Bitcoin Cash, Bitcoin SV’s on-chain metrics reveal this is the risk they are facing

Bitcoin, the market’s largest cryptocurrency, has undergone a host of forks since its inception in 2009. Each of these splits has birthed new versions of the original Bitcoin. Bitcoin Cash, for instance, split off from the main blockchain in August 2017. On the contrary, Bitcoin SV was the result of a highly contentious hard fork of BCH.

These two altcoins managed to fare well in their infancy. However, is the narrative still the same? Well, let’s check them out.

Are these alts losing a say in the market?

The macro-condition of both these altcoins has been deteriorating over the past few months. During the first half of May, when most alts and Bitcoin, for that matter, were rallying, both BCH and BSV’s prices remained relatively flat. In the period from 1 May to 18 May, BSV’s price fell from $315 to $290 while BCH’s price registered an uptick of 12.7%. The latter, crucially, was well below the hikes noted by other cryptos.

Returns fetched by HODLers of these two altcoins have been pretty unsatisfactory of late too. Over the last three months, both BSV and BCH shed more than 60% of their values [-67.95% and 65.05% respectively]. Here, it should be noted that the near-term RoI plays a major role in attracting new participants into the market.

Owing to the diminishing returns, the real volume of both these altcoins remains pretty un-impressive. At the time of writing, BSV’s volume amounted to just $155 million. In fact, for the most part of 2019 and 2020 too, its real volume oscillated around the same level. BCH’s volume too was recorded to be pretty close to its 2018 lows ($400 million).

Does the market cap weave a slightly different tale?

When ranked by market cap, BCH remains the 13th largest crypto in the market. Bitcoin SV, on the contrary, finds itself just inside the top 50. Their market cap valuations stood at $9.9 billion and $2.5 billion, respectively.

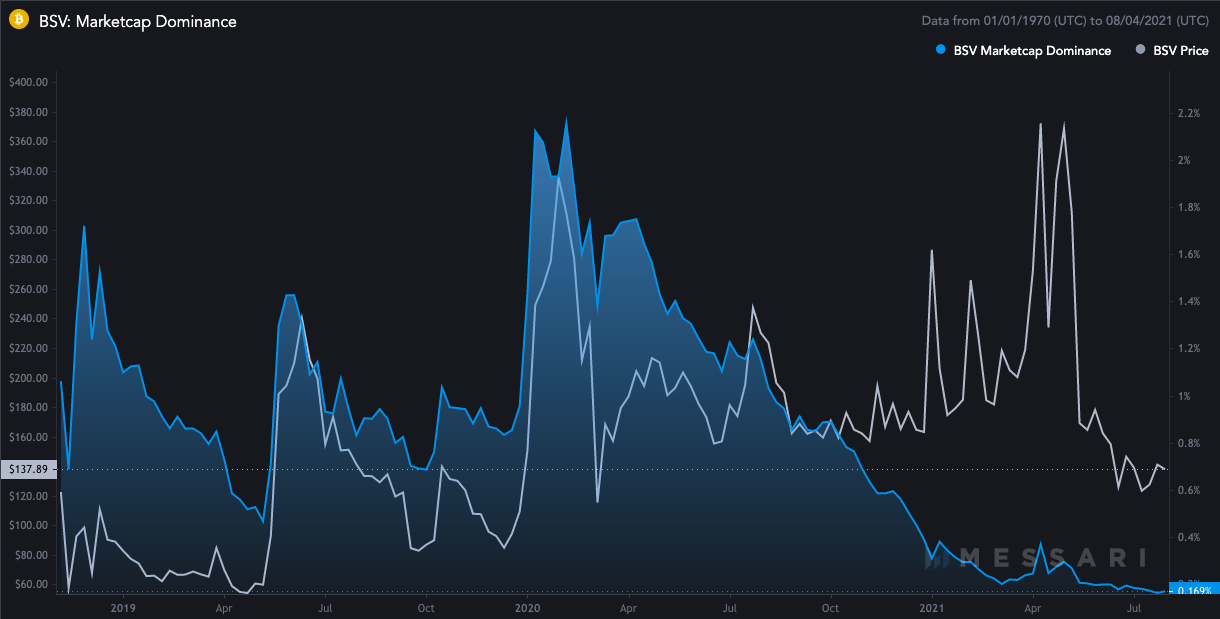

However, viewing the current market cap solely does not give a fair picture of where the alts are at the moment. Let’s consider Market Cap Dominance to understand the bigger picture better.

According to Messari’s data, these two cryptos have been losing their dominance in the market. BSV, once upon a time, had a 2% share in the broader crypto-market. However, the same, over the past few weeks, has been oscillating around 0.1%.

BCH’s tale was no different. In early 2019, this alt had a 10% command over the crypto-market. The same, at press time, had fallen to 0.65%. So no, the market caps of these two alts do not weave a different story.

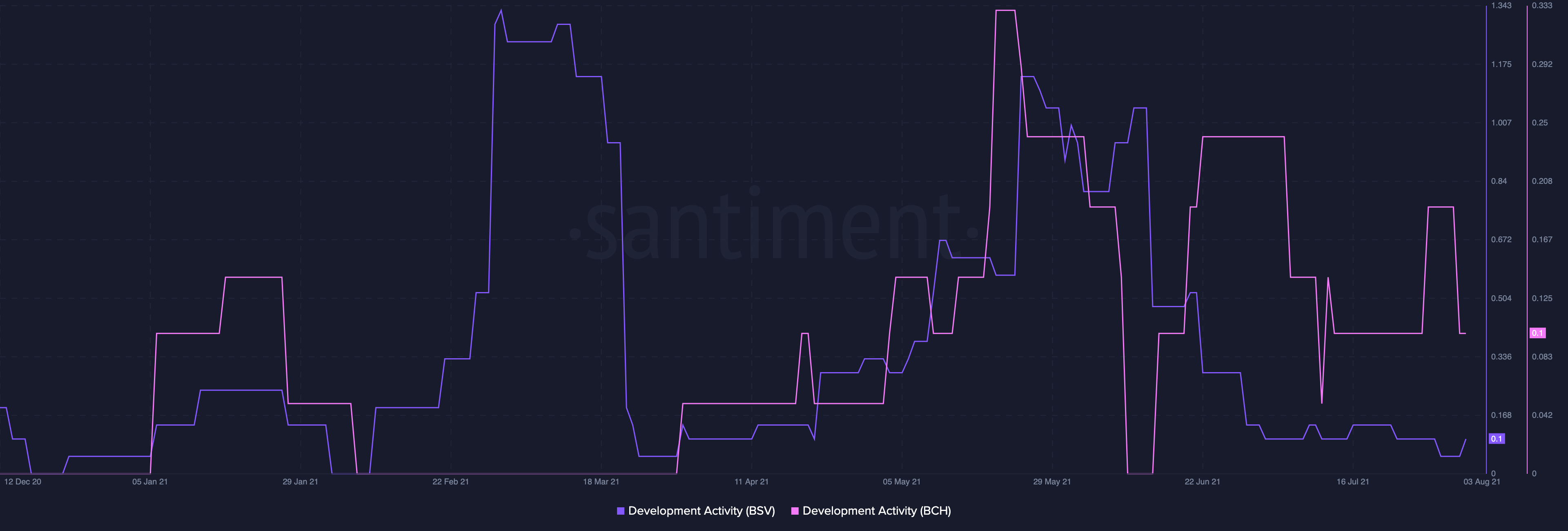

The development facet

In terms of development activity, BCH has managed to project a slightly compelling picture of late. BSV, on the other hand, did not show any signs of revival as far as this metric is concerned too.

To make things worse, BSV reportedly suffered a massive 51% attack on Tuesday. For over three hours, attackers took over the chain and reorganized over a dozen blocks. Additionally, up to three versions of the chain were being mined simultaneously across pools. This attack came on the back of other attacks in June and July.

Needless to say, these cryptos have been engulfed by their own vicious bullish-bearish cycles, independent of the broader market state. As per the state of the aforementioned metrics, it can be said that these two alts have lost their sheen and are at the risk of fading away with time.