Ethereum DeFi user numbers reveal this truth about the success of Ethereum adoption

When looking at 2021 in crypto, experts and analysts often use the term “DeFi boom.” What’s more, as the top alt, Ethereum is often touted as being the driving force behind said boom. However, is Ethereum adoption really all that it’s made out to be?

The truth beneath the hype

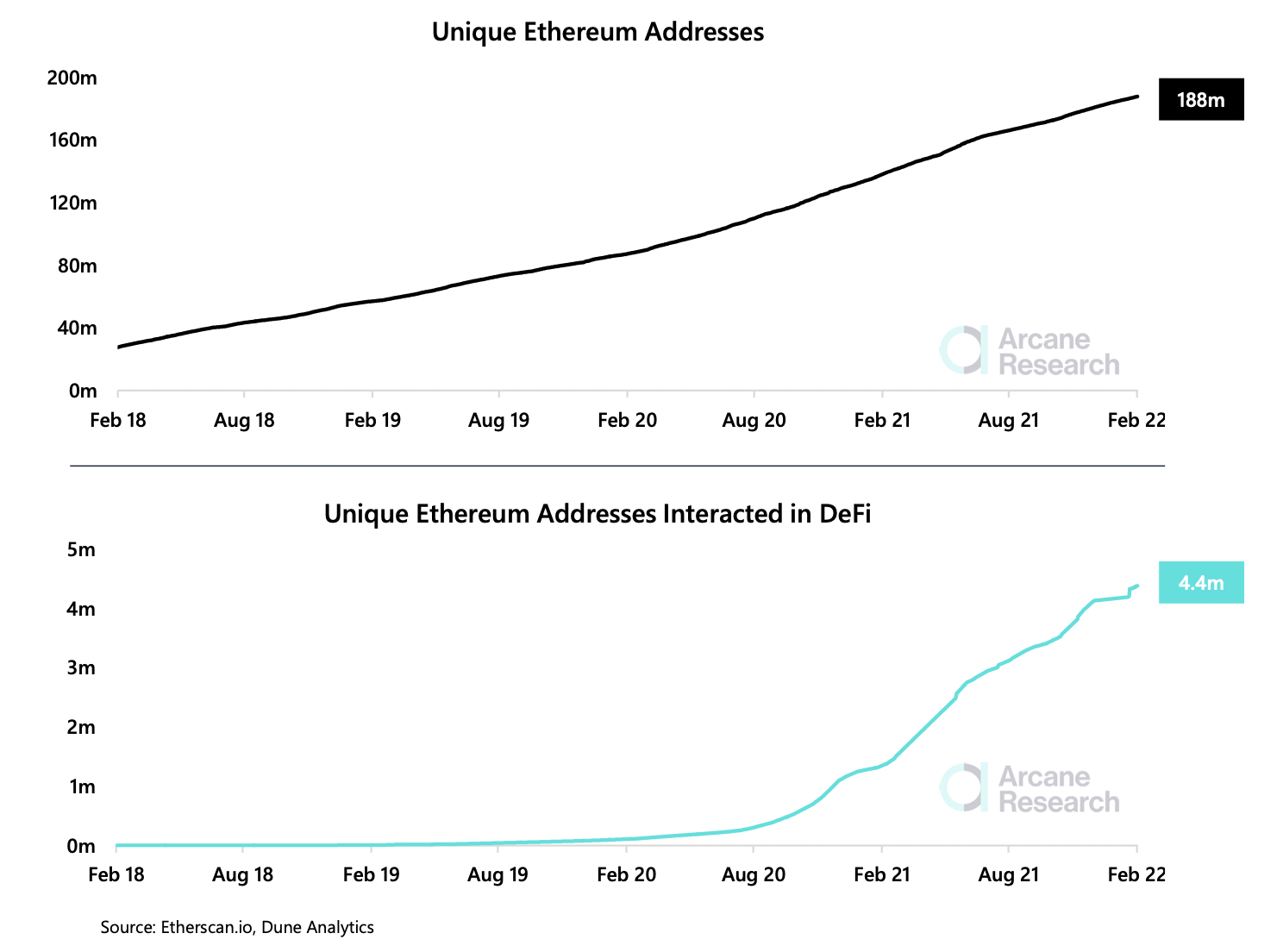

A report by Arcane Research revealed that while many might consider Ethereum’s DeFi scene to be the network’s powerhouse, DeFi users only made up about 2.3% of Ethereum’s total unique address count.

To put it in numbers, this is about 4.4 million unique addresses with DeFi interactions out of a total of approximately 188 million unique Ethereum addresses. Again, these numbers might not be accurate when considering how users create multiple addresses.

This naturally raises serious questions about the rate of Ethereum’s adoption. Arcane Research’s report touched on how one obstacle in Ethereum’s way could be the mindset of investors, who would rather make quick profits than seriously work with the technology.

Another headache, of course, was gas fees.

Source: Arcane Research

On the other hand, Ethereum has more than $123 billion in total value locked [TVL], meaning that significant adoption is certainly taking place.

You certainly took your own “crime”

DeFi lovers may only make up a small part of Ethereum’s user base, but DeFi is far from niche when it comes to the question of illicit activities. Chainalysis’ 2022 crypto crime report recorded an astronomical rise of 1,964% in the usage of DeFi protocols for money laundering. What’s more, Ethereum isn’t off the hook either.

Chainalysis’ report stated,

“The 20 biggest money laundering deposit addresses receive just 19% of all Bitcoin sent from illicit addresses, compared to 57% for stablecoins, 63% for Ethereum, and 68% for altcoins.”

In total, about $8.6 billion in crypto was laundered in 2021.

Ether my way or the highway

At press time, Ether’s price was $3,058.04, having fallen by 2.48% in the last 24 hours. While the top alt has seen a gradual rally since the lows of January 2022, Glassnode data showed that the number of receiving addresses for ETH fell to a new four-month low.

This suggests that investors’ sentiments are still poor.

? #Ethereum $ETH Number of Receiving Addresses (7d MA) just reached a 4-month low of 12,512.798

View metric:https://t.co/Vm6VJY2z37 pic.twitter.com/tYO2Fq8JuV

— glassnode alerts (@glassnodealerts) February 17, 2022

Counting crypto sheep

Furthermore, Arcane Research’s report pointed out how counting unique addresses are not the most accurate way to judge a network’s adoption rate. However, it’s important to remember this isn’t just an Ethereum problem.

A few months earlier, journalist Laura Shin questioned the adoption stats of Solana’s Phantom wallet.

1/4 — 2021 has been an incredible year for Phantom & the @solana ecosystem! We opened up our invite-only beta in March and then launched publicly in July.

In just 9 months we have grown to over 1.8M monthly active users with no sign of slowing down! pic.twitter.com/kY4tjBQuyv

— Phantom (@phantom) January 1, 2022

In this case, Shin wanted to make sure of the difference between active users and active addresses.