As these factors nudge MATIC toward greener pastures, $2.7 looks imminent

MATIC has quite smoothly rallied over the past 40-odd hours. On 1 December, this alt’s opening price reflected a value of $1.7. By the end of the day, it, however, managed to cross the $2 threshold.

On 2 December, the alt started trading around the same $2 mark but went on to breach $2.2 quite quickly. At press time, MATIC was seen exchanging hands around the same level.

Well fertilized environment

The grass in Polygon’s environment is currently quite fresh and green. The number of active users on the network, for instance, has steadily been climbing up of late. For four successive weeks, Polygon has recorded more than 300k active users.

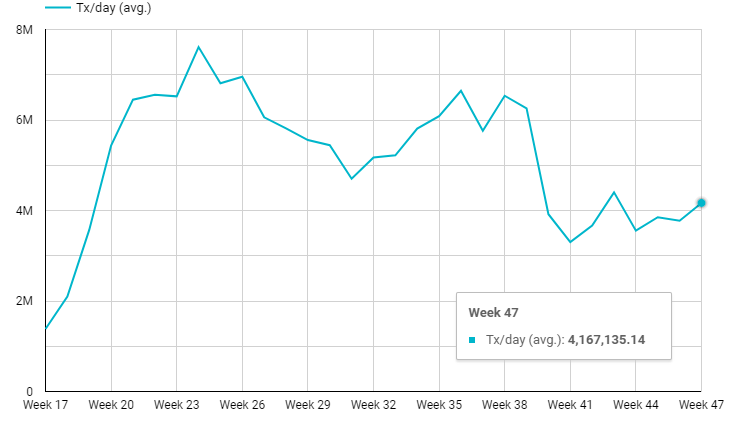

Now, it is quite obvious that users are the biggest driver of transactions. As expected, the rise in the number of users has simultaneously been accompanied by a rise in the number of daily transactions. In just the past 7-days, the same has witnessed a 10.39% rise, making 4.16 million the second highest peak in the last two months.

Source: Twitter

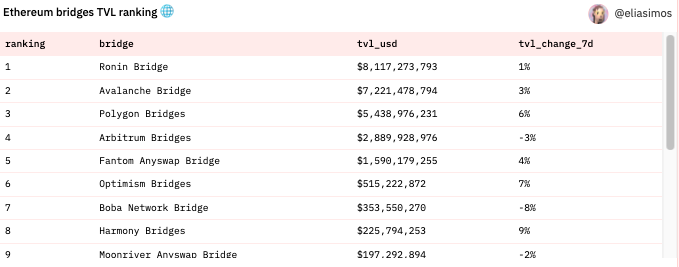

The total value locked up on Polygon’s bridges has additionally been on the rise. As per data from Dune Analytics, Polygon’s cumulative TVL has spiked up by 6% over the past week and reflected a value of more than $5.4 billion, at the time of writing.

In fact, the same has grown at a much faster pace when compared to other Ethereum bridges including Ronin, Avalanche, Arbitrum, Fantom, and Boba. This essentially means that MATIC is one of the most liquid protocols at the moment.

Source: Dune Analytics

Polygon’s protocol revenue has, in turn, spiked up by 16% over the past 7-days. It, interestingly, created a new ATH of $93.8k/day for the first time this week. With that, MATIC’s network has now been able to successfully register double-digit growth figures for three-consecutive weeks straight.

Source: Twitter

Other tangents

Well, Polygon has gradually been trying to establish itself as a premium gaming solution. Pegaxy, a racing game built on Polygon, has single-handedly managed to escalate the state of the network’s metrics over the past month. The same was highlighted in a Twitter thread by Simran, an analyst at Polygon.

Further, just a day back, ETP issuer 21Shares announced that it’s listing a MATIC-centric product on Euronext exchanges in Paris and Amsterdam. This development, to a fair extent, aided MATIC’s price rally further.

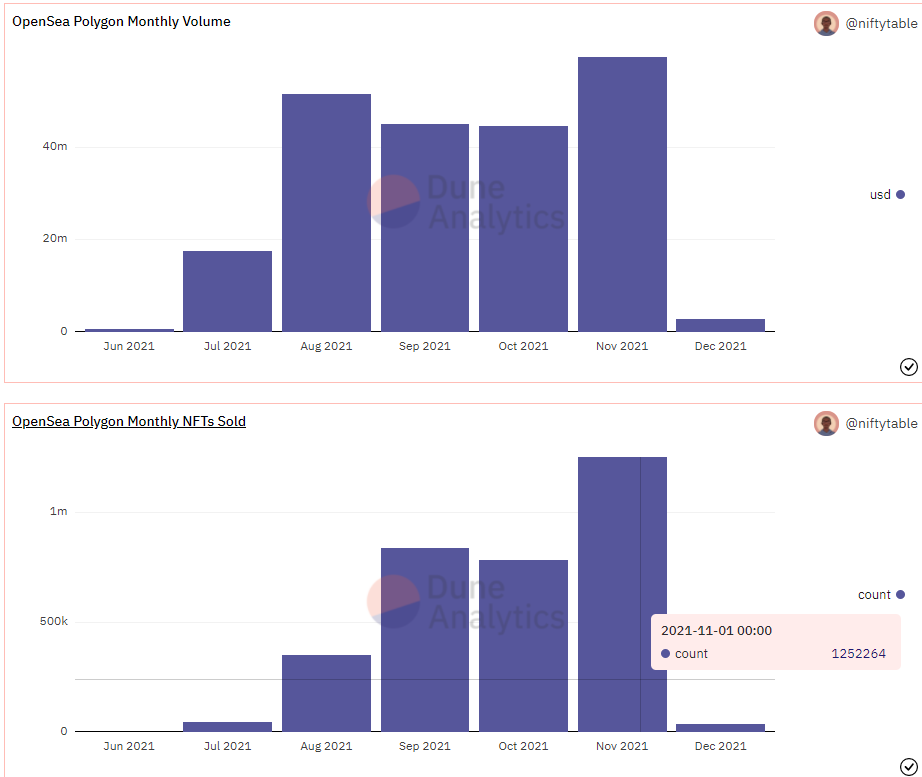

What’s more, the network has been faring quite well on the NFT-front. November was a stand-out month for Polygon on OpenSea.

Source: Twitter

Well, Polygon’s expanding ecosystem along with the aforementioned developments do paint a colorful picture for MATIC. Thus, over the course of next few days, market participants can expect this token to advance towards its May highs of $2.7.