Uniswap sees 24-hour volume to the tune of $4.8 billion, what’s in store for holders

Despite being a DeFi token, Uniswap has managed to beat some major traditional crypto assets. However, the credit for this goes to those who have managed to make the best use of Uniswap’s decentralized governance system to benefit everyone.

Uniswap and its investors

Most of the market is displaying mixed signals with Bitcoin standing in red and Ethereum in green. However, with minimal advances, Uniswap has managed to chart 5.24% gains in the last 72 hours, while maintaining $15.6 as critical support.

Uniswap price action | Source: TradingView – AMBCrypto

This kind of bullishness is observed to be coming from investors as that has enabled UNI to make major records this week.

Firstly, the network saw record-high volumes in 24 hours of $4.8 billion, and this also led to Uniswap V3 marking an all-time high weekly volume of more than $21 billion. Consequently, the network generated more ETH/USD than even Coinbase could, this week.

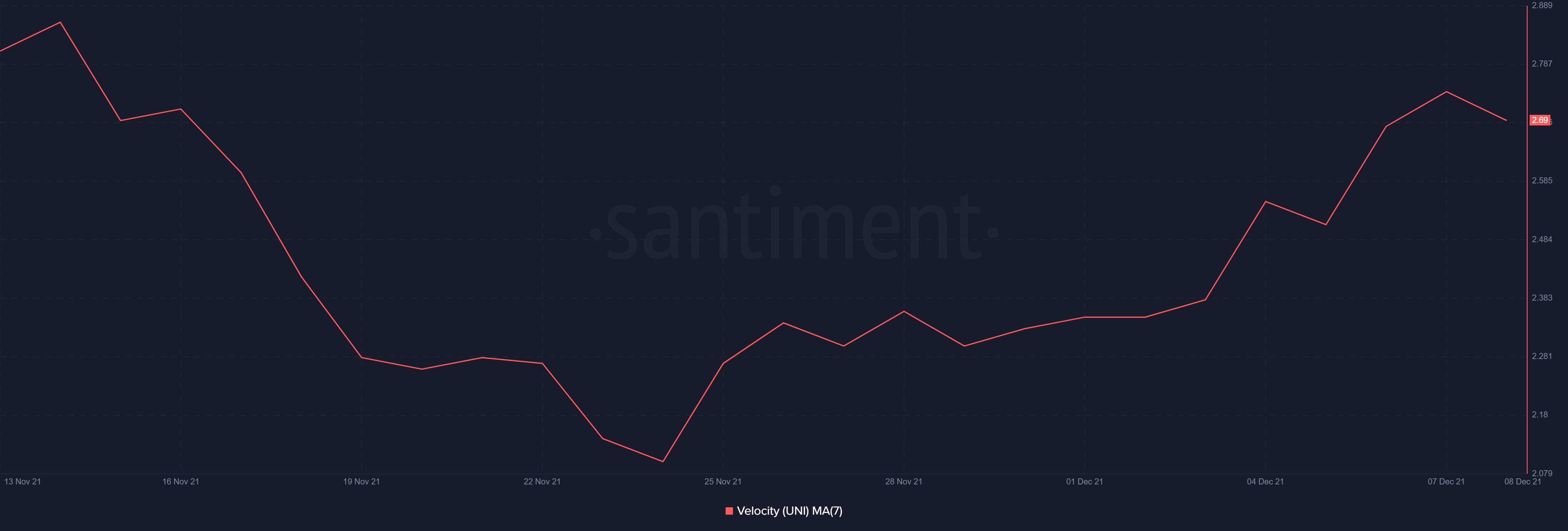

These record-breaking volumes are also verified by the rising velocity of UNI this week, which shows that it’s changing hands more frequently thanks to increased transactions.

Uniswap velocity | Source: Santiment – AMBCrypto

Well, thanks to the UNI community and a governance protocol where the 1bp fee tier was activated, the altcoin went from occupying 10% of 1inch’s daily exported volumes to 84%, as of press time.

Uniswap volumes | Source: Dune – AMBCrypto

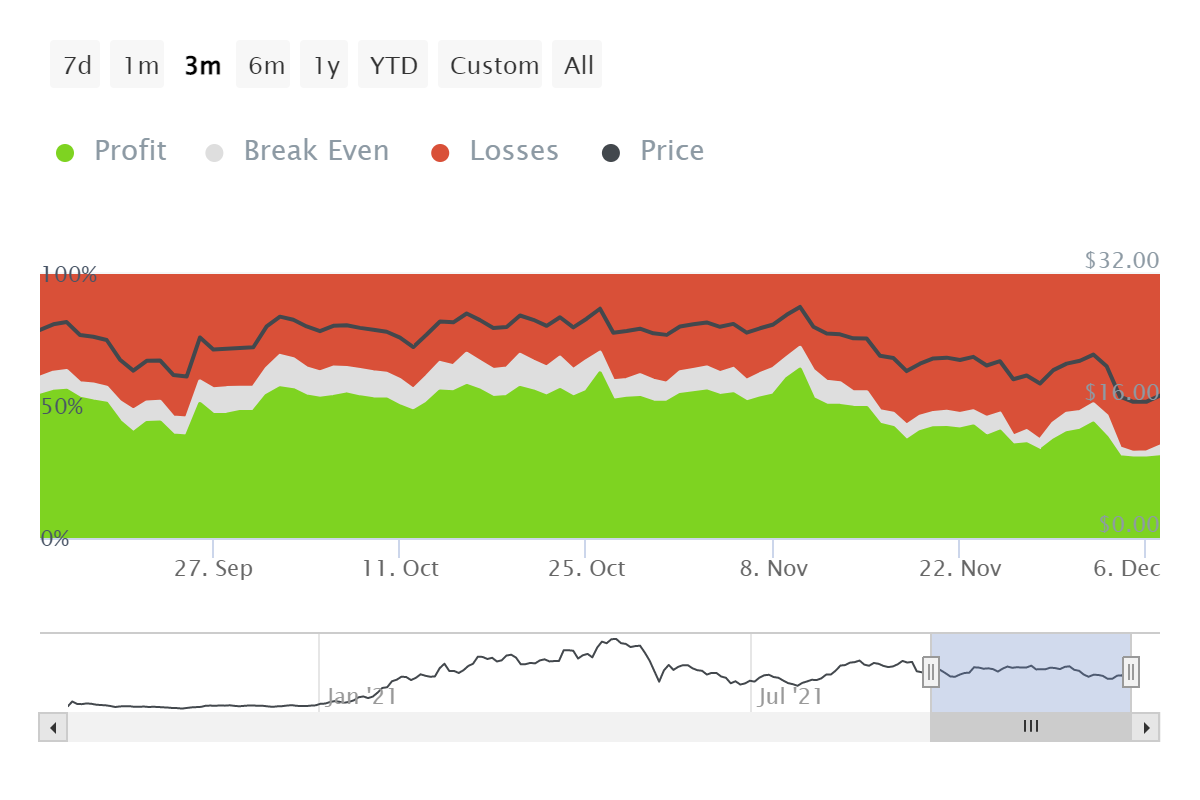

This despite over 65% of the addresses suffering losses. In fact, even then the network has not seen any investor exit the market yet.

Uniswap holders’ profitability | Source: Intotheblock – AMBCrypto

UNI Holders continue to remain optimistic for the coin with the market continuing to hold the accumulation sentiment. As a matter of fact, Uniswap hasn’t seen a significant distribution period in almost nine months now.

Uniswap mean coin age | Source: Santiment – AMBCrypto

Moreover, unlike other investors who have been selling their holdings around falling prices, Uniswap holders have instead been buying more, and are continuing to do so.

The reason behind this could be the altcoin’s high correlation with Bitcoin standing at 0.96, which is keeping investors hopeful about a quick recovery.