Over 10,000 Bitcoin sold in panic selling bout, but investor confidence undeterred

Bitcoin investors are not alien to FUDs. However, this time it seems like the reason they reacted the way they did, was probably due to some sort of trigger. In response, thousands of Bitcoins were sold off by the investors. But the situation is not as dreadful as it might appear to be.

The new variant of Bitcoin FUD

The ongoing COVID Omnicron worry combined with the general market FUD led a lot of investors to sell off their holdings to prevent any losses. As it is, in November, over 3 million addresses experienced absolute losses owing to the price fall.

Now, as Bitcoin trades in red again today, after yesterday’s stabilization, it appears that the investors might have made a hasty call.

Yesterday over 10,242 BTC worth $575 million were sold off in 24 hours. This selling makes sense and was anyway expected since the beginning of December wasn’t particularly great.

Bitcoin exchange flows | Source: Santiment – AMBCrypto

But the problem is that this selling wasn’t organically motivated. This selling took place particularly due to FUD as yesterday the mention of COVID, pandemic, etc. witnessed tremendous uptick. The search was mentioned significantly more times than it did back in March when COVID was at its peak.

Bitcoin Covid search volumes at peak | Source: Santiment

This sudden rise in FUD also led to the Bitcoin market slipping into the levels of fear for a second consecutive week. And as a result, once again, the recovery of the 8.82% drop of November 26 did not see recovery.

Bitcoin fear and greed index | Source: Alternative

It is noteworthy that the 10k BTC sold also included some old coins as CDD shows 40.9 million days destroyed yesterday.

Bitcoin CDD | Source: Glassnode – AMBCrypto

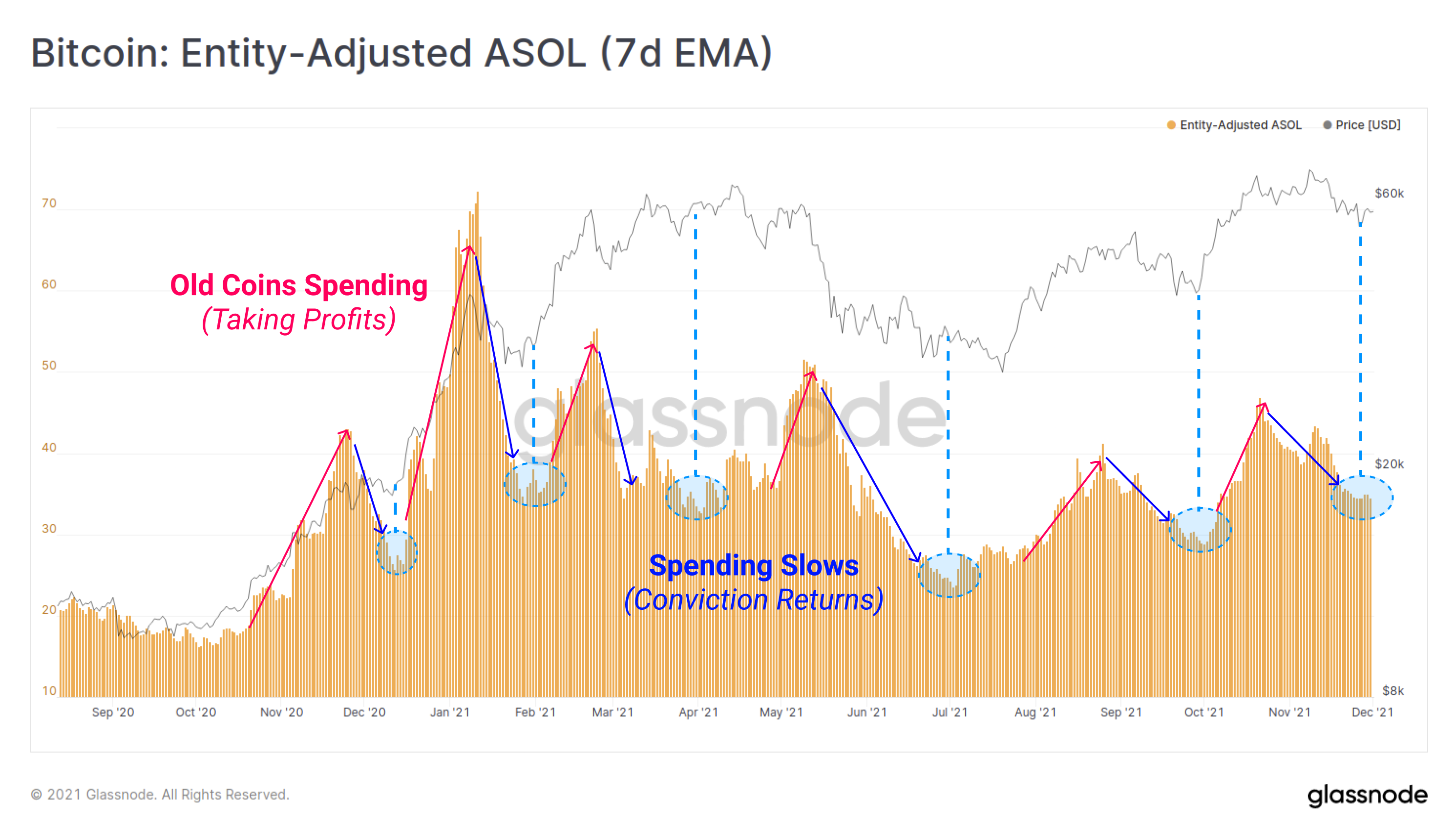

But the LTH selling was just a FUD-induced spike as it was the first spike since October. Besides on a macro scale, investor confidence is actually improving as fewer coins are being spent presently.

Bitcoin ASOL | Source: Glassnode

That said, thanks to an equally high demand, most Bitcoin sold is being bought off, with only a marginal amount still remaining in exchanges’ wallets.