This is what Avalanche investors should be looking out for

As is the case with every asset in the market right now, Avalanche is recovering from yesterday’s price fall. From the perspective of an investor, that may not necessarily be good news

But then again, Avalanche investors have been slightly more careful about their investments than necessary. So, here you can know in detail why or why not you should invest in one of the biggest DeFi tokens out there.

AVALANCHE!

In just about a month, Avalanche’s total value locked (TVL) has risen from $680 million to $2.79 billion. This 310.3% increase in TVL has managed to make Avalanche the sixth-biggest DeFi blockchain in the world.

Additionally, at the same time, the value of its token AVAX has risen by almost 113.62% over the last month.

Avalanche’s 113% rise | Source: TradingView – AMBCrypto

Ideally, such growth makes investing in such assets an ideal option. However, there are a couple more factors that a person has to consider before investing in altcoins like AVAX.

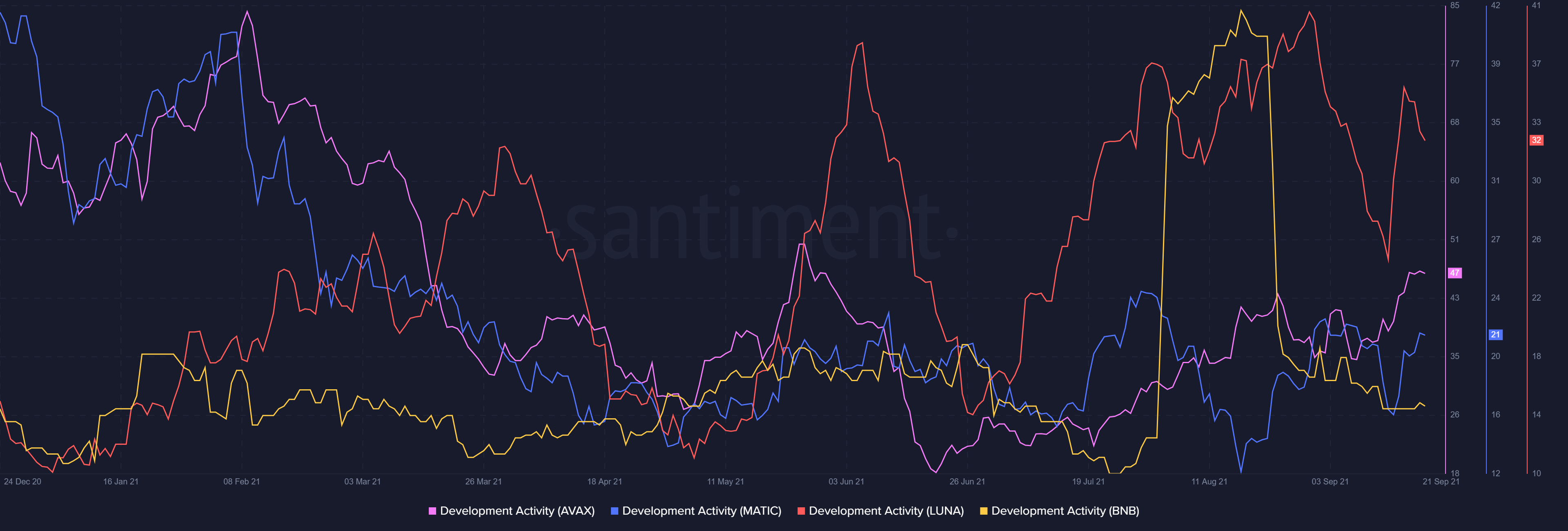

For starters, consider the network’s value. Avalanche has one of the highest development activities when compared to its competitors. Leaving behind the likes of Polygon, Terra, and Binance Smart Chain, it makes a strong case for participation.

Avalanche’s developer activity compared to its competitors | Source: Santiment – AMBCrypto

Alas, the high volatility of the network makes it susceptible to sudden price changes.

Avalanche’s volatility | Source: Messari – AMBCrypto

What about profitability?

AVAX promises good returns when compared to a risk-free asset, thanks to a decent Sharpe ratio value of 3.52.

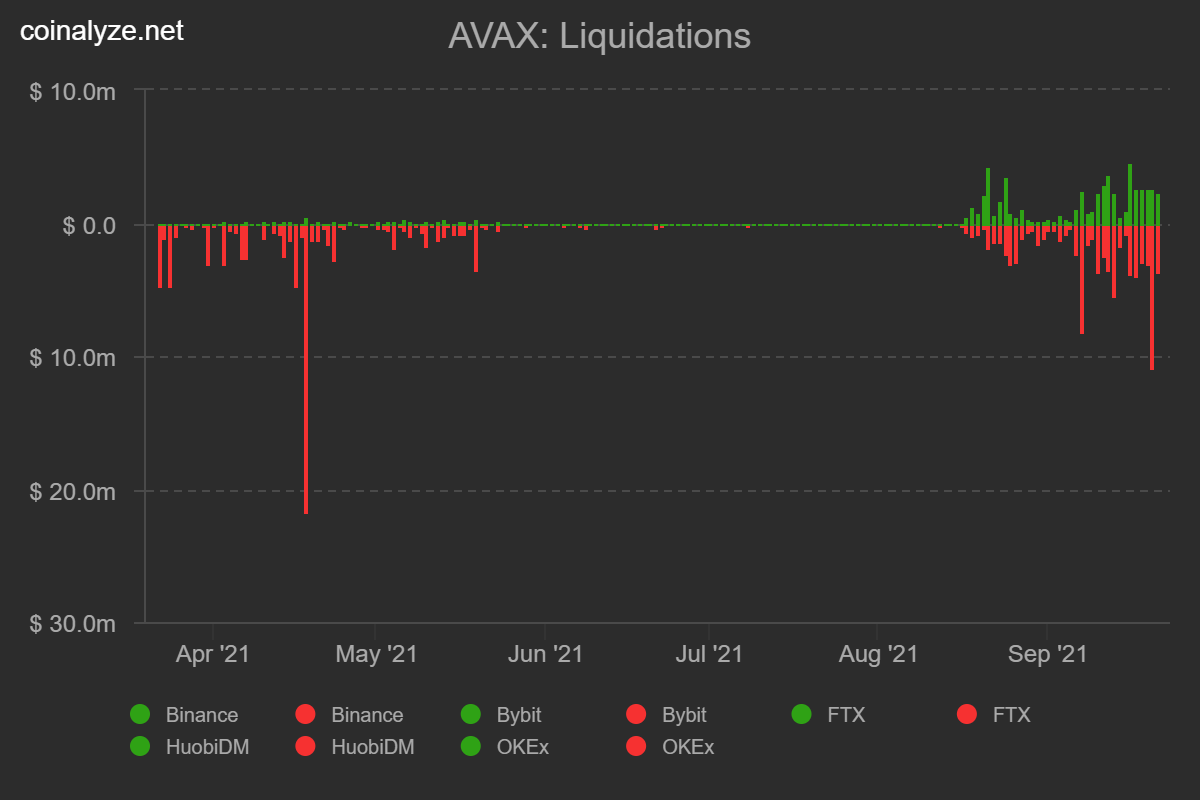

However, the uncertainty observed in investors’ behavior can become a threat in maintaining AVAX’s price at a higher level. 5 to 8 million AVAX gets sold over the slightest price movement and liquidations worth $11 million recently occurred on the chain. This was the highest level the AVAX market saw in 5 months.

At times, such fluctuations do make one question how the price can maintain consistent growth.

Avalanche’s liquidations are at a 5-month high | Source: Coinalyze – AMBCrypto

On top of that, just yesterday, DeFi platform Vee.Finance operating on the Avalanche network reported an exploit of $35 million. In the exploit, 8804.7 ETH and 213.93 BTC were stolen. This can make new investors a little skeptical about the network.

Then again, a few days ago, the network secured a $230 million investment to develop the DeFi space. And, given the network’s stellar growth, it could see a further rise.

Thus, investors can look at both sides of the coin here and make an informed decision about whether or not to invest.