Anchor is now making its APY ‘Dynamic;’ would it see ANC invalidate all its losses

Anchor has been one of the fastest-growing Decentralized Finance protocols in the crypto space. In less than a year, dApp has managed to attract a large number of investors. Consequently, the total value locked in it has increased by 1,851%.

Now, it is competing to be the biggest lending protocol, fuelled by one simple tactic – APY.

Anchor introspects

Anchor’s brush with an almost empty yield reserve last month brought things into perspective for the lending protocol that is known for its high APY.

The 20% Annual Percentage Yield (APY) “Anchor rate” exceeds most of the other lending platforms’ rate of earning. This is why investors have been choosing Anchor over other protocols.

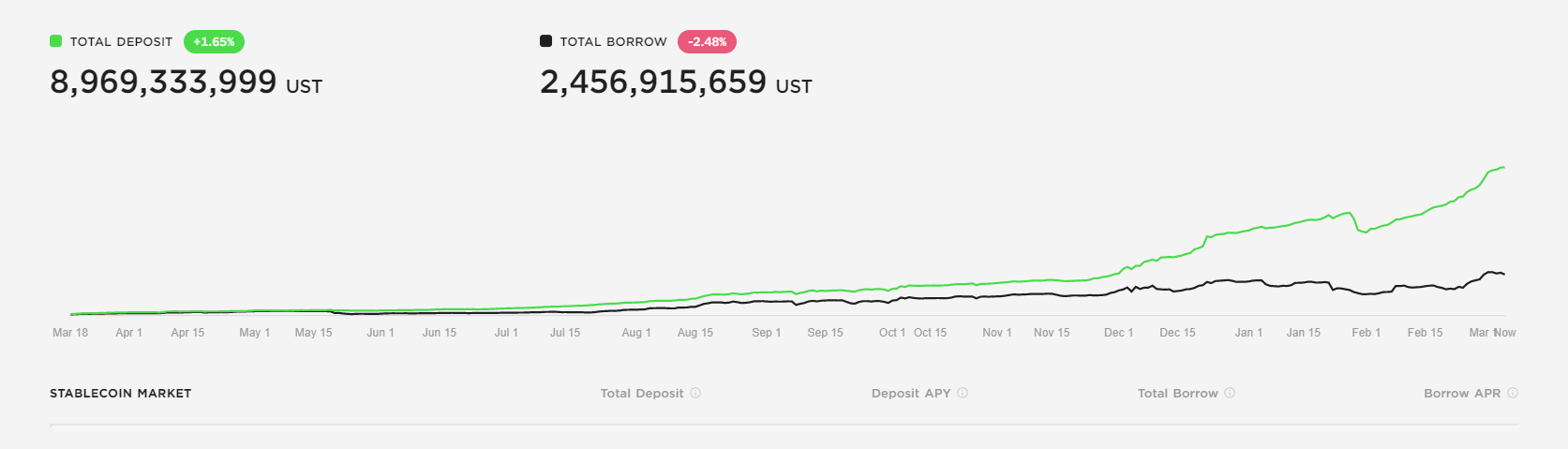

Interestingly, it was the very same APY that landed Anchor into trouble a month ago. How so? Well, since the beginning of the market crash borrowing on the dApp reduced but deposits kept rising. This led to an 828% increase in the deposit-borrow difference as the total deposits currently sit at 8.9 billion UST while the total borrowed UST is at 2.4 billion.

The rising difference of Anchor deposits and borrow | Source: Anchor

People kept earning their 20% APY, however, the count of borrowing from the dApp reduced. In fact, the interest generated was also diminished. Consequently, the yield reserve was used to maintain the APY, which was almost drained empty last month.

Although the Luna Foundation Guard infused $450 million into the reserve, the protocol had to come up with a more economical approach to deal with such a situation.

Thus, to ensure sustainability and increased potential for ramped-up borrowing demand, Anchor proposed a semi-dynamic rate a few days ago. This would adjust the earn rate by increasing or decreasing it as per the yield reserve status.

If the yield reserve was to increase by a certain amount, algorithmically the APY would rise as well and reduce in case the yield reserve falls.

This new semi-dynamic rate would be useful to prevent another similar instance given the price action has been highly volatile for the last few days.

In the case of Anchor itself, the ANC token rallied by 333.67% in February but also fell by almost 34% just in the last 24 hours. With indicators pointing towards a further drop in price, investors might try and capitalize on the benefit of the 20% Anchor rate.

Anchor Protocol price action | Source: TradingView – AMBCrypto