All about 7 in 7 for Bitcoin, Ethereum’s 13-week high, and alts’ ‘mixed fortunes’

Cryptocurrency prices have climbed somewhat after investors appeared to view Bitcoin as a safe haven for their money. In fact, even the Russians and Ukrainians have been seeking alternatives to their country’s financial institutions.

Bitcoin is a particular favourite, with the current geopolitical events allowing Bitcoin (BTC) to transition into a store-of-value asset.

Nonetheless, institutional investors are backing the wider cryptocurrency market too, with most digital assets seeings signs of recovery.

Much-needed uptick

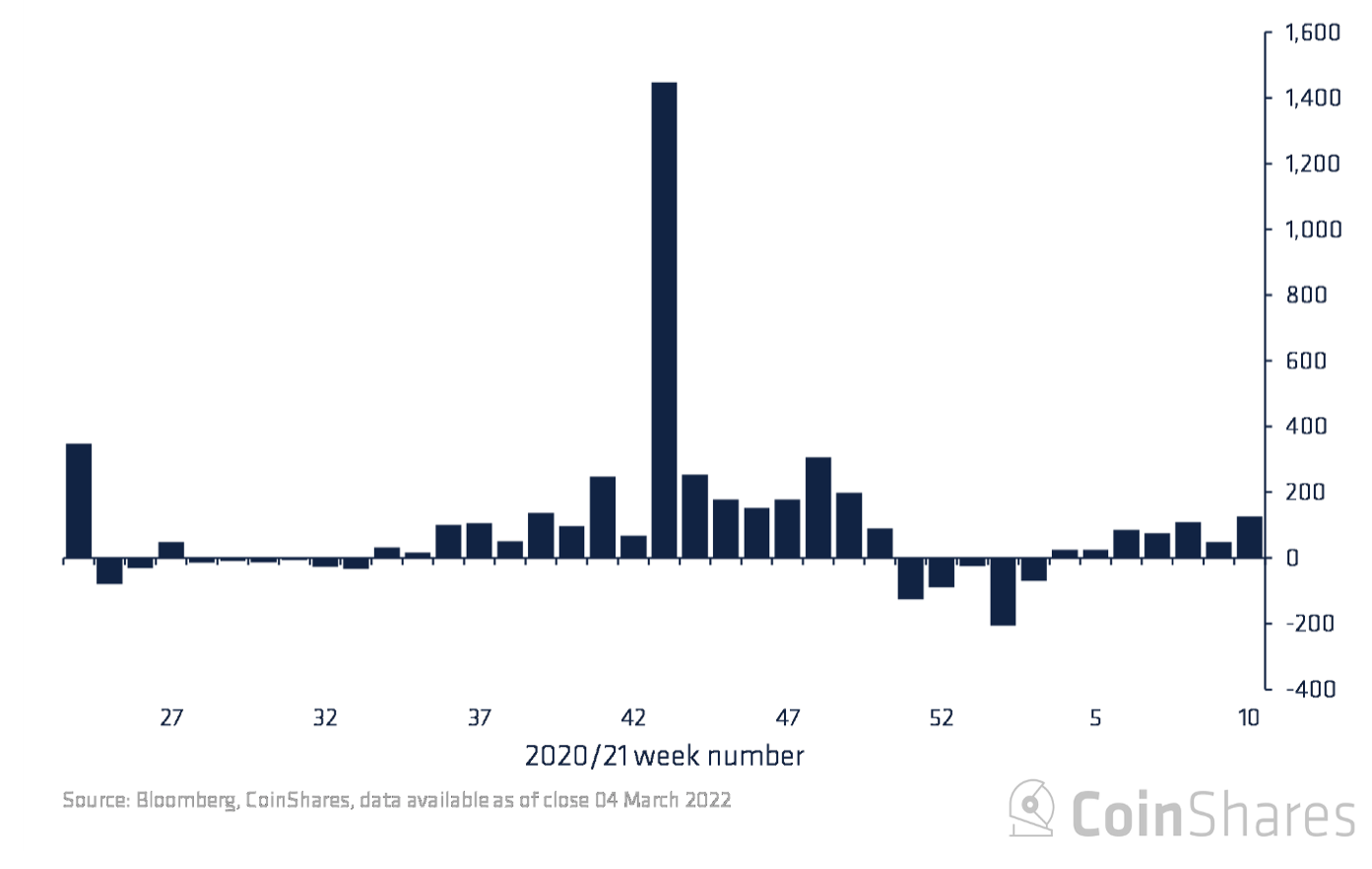

Crypto-investment products saw inflows of $127 million last week, according to a CoinShares report. The fresh investment inflows into crypto-funds jumped threefold last week to its highest in almost three months.

As can be observed, there have now been seven consecutive weeks of positive inflows for Bitcoin. This is a sign of institutional investors’ interest in crypto, despite the recent retail sell-off. Such positive sentiment was centered in North America, with the region seeing inflows of $151M. Europe, on the contrary, saw outflows totaling $24M.

Bitcoin was the most popular asset among institutional investors, as almost $100 million funds were moved into it.

Source: CoinShares

Bitcoin saw inflows totalling $95M last week, the largest single weekly inflow since early December 2021. This marked 7 consecutive weeks of inflows for the largest cryptocurrency. Indeed a major jump from last time when BTC registered inflows of around $17 million.

It didn’t really come as a surprise given the dependence on Bitcoin in previous weeks. Worldwide sanctions following Russia’s invasion of Ukraine, as well as truckers in Canada losing banking access during a protest against their government, propelled Bitcoin away from the risk-on category of investments.

And the remainder?

Well, altcoins saw a mixed bag of fortunes. However, Ethereum, the world’s largest altcoin, got much-needed relief after witnessing a series of outflows. Ether funds saw minor inflows of $25 million, its highest figures in 13 weeks.

Multi-asset crypto-funds saw inflows amounting to $8.6M but individual altcoins remained flat over the week. In fact, some even saw outflows. The report stated,

“Altcoin fortunes were mixed last week, with outflows from Solana (US$1.7m), Polkadot (US$0.9m) and Binance (US$0.4m). While Litecoin, Cardano, and XRP saw inflows totalling US$0.4m, US$0.9m and US$0.4m respectively.”

Overall, while it might be a good sign considering the return of institutional investors, risks are still there. All one can do is brace and hedge against the risks.

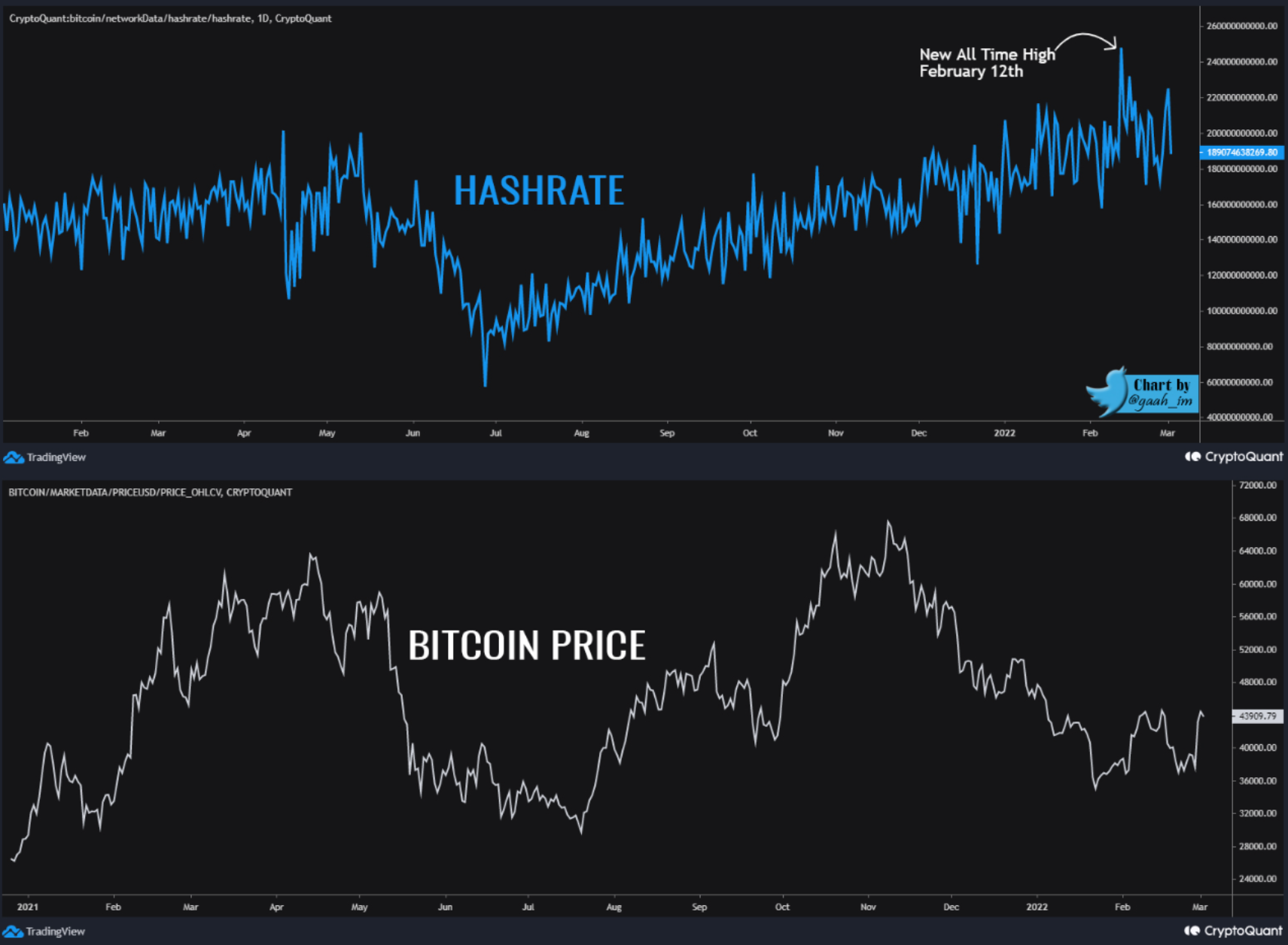

For instance, miners have continued adding Bitcoin to their reserves. The hashrate or network’s computing power hit a high of 212,000 Ehash/s too.

Source: CryptoQuant

The last significant exit of miners was back when the price was breaking its previous all-time high, trading near $25,000. Since then, however, there have been no more mass sales.

3/3 ?

Unlike previous cycles post Halving, the highly liquid supply has been draining.

About 19% since the supply reduction event in May 2020.

Currently only about 4.4 million #BTC are in constant circulation and available for purchase and sale. pic.twitter.com/13AA9E75ap

— G a a h (@gaah_im) March 8, 2022