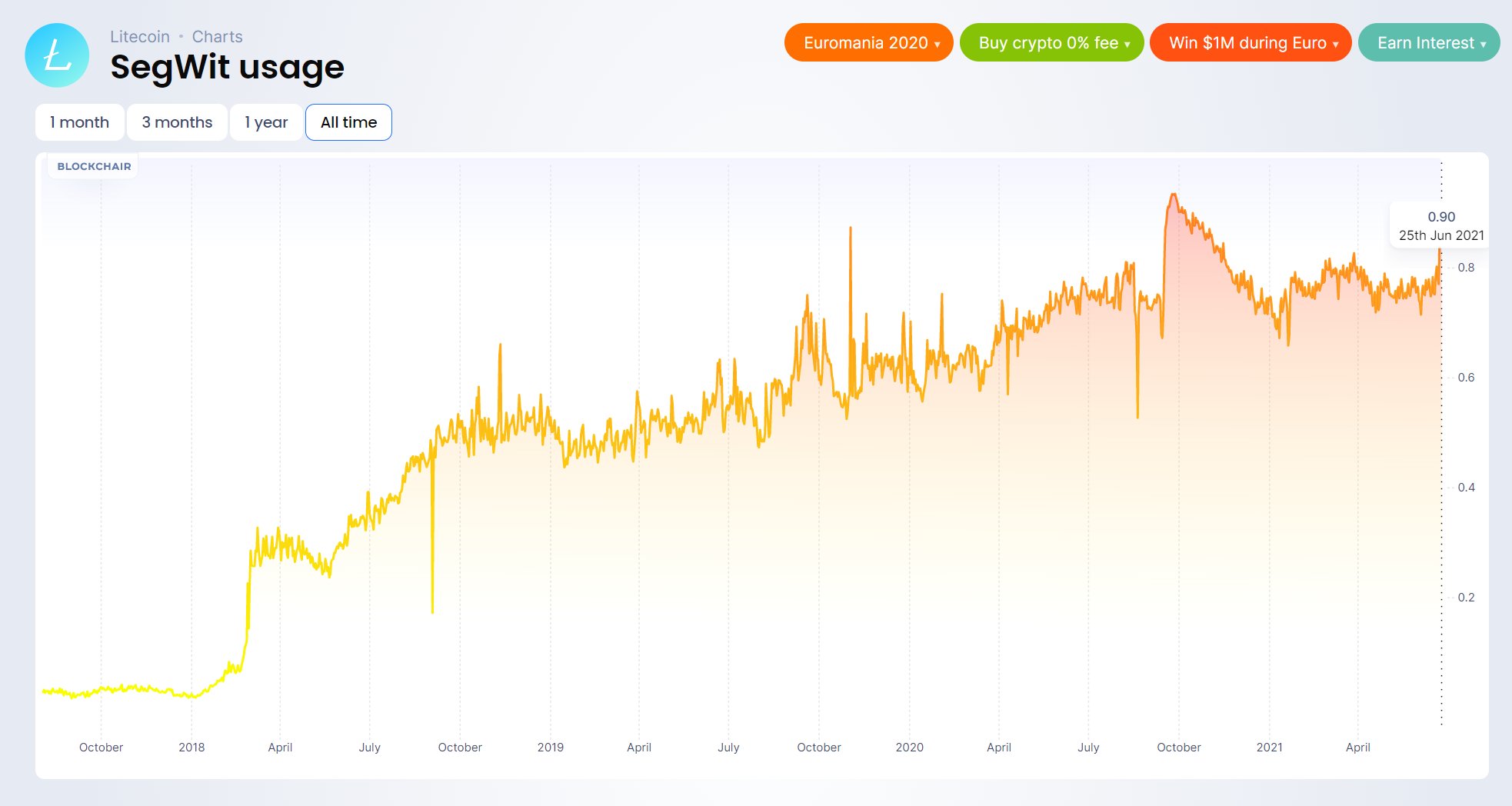

Litecoin has dropped by 68% ever since its peak was noted earlier in May. Although the price of the digital asset has been falling lately, curiously, its Segregated Witness or SegWit usage hit a yearly high of 90% on 25 June.

SegWit was adopted by Litecoin in 2017 and is a change in the transaction format of LTC which increases data efficiency and lowered costs, among other effects.

David Schwartz, the Project Director at Litecoin Foundation, shared these statistics with the community today and revealed that this has been the highest value reported since the introduction of an RPG game, LiteBringer. The chart below highlighted Litecoin’s SegWit usage –

Source: Blockchair

According to the attached chart, the SegWit usage for LTC jumped from September 2020 to October 2020. This coincided with the launch of the LiteBringer game in September. It was noted that every move within the game affects the Litecoin ecosystem in various ways and this became clear when the transactions per second spurred to +60k within 24 hours and most of them were microtransactions of under $1 associated with the game.

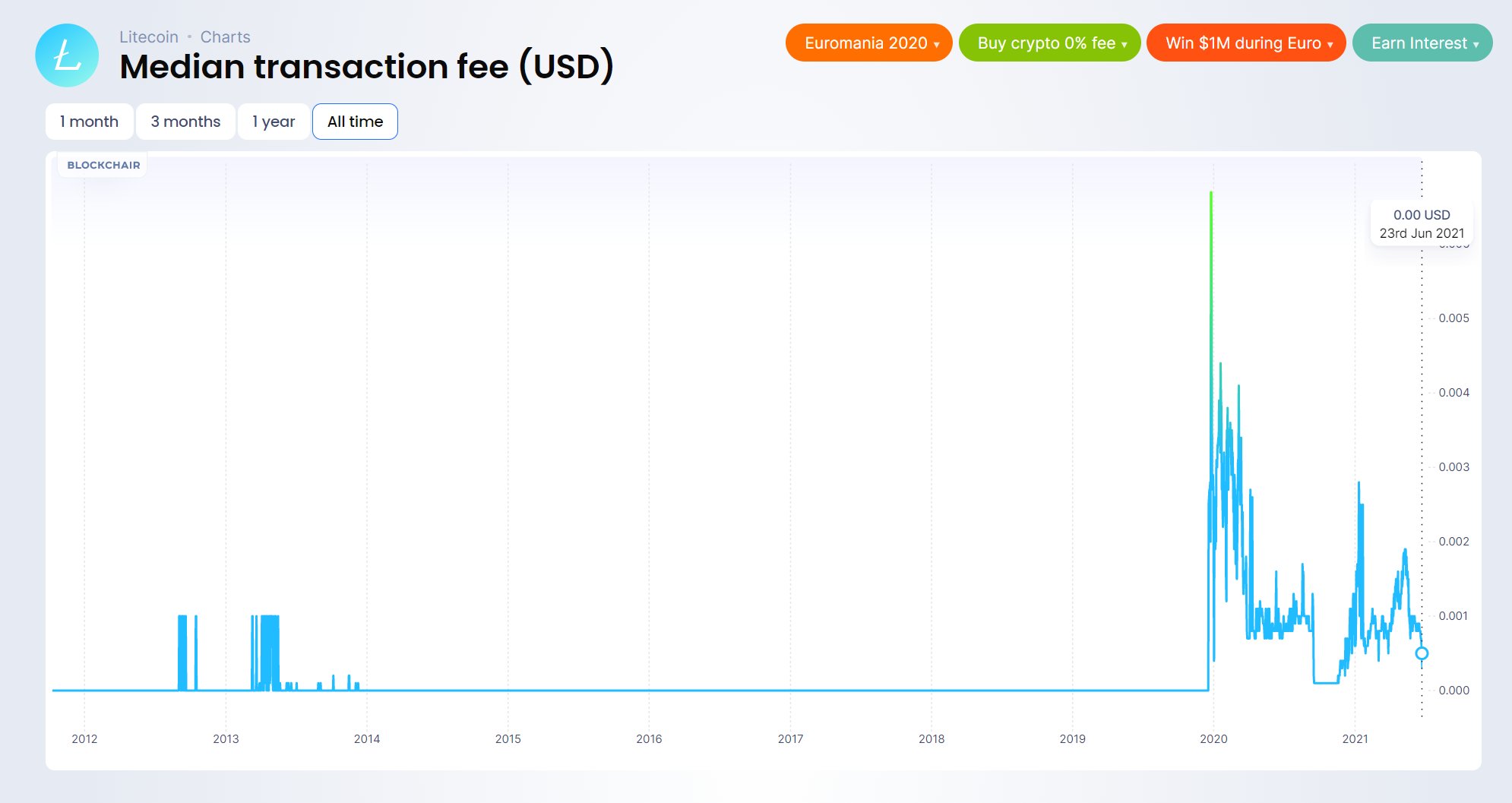

On 24 June, the game released its 11th update, a development that has once again resurrected and pushed Litecoin’s SegWit usage to 90%. This has also pushed the median fees down to levels last seen in September and October 2020, upon LiteBringer’s release. In 2020, the median transaction fees plummeted to $.0002 from around $0.0005-0.0008 previously. In fact, some have suggested that these microtransactions are “spamming” the blockchain.

It’s worth noting, however, that it has helped reduce the transaction fees once again.

Source: Blockchair

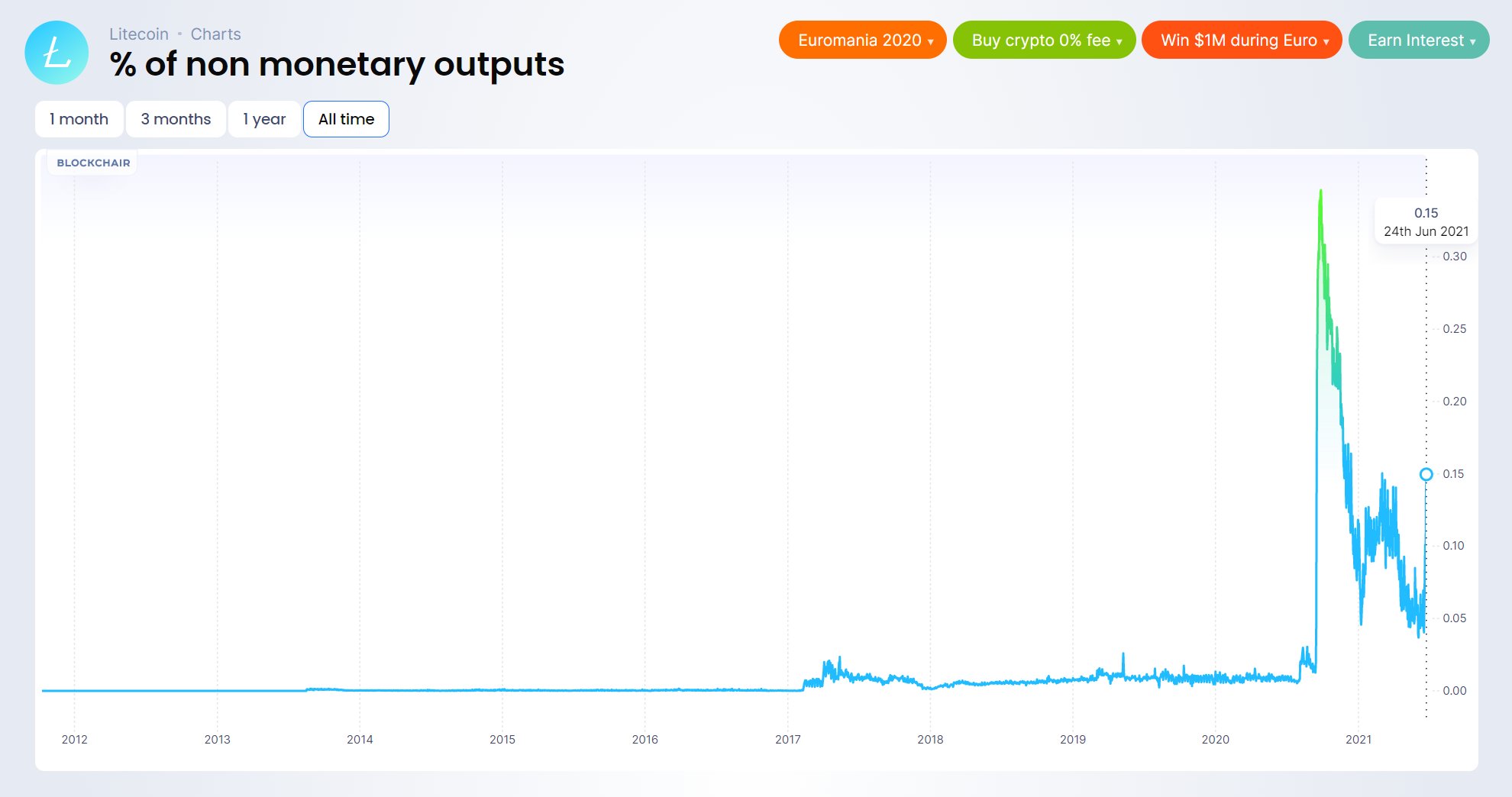

As the fees fell and the usage spiked, non-monetary outputs [NMOs] also registered a dramatic increase. Since this was not actual cash, but assets for barter within the blockchain, the said spike can be associated with the game. As per data, the NMOs remained under 10% until recently, but spiked to 15% on 24 June.

Source: Blockchair

Interestingly, all the SegWit activity witnessed was after a game that induced momentum in the SegWit usage. Naturally, this sudden growth cannot be sustained by the users. In 2020, when the game was released, a similar spike in NMOs and usage was visible. However, as the hype died down, both metrics saw a visible correction to original levels.

Bitcoin was the first one to adopt SegWit in 2015 to address its scalability issues. In 2021, SegWit usage averaged 51% and reached an all-time high of 73% today. However, unlike LTC, BTC did not provide a special reason for such a drastic increase through June. Litecoin has definitely benefitted from the increase in transactions and reducing median fees, but a game may not be enough for continuous progress.