LUNA: UST’s demand, burning rates, and what they mean for the alt

The stablecoin space is an intriguing one for investors right now. For many, Terra remains a top pick.

Algorithmic stablecoin network Terra and its LUNA token registered an impressive rally over the past few days. After hovering around the $50-level last week, LUNA exploded to trade close to $89, at the time of writing – A gain of approximately 50%.

In the last 24 hours alone, Terra surged 19% higher, leading all the top-10 cryptocurrencies as far as gains are concerned.

LUNA-tics are at it

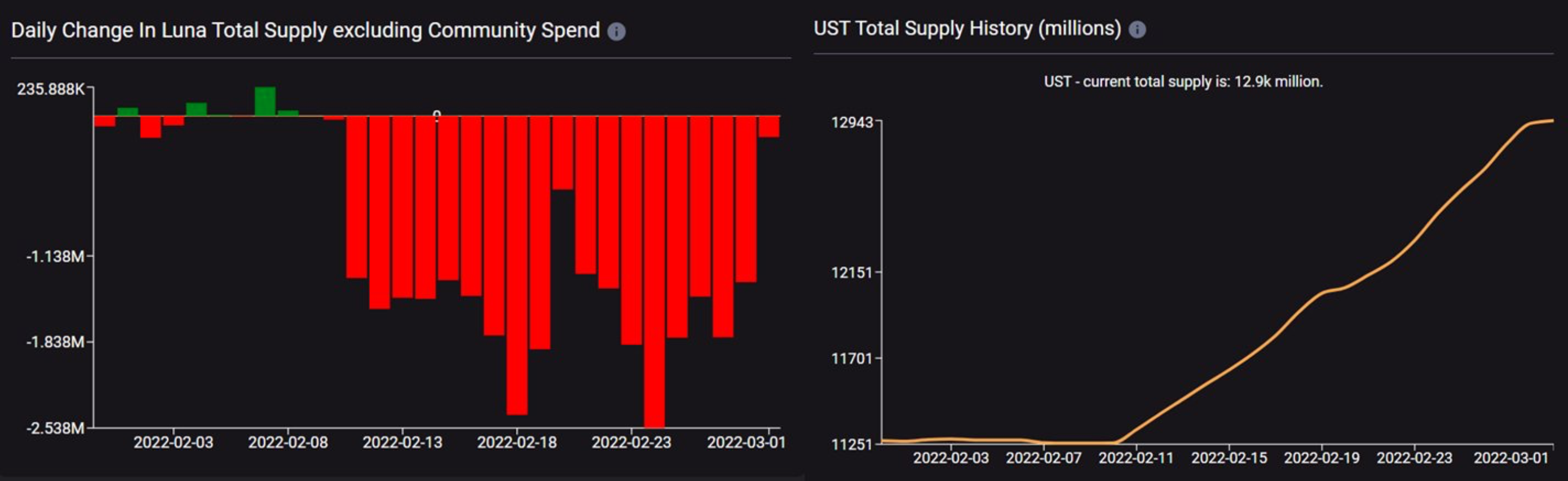

According to Smart Stake, LUNA burned more than 29 million for 21 days, signifying the increasing demand for UST. The total supply has increased from 11,256.43 million on 9 February to 12,942.91 million, an increase of nearly 15%. In fact, popular journalist Colin Wu tweeted about this milestone too.

Source: Wu Blockchain

The aforementioned graph pointed towards one key concept – To mint UST, more and more LUNA was burned.

For further context, consider the following – Decentralized stablecoins are used as risk-on assets during drawdowns while there is rotation from decentralized to centralized stablecoins due to peg risks. Furthermore, there is a stark difference now with stablecoins like UST considered as safe-havens.

In fact, while the larger crypto-market was down by 25%, UST’s supply surged by 28% over the past 60 days.

In addition to this, Terra accounted for more than 10% of DeFi’s total value locked, at press time. According to the DeFi Llama tracking platform data, Terra now has a share of 10.96% (~$23B) in DeFi’s cumulative TVL.

Finally, social activity on LunarCrush seemed to underline a promising scenario too. LunarCrush’s metrics reiterated the same as well.

Terra 1-week social activity:

Galaxy Score™ 65/100

AltRank™ 1/3,585

54,092 social mentions

135,577,706 engagements

334 social contributors

0.52% social dominance

5,152 shared links

Price +80.802% to $88.94 https://t.co/TwNkEaKbJH$luna #terra— Showkat1747 (@show1747) March 1, 2022

An opportunity to buy in?

To many, higher returns is a significant probability as far as LUNA is concerned. Popular crypto-analyst Altcoin Sherpa, for instance, termed LUNA as one of the ‘strongest altcoins’ in the market.

$LUNA: I never got this entry which sucks but this remains 1 of the strongest altcoins on the market rn. I still don't think this is the right place to long and this is one of the few candidates where you should buy the fucking dip when it comes. #LUNA pic.twitter.com/oeXByj6BfS

— Altcoin Sherpa (@AltcoinSherpa) February 28, 2022

Consequently, the price increase has increased the market capitalization of LUNA to over $33 billion, making it the seventh-largest cryptocurrency in the world. Terra overtook Cardano (ADA) and Solana (SOL) to take the seventh spot on CoinMarketCap.

Here, it’s worth pointing out that an article published by AMBCrypto recently highlighted an incoming 45% rally – A massive leg-up.