For the first time in 7 weeks, Bitcoin and Ethereum see heavy outflows worth $110M

Regulatory hurdles and geopolitics remain at the forefront of investors’ concerns for digital assets. Notably, Bitcoin traded roughly flat over the past 24 hours. In fact, trading volume across major exchanges declined to its lowest level since 19 February. Well, this signals some caution for the traders ahead of the Fed meeting this week. Curiously, altcoin suffered the same fate.

Free-fallin’

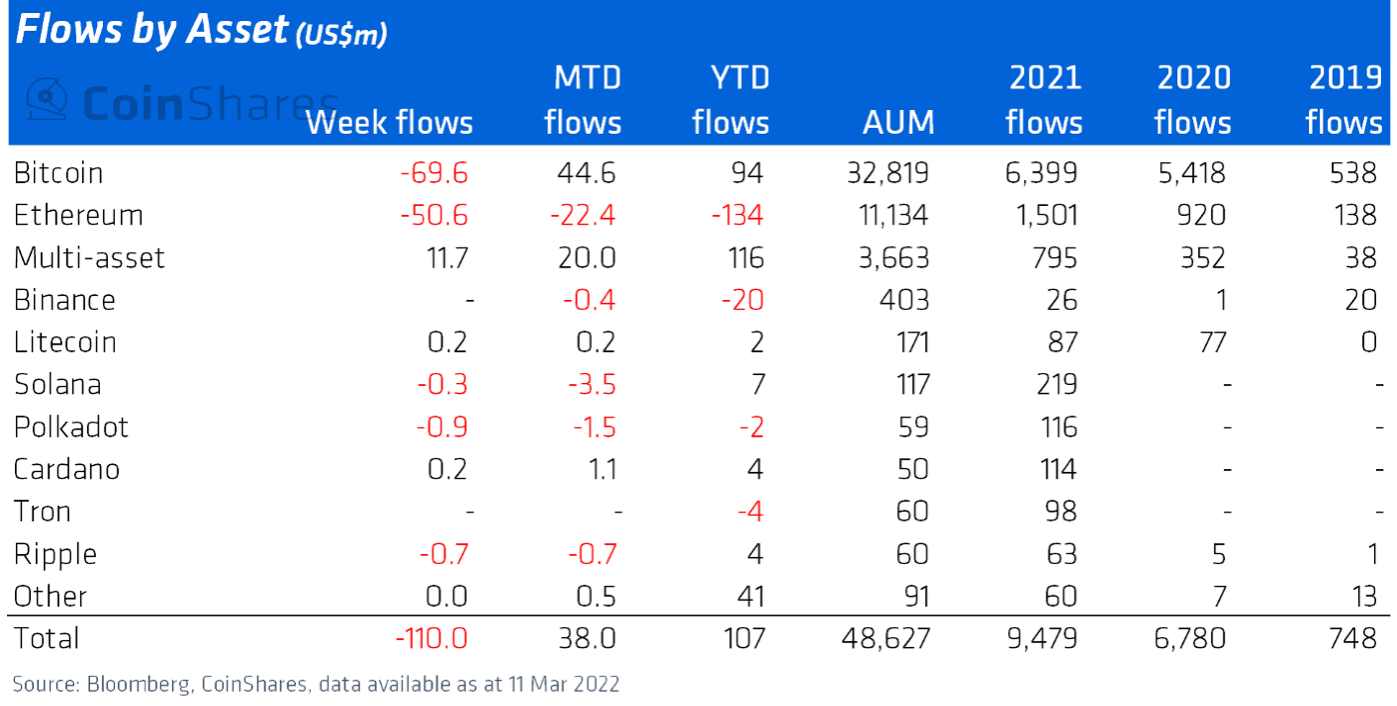

Bitcoin and major altcoins witnessed a sizable exit of money according to the latest weekly CoinShares report. Unfortunately, digital asset investment products suffered outflows of $110M last week. Here, crypto investment products experienced outflows over the last week for the first time in seven weeks.

Source: CoinShares

Geographically, North America and Europe saw $80M and $30M outflows that were mainly triggered by the response of U.S. President Joe Biden’s executive order on crypto. Although exact reasons were unclear. Nonetheless, the report stated,

“Regulatory concerns and geopolitics remain at the forefront of investors’ concerns for digital assets.”

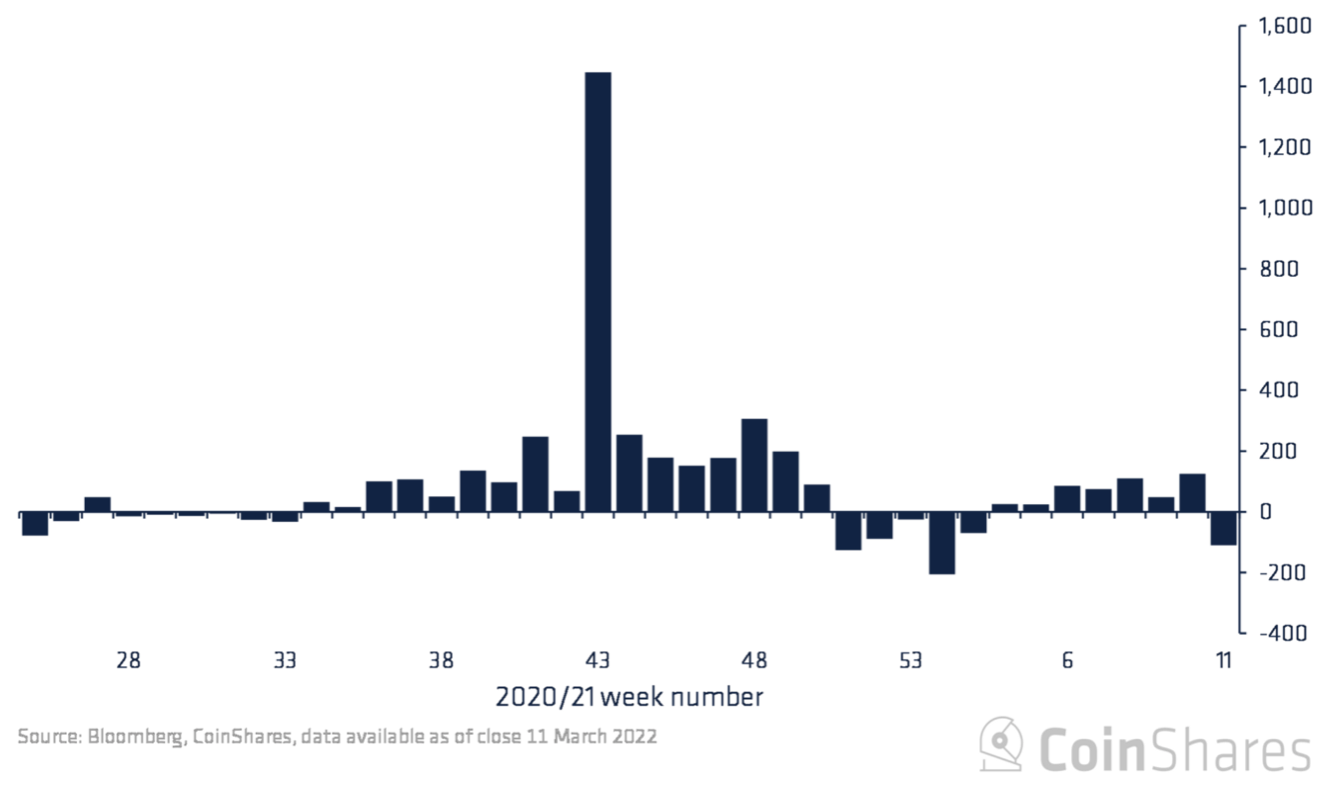

BTC experienced the heaviest outflows, with $70 million leaving BTC investment products. Investment products traded US$1bn last week compared to the average US$1.24bn. Thus, representing just 5% of total Bitcoin trading volumes. This scenario was evident from the chart below.

Indeed, a drastic change from the previous report, dated 9 March when Bitcoin was the most popular asset among institutional investors, as almost $100 million funds were moved into it.

Alas, that wasn’t the case here. Ethereum, on a relative basis, saw the second-largest outflows last week. It totaled US$51m outflows year-to-date and represented 1.2% of assets under management. Apart from this, major altcoins saw a mixed reaction.

Digital assets Solana, XRP, and Polkadot saw outflows of $0.3 million, $0.7 million, and $0.9 million respectively. However, Cardano and Litecoin each enjoyed inflows of $0.2 million.

Despite the bloodshed, outflows in digital asset funds that directly invest in cryptocurrencies, blockchain-related stocks remained popular. The blog claimed,

“Multi-asset (multi-coin) and blockchain equity investment products saw inflows totaling US$12m and US$4.1m last week and remain the most popular amongst investors…”

Try harder?

Well, as per Santiment, the crypto market did try to recover the losses as mentioned in the tweet below. But was this enough?

? #Crypto markets have enjoyed a rebound, and #Bitcoin quickly jumped back to Friday levels above $39.4k. Additionally, several #altcoins are seeing address activity jumps. $MFT, $CRE, $AERGO, & $PNT are among projects at least doubling their normal rate. https://t.co/cfn7qeRZma pic.twitter.com/wuk64ZBcwF

— Santiment (@santimentfeed) March 14, 2022

Apparently not, Bitcoin along with major altcoin continued to bleed more as the losses became even worse. Overall, the crypto market suffered a 1% setback as per CoinMarketCap.