Cardano, its downtrend, and what can stop it

It has been a while since Cardano’s price rallied. Way back in September, it peaked at $3.101. Post that, however, things have only gone downhill for this altcoin.

Towards mid-September, ADA’s price entered a symmetrical triangle on the charts. And, by mid-October, it broke below the lower support line to continue its extended downtrend.

After briefly consolidating and then registering a couple of long green candles, ADA once again conceded to the aforementioned narrative by stepping into a descending channel. In fact, at press time, it remained encapsulated within the same structure on the charts.

Change – The only constant

Well, in September, when Cardano rallied to $3, the entire market was consolidating and experiencing the ‘blues.’ Since then, however, the dynamics have changed.

ADA has now become more susceptible to broader market trends. In fact, it is now among the handful of coins to get swayed and influenced by Bitcoin’s price movements the most.

Having said that, it should be noted that ADA’s correlation with the market’s king coin has inched up from zero to almost one in less than two months. So now, if the broader market led by Bitcoin continues to shed value, then Cardano, in all likelihood, will tread the same path.

Source: IntoTheBlock

Down and out?

The market sentiment associated with Cardano wasn’t quite sanguine either, at the time of this analysis. The average HODLer balance, for instance, has shrunk by more than half since mid-October.

This brings to light the presence of macro sell pressure. Even as far as the short term is concerned, the state is no different. ITB’s order book stats underlined the fact that over the last 12 hours, the number of tokens sold exceeded the number bought by more than 8 million.

So, as long as the sell-side pressure remains in the market, it would be difficult for Cardano to tackle the bears.

Source: IntoTheBlock

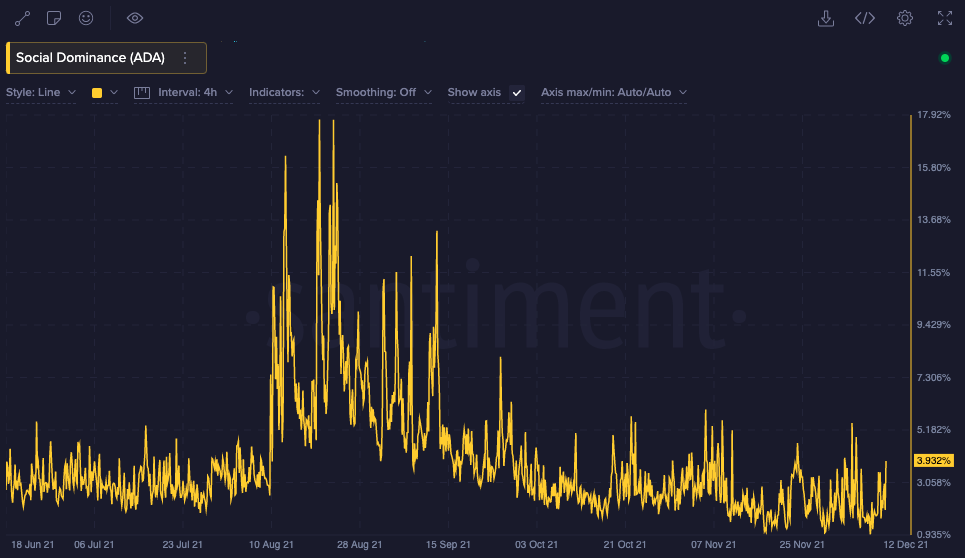

Furthermore, the coin’s social appeal also seems to be quite weak at the moment. Price peaks for this alt have, more often than not, coincided with high social dominance.

Social dominance increases when people from the space mention or talk about the altcoin online on crypto-related social media.

Source: Santiment

So, only when crowd euphoria returns to the market with buy-side momentum will Cardano be able to start negating the losses incurred thus far. Until then, the sixth-ranked crypto’s odds of recovering and breaking above its descending channel are low.