These may be the ‘pre-bull run signs’ of another Solana rally

Towards the beginning of this year, Solana traded close to $2, and as SOL noted more than 10,000% rise by the third quarter, Solana’s initial gains seemed to be just a kickstarter. Solana’s journey from an under $2 asset to now the seventh-ranked asset by market cap has been rather impressive, to say the least, but as September came to a close and the alt’s chart turned bearish, there were doubts regarding SOL’s further growth.

Price corrections – a speed breaker?

After traders termed Solana’s August-September rally “Solana Summer” as the price of SOL reached more than $200 per token, the rally was soon met with considerable consolidation. The consolidation came as a shock due to the independent rally that the alt highlighted. Even though the fall in prices was despised by the participants, at the time of writing Solana noted an almost parabolic recovery on its daily charts.

In fact, the almost 18% rise in SOL’s price as October began heightened anticipations from the altcoin again. This happened as Grayscale added Solana to its large-cap crypto fund for the first time on Friday itself. The company in a statement said that its $494 million Digital Large Cap Fund closed with a 3.24% SOL position. This was the first time SOL will be included in a Grayscale investment vehicle. Earlier effects of Grayscale adding cryptocurrencies to its fund have been noted in the price trajectories of top altcoins like Cardano.

At press time, as Solana’s price noted 9.87% daily and 13.64% weekly gains, seems like the consolidation and subsequent price drop was just a speed breaker. Nonetheless, as SOL traded close to $158 at press time, market participants worried if they had missed an entry in the market.

Pre-bull run signs

After SOL’s consolidation, the market got skeptical of its trajectory but the market-wide recovery and Grayscale’s announcement has pumped the alt again. So was the network outage a “buy the dip” opportunity and how will SOL’s performance look like in the remaining year?

Solana had experienced high social anticipation over the last couple of months amid back-to-back price ATHs. While macro-events ranging from the China-crypto ban to SOL’s network shutdown and dwindling trade volumes contributed to SOL’s struggle, the NFT mania has been pushing SOL upwards. Recently, NFT from SolanaMonkeyBusiness, a collection of 5,000 NFTs minted on the Solana blockchain, sold an NFT for 13,027 SOL.

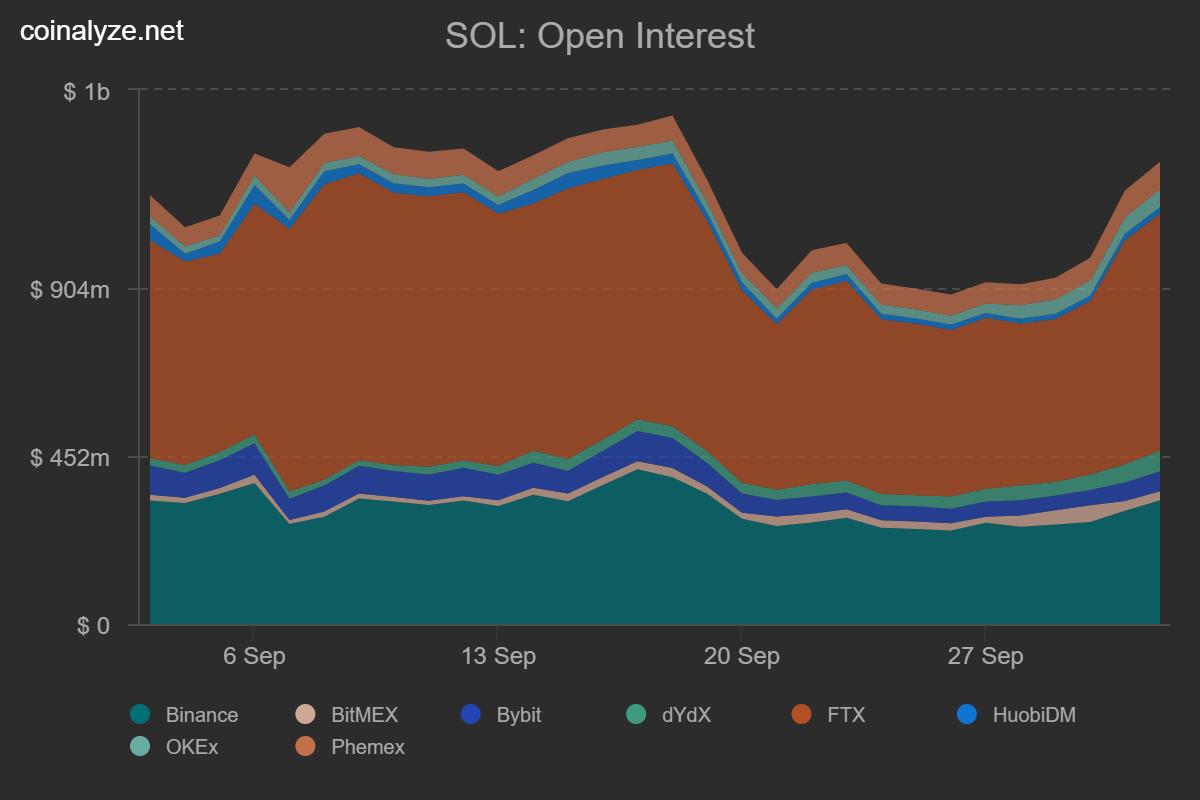

Notably, amid all of this, SOL’s social volumes have been low which is a good pre-bull run sign for the asset. Additionally, Solana’s futures market looked healthy too, with its total open interest noting $939.87 million at the time of writing. This was a more than 700% increase in two months.

Solana’s Open Interest sees a rise; Source: Coinalyze

Further, alongside rising prices, SOL saw close to $12.6 million short liquidations in the last 24-hours from press time. Thus looked like the market started turning bullish on SOL again.

Other than that, Solana is also coming up with Soldex, a third-generation crypto exchange and one of the first decentralized exchanges (DEXs), to be built on Solana. These external developments as SOL is merely 20% away from its ATH are a good sign for the alt’s growth and may trigger a rally if the larger market sustains.