What Ethereum needs for a push above $4000

The top altcoin, for the last couple of days, seems to be teasing the market with hopes of a move above $4000. However, the same has not been breached yet. With Bitcoin above $60K though the anticipation from Ethereum’s price has soared too. As Ethereum oscillated close to $3900 here’s how the coin’s trajectory upward looked like.

Steady growth to the top

The price of ETH has jumped to scrape past $3,800 and the journey from the July lows under $2000 can be partly credited to Defi projects accumulating more total value locked (TVL) and to the disinflationary mechanism introduced in EIP-1559. The top altcoin seems to be slowly gaining momentum over the past month as the network’s core developers are making steady progress toward Ethereum 2.0.

Further, as Consumer Price Index data highlighted another month of prices climbing up throughout September, it seemed like macro inflation continued to drive the crypto space.

Post EIP-1559, though, with fee burning ETH’s hedge against inflation narrative has further strengthened. However, the rise of Defi last fall and increasing popular interest in NFTs has led to issues like network congestion which the team still needs to deal with post the transition.

The road ahead missing this crucial element

Notably, there has been a steady rise in ETH’s active addresses new addresses since the beginning of October. There has also been a rise in Ethereum’s options open interest which sat at a monthly ATH at the time of writing. In fact, ETH options global open interest by strike highlights the highest number of options expiry is set for October 29 with calls placed at $5K level.

Source: Skew

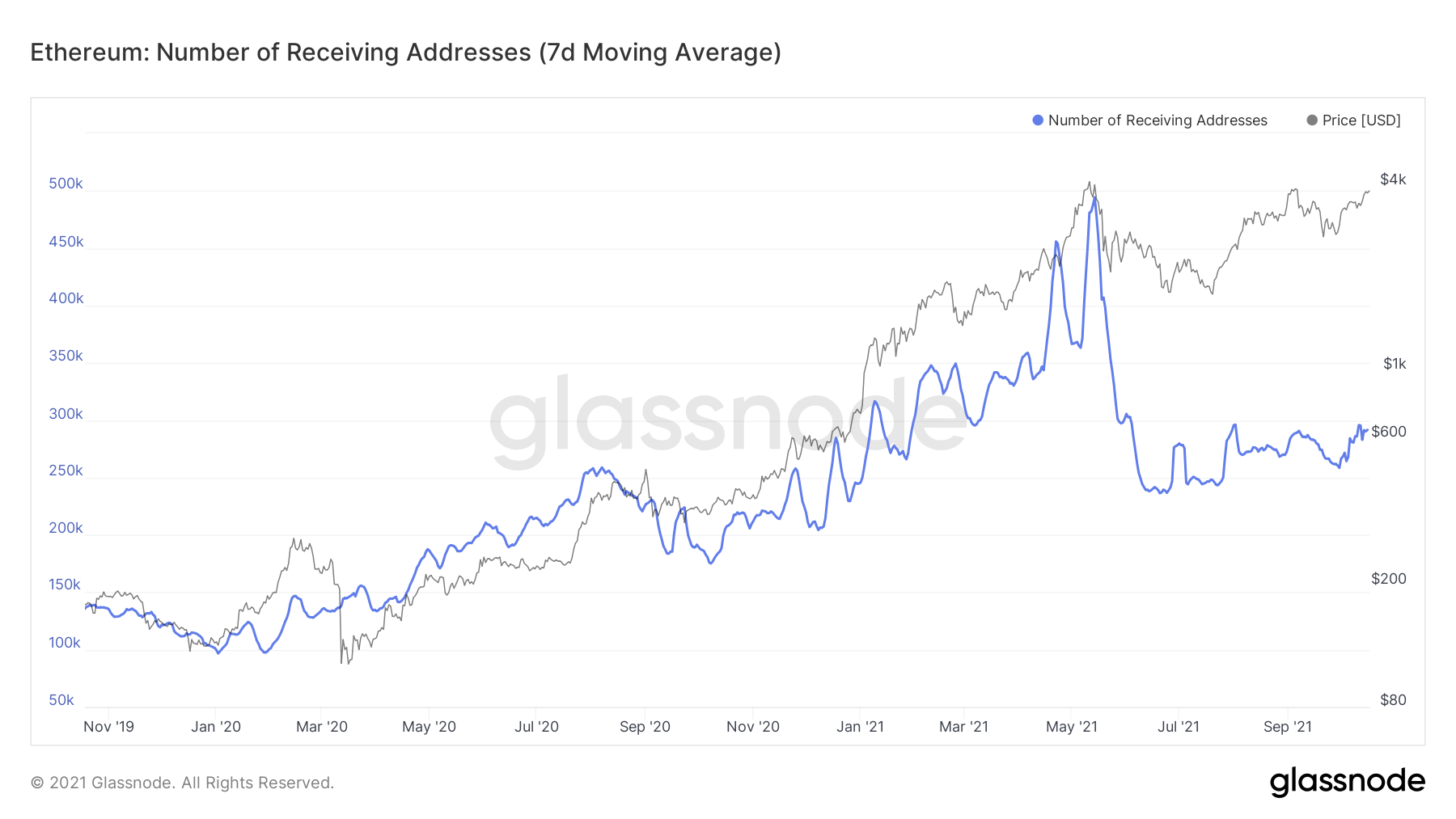

While these were all subtle signs of ETH’s run there seemed to be a lack of FOMO over the past week which may be the only thing stopping ETH from $4K and beyond. Notably, the number of ETH receiving addresses stayed well below the yearly average.

What’s more, the number of transactions was equivalent to the January 2021 levels. Seemed like ETH needed a push from retail investors who are crucial for triggering rallies past key resistances.

But, here’s the good news

However, the good news was that institutional investors were bullish on Ethereum with rising capital inflow and ETH reserves across exchanges seeing incensed outflows. Notably, over 400K ETH was pulled out of Coinbase, dropping exchange reserves thereby driving a supply crisis narrative which was just what ETH needed for a price push.

While Ethereum at the time of writing traded at $3880 looking at the aforementioned metrics it did seem like $4000 wasn’t too far away now.

![Ethereum [ETH] recently regained the $2,700 level, a price it last traded at on the 24th of February. This followed a notable 5.63% rally in the past 24 hours.](https://ambcrypto.com/wp-content/uploads/2025/05/50E1EECB-207E-4DD6-B7B4-ECF1489870E9-400x240.webp)