Metrics suggest this about MATIC’s weekend

As MATIC finally broke above its $1.20 resistance zone after highlighting a 30% hike over the last week all eyes were on the alt. However, MATIC holders were taken almost by surprise as the token fell by 5% at press time and traded at $1.4. Clearly, the buzz around the first-ever crypto token merger, between MATIC and HEZ as Polygon acquired the Hermez Network couldn’t do much for the alt’s price .

Metrics point towards a slow weekend

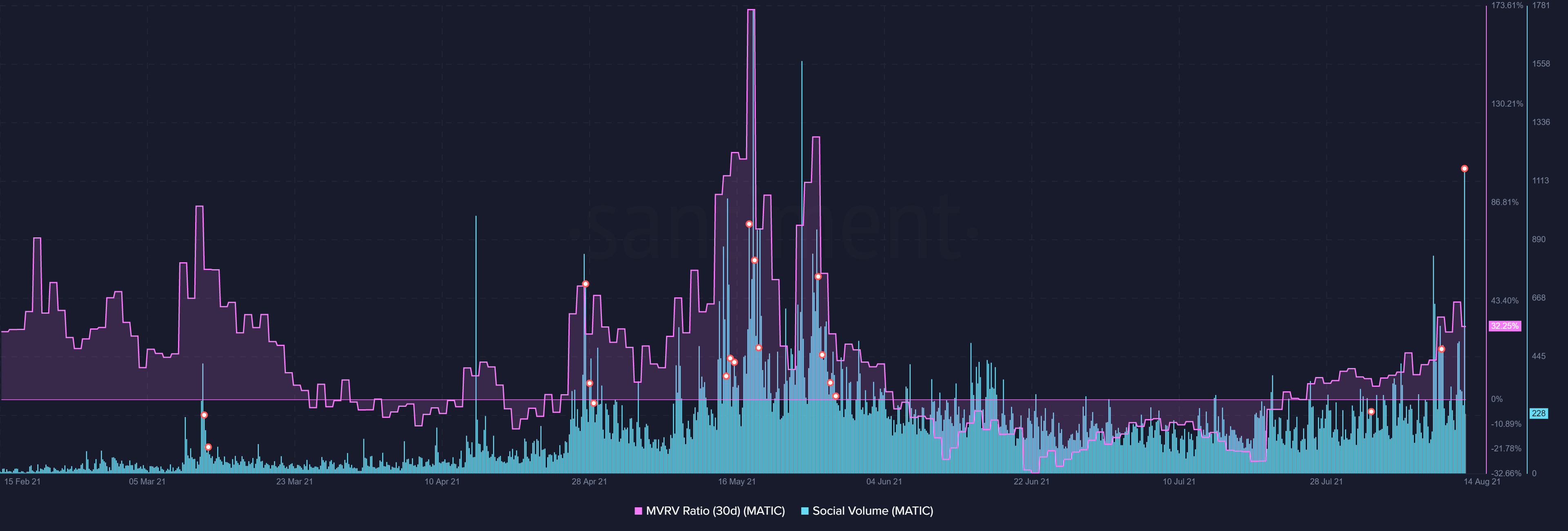

Even though the prices seemed to recover on MATIC’s one-hour chart, MVRV (30 day) for the alt which had peaked on August 13 and took a downturn. MATIC highlighted some really exciting metrics at the time of writing which was perplexing, to say the least. A downtrend in MVRV was accompanied by an all-time high social volume level. Looking at the news around the merger, the hike in social volumes was more or less expected and it won’t be wrong to say that the same didn’t have much impact on the price.

Source: Sanbase

Furthermore, there were record inflows from the altcoin highlighting large exchange deposits. Generally, when not preceded by a big outflow as seen in the case for MATIC, inflow spikes lead to price corrections. A price correction may be in store for MATIC but its slight price recovery at press time said otherwise. That being said, MATIC also had a decent number of active addresses which was a good sign. Had there been a drop in the same, the low participation in its network would’ve been a bearish sign.

Source: Sanbase

Notably, token’s age consumed saw a peak too, as MATIC reached a local price top at $1.52. While this could also be a sign of dormant tokens moving with the intention of pushing the prices up it wasn’t seen since the price went down.

Is MATIC going to correct?

MATIC’s price trajectory so far hasn’t been too bad but the token had undergone certain minor corrections even during the August rally. While a notable uptick in metrics like exchange inflows highlighted that a correction might take place, it can’t be surely said whether the correction would be a major one. At the time of writing though, scales were tipping more toward a minor market correction for the alt.