How the Metaverse, NFT fever can fuel HBAR’s growth further

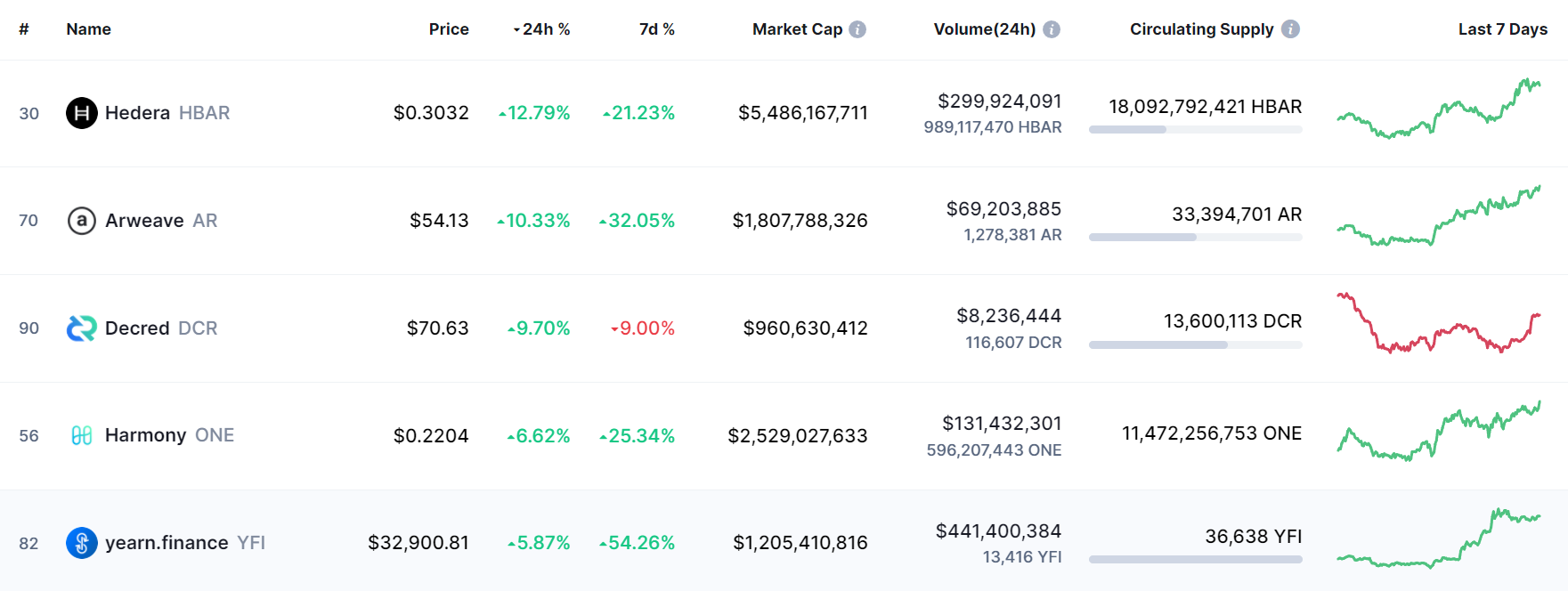

HBAR rose by 12.79%, Arweave appreciated by 10.33%, Decred was up by 9.70%, and yearn.finance (YFI) saw a hike of over 7% over the last 24-hours in what seemed to be an altcoin rally party.

Among the top 100 assets by market cap, the aforementioned coins were the top five gainers of the day, with Hedera (HBAR) leading the race.

While mid-cap altcoins seemed to steal the show, whether the altcoin rally would continue is to some extent dependent on BTC’s on-chain and social metrics retaining bullish divergences.

Nonetheless, at the time of writing, the top gainer Hedera looked like a bright project. So, what to expect from the altcoin?

Why the rally?

HBAR is up by almost 40% over the week as the HBAR Foundation jumped on the Metaverse bandwagon after a new partnership with MetaVRse to support the development of metaverse-related applications. The renewed interest in HBAR was also triggered after the company shared a Tweet about Google willing to take crypto-money for Google Cloud and that it “also has agreements with Hedera and others.”

The enterprise-grade, proof-of-stake public network, Hedera’s native token, HBAR, has seen an almost sevenfold rise in price year to date. However, when looked at the same in relative terms, projects like MATIC saw an over 100-fold increase.

Nonetheless, as per data, HBAR on 18 December achieved a network usage of over 2K+ TPS – A very good number reflecting the high network usage activity on the blockchain.

HBAR gained popularity after Elon Musk called for a sustainable coin. It has since been an interesting project. In fact, Hedera’s development activity had grown and stood at all-time high levels, at the time of writing.

While HBAR seems like an attractive prospect, at the moment, the coin is still over 35% down from its September ATH price of $0.57. So, will HBAR finally move towards recovery and target its all-time high?

Where can the price go?

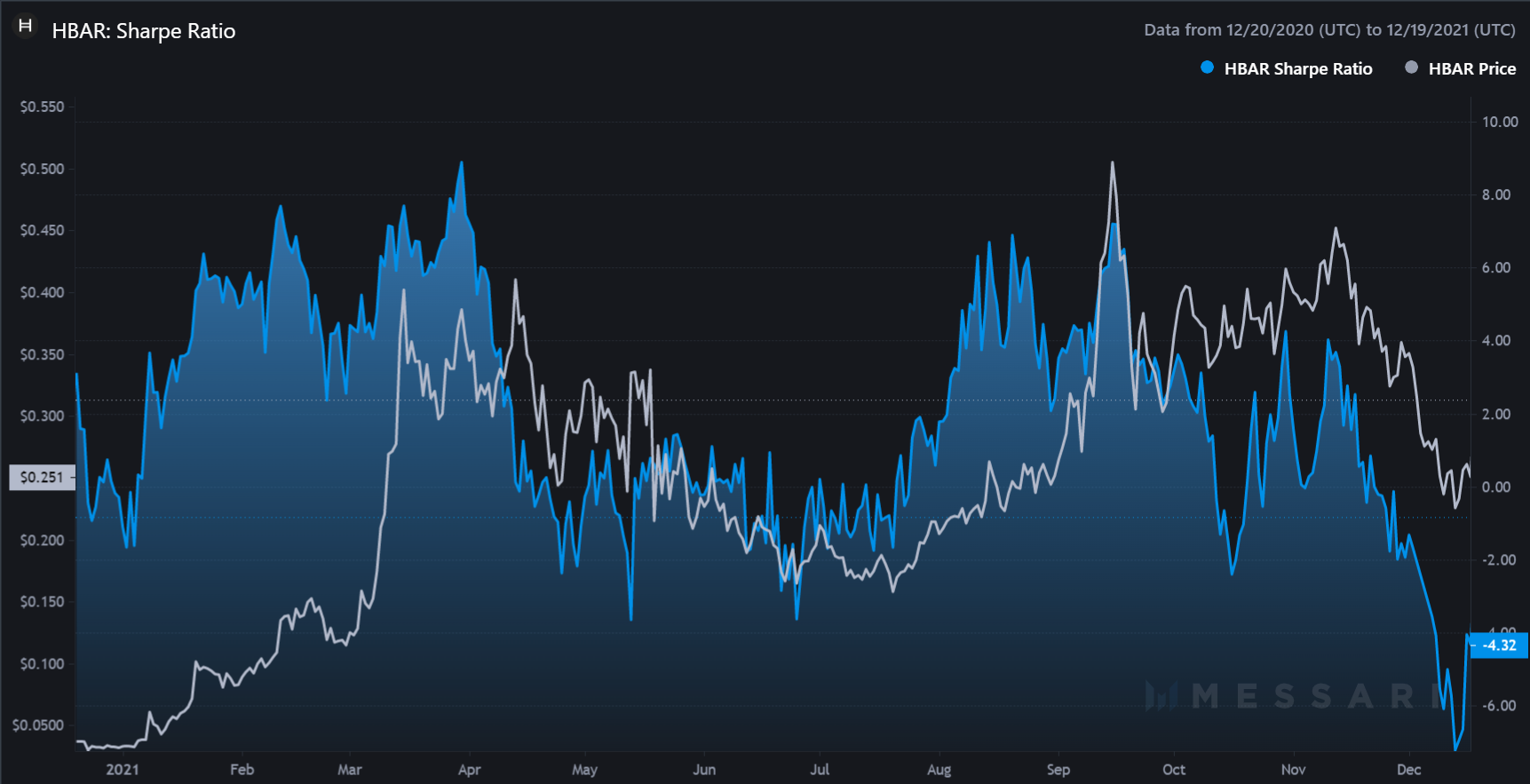

With the price picking up, HBAR’s circulating marketing cap has been picking up too – A good sign. The altcoin’s Sharpe ratio, however, was still negative but was recovering from all-time low levels – A fortunate sign of price recovery.

HBAR’s higher trade volumes in the spot market fueled a good narrative in the Futures market too as Open Interest saw an 88.86% jump across the Perpetual market. In fact, as per data from Coinalyze, over $477k worth of shorts were liquidated on 18 December. This meant that the market was tipping towards the bullish side, at the time of writing.

That being said, HBAR had flipped the $0.3 Support/Resistance line as the alt traded at $0.305. If the coin can maintain its bullish trajectory above this crucial support, the altcoin could head for higher price levels.

However, HBAR’s price action has been rather volatile throughout the year. And, with volatility going up again, it’ll be best to call only calculated shots.