With decent network growth, Aave, 1Inch make the most of Bitcoin’s price trajectory

Bitcoin’s short trip to under the $60K zone seemed like a blessing in disguise for some altcoins. Even though the larger market seemed to undergo minor corrections for the last couple of days, 1inch token and Aave were going against the tide. The former surged by as much as 95%, while the latter saw a close to 37% rise, on 27 October.

The aforementioned rise in price happened as Korea’s leading cryptocurrency exchange Upbit, listed the two tokens for trading. Listing on prominent exchanges has been known to pump coins’ price. More so, for mid-cap altcoins but apart from the listing mania, there were other factors that contributed to the two coin’s price growth. However, whether AAVE and 1INCH can sustain the gains, happens to be the more crucial question for now.

Metrics holding up

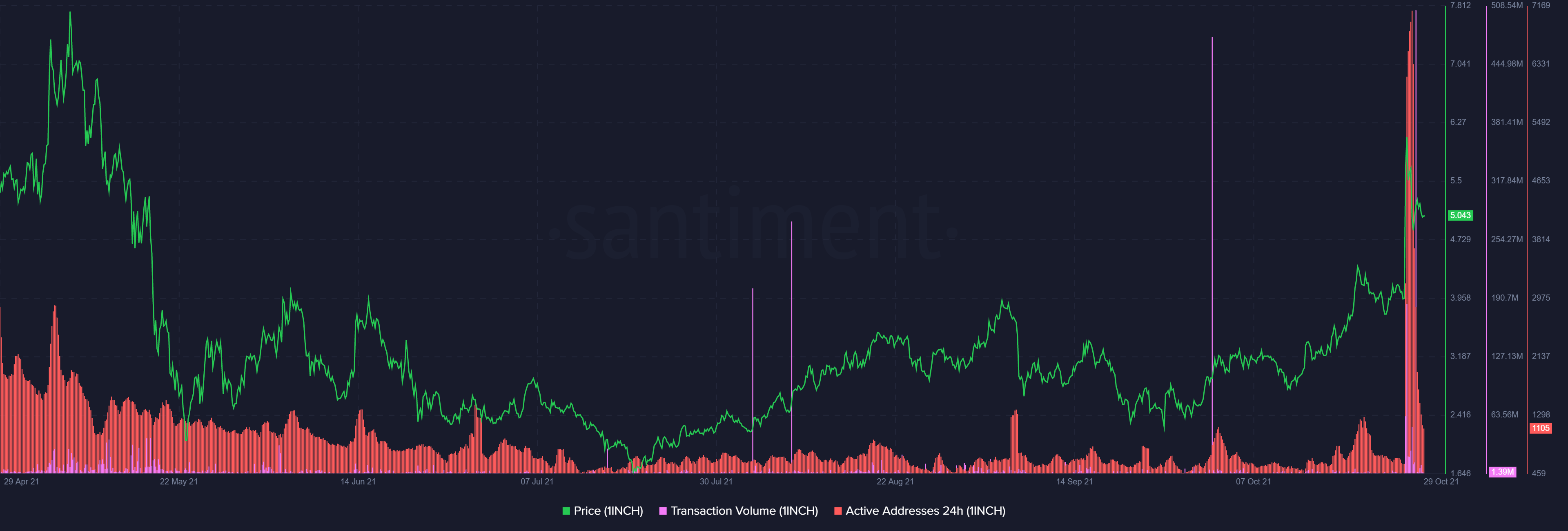

Notably, for both AAVE and 1inch, transaction volumes had spiked and noted large transactions at the time of writing. This is indicative of an active market for both the coins. Additionally, AAVE saw record high active users, as its active addresses spiked to 4400, as prices rose.

Source: Sanbase

However, a fall in the number of active addresses for AAVE as its price fell by 25%, from $459 was a cause for concern. 1Inch saw a similar trend where its active addresses rose to above seven thousand, as its price made an ATH on 27 October, but then there was a more than 85% dip from those levels at press time.

Source: Sanbase

Nonetheless, for both alts, active addresses were held at average levels. For AAVE, there were notable spikes visible in the Age Consumed as over 65 million days were consumed due to long-term holders either selling or moving their holdings on 27 October .

In spite of the drastic fall in active addresses as far as the two coins were concerned, the on-chain data was still showing healthy signs. The net transfer volume from/to exchanges has been spending more time in the negative territory over the past fortnight. This suggested that outflows have been overshadowing inflows.

These price levels need to hold

1Inch reached a new ATH as the listing news got out, while Aave saw over 30% gains. Nonetheless, it was notable that barring that one-day massive spike in prices, the prices didn’t hold for too long. Aave was down 25% from the October 27 price level, while 1Inch was down 30% from its ATH, at the time of writing.

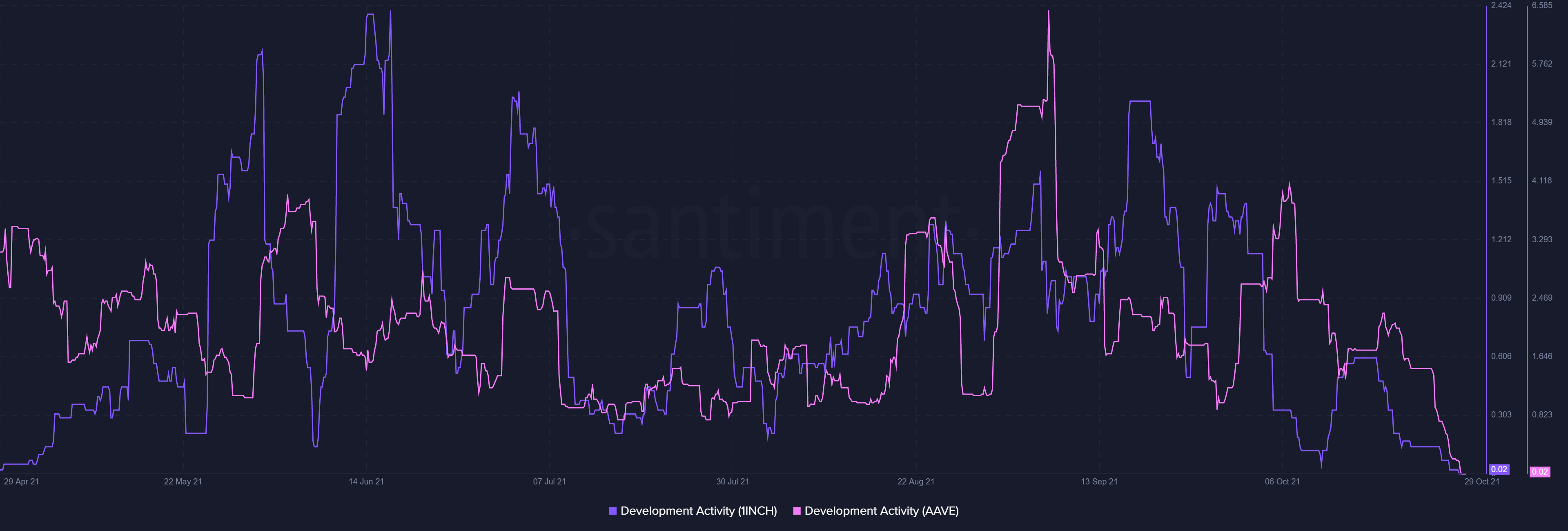

One reason why prices couldn’t sustain the high levels, could be the sustained fall in development activity that the two tokens saw. Notably, the development activity for the two assets had been making lower lows.

Source: Sanbase

However, 1Inch held the $5 level pretty well, while AAVE oscillated above the $328 mark which was a good sign. With their network growth still at above-average levels, BTC’s consolidation could bring the two altcoins further growth in the near future.