QNT rose by 425% in 45 days, but is that all there is to it

There are many altcoins in the market that are looking to dethrone Ethereum. However, it is often a surprise when one of the tokens on the Ethereum blockchain moves unexpectedly, independent of ETH. At press time, Quant (QNT) was going up the charts, even when Ethereum was falling.

Ergo, the question is – What is so attractive about QNT and can it be your next best investment?

Ethereum’s token beats Ethereum

Quant has risen by over 84.85% this week, despite the recent market crash. On 7 September, when most of the market saw a dip, however, QNT hiked by 9%.

Over the course of the last month and a half, Quant has gone up by 425.87%, rising from $68 to $344.9.

Quant’s rally of 84% | Source: TradingView – AMBCrypto

A huge factor behind the aforementioned appreciation is the release of Overledger 2.0.5. This update intends to bridge institutional and enterprise ecosystems with stablecoins, DeFi, NFTs, and popular ERC20 and ERC721 digital assets for clearing and settlement.

However, such bullishness was not spurred by the release alone. The market has been bullish for the alt since its listing on Coinbase on 25 June. This pushed its volumes from an average of $9-$10 million to $740 million (across all exchanges) on 6 September.

What’s more, the network has been attracting a lot of investors due to its network capabilities and profitability.

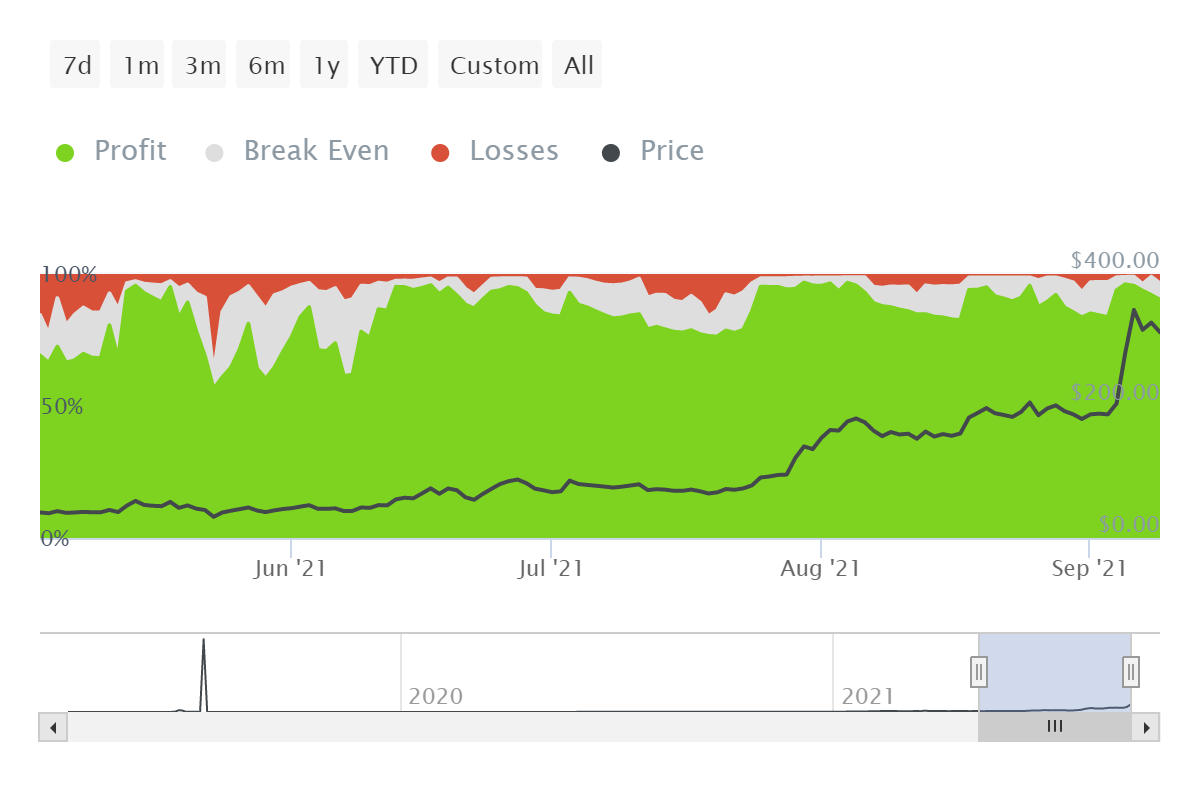

Quant’s profitable addresses | Source: Intotheblock – AMBCrypto

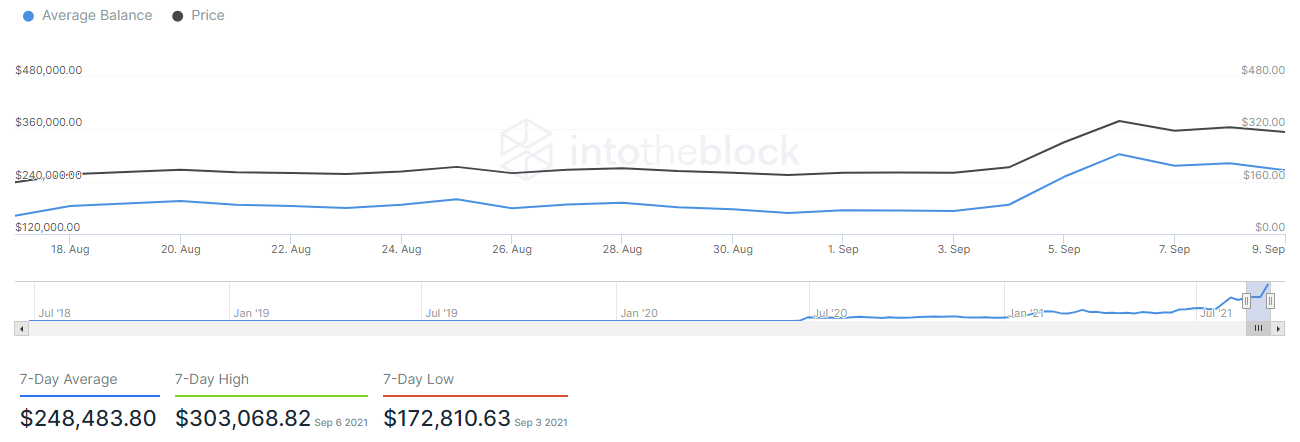

Even in a recovering market, Quant’s profitability has been at its peak with 91% addresses sitting in profits. On top of that, the average balance on every address was $248k for QNT at press time.

Plus, the MVRV for the altcoin is now at its highest in 3 years, making it more attractive to new investors.

Quant’s average balance on addresses | Source: Intotheblock – AMBCrypto

But, not every shiny object is gold

As well as its financial stats look, network statistics do fall short in making it the best investment. QNT’s correlation to Bitcoin, for instance, was a mere 0.26, taking away the label of the altcoin being a risk-free investment.

Quant’s correlation to Bitcoin | Source: Intotheblock – AMBCrypto

The network also has non-existent development activity, even though the most recent update was rolled out 3 days ago.

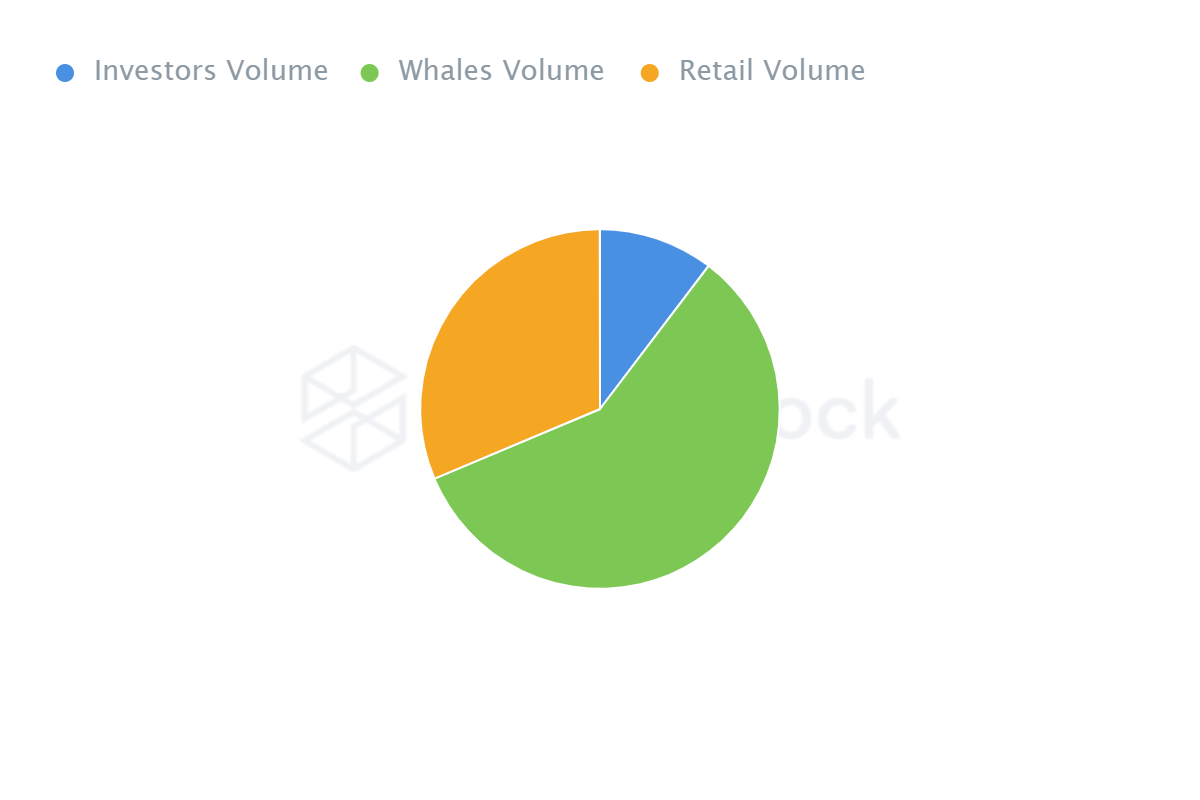

Finally, it has 58% whale domination with the average holding time sitting at 2 years. This makes it very susceptible to dumping, with the same adversely affecting the crypto’s liquidity too.

Quant’s whale dominance is at 58% | Source: Intotheblock – AMBCrypto

Thus, despite having some good-looking financials, Quant might not necessarily be your next best bet.

![Chainlink [LINK] price prediction - Watch out for a defense of THIS key level!](https://ambcrypto.com/wp-content/uploads/2025/04/Evans-17-min-400x240.png)