Did LRC’s short spike create a selling pressure for investors

The broader crypto market has been registering bearish signals since 12 April. And, Loopring hasn’t been an exception like SHIB, COMP, and SOL which noted green candles after their listing on Robinhood.

Loopring did not make a comeback?

The short spike in LRC’s value on 12 April created selling pressure for Loopring.

According to the Chaikin Money Flow (CMF) indicator, historically, every time LRC shoots up, CMF goes up as well. This spike on the indicator shows that a buying pressure is being formed in the market, which at the moment is looking true thanks to investors’ recent behavior.

Investors try to jump in usually when there are concrete indications of a rise or a recovery. Now, since the recent mid-March to April rally of 90% was the first major rise in more than four months, it was bound to lure in investors.

Loopring price action | Source: TradingView – AMBCrypto

Interestingly, there was a selling opportunity for investors who bought their LRC before 12 April’s closing price of $0.9. Thus, creating a selling pressure in the market.

And, this timidness from LRC holders makes sense since their activity has been somewhat restrained over the last couple of weeks.

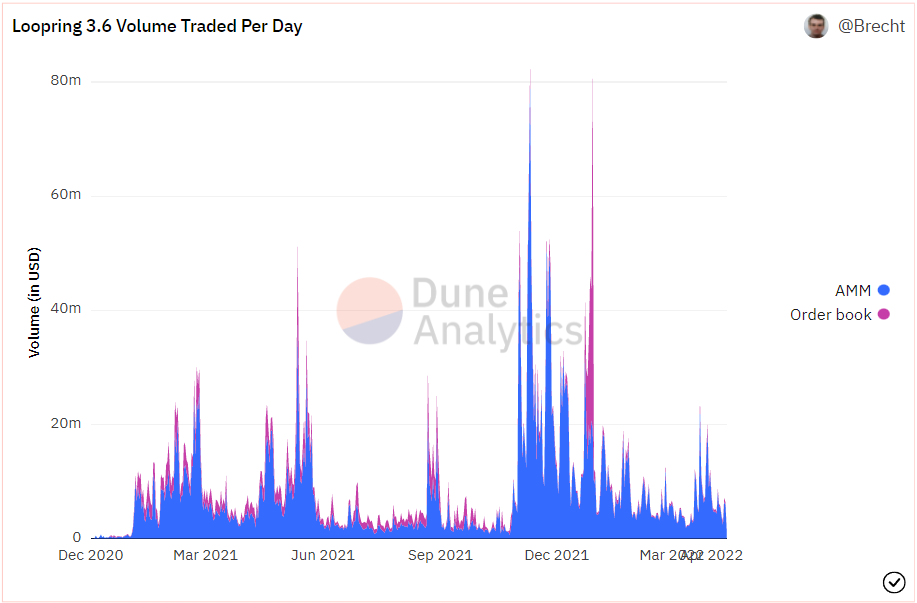

According to Loopring’s on-chain statistics, the daily trading volume, which spiked towards the end of March, came back down to note less than $2.5 million worth of transactions in a day.

Loopring 3.6 transaction volume | Source: Dune – AMBCrypto

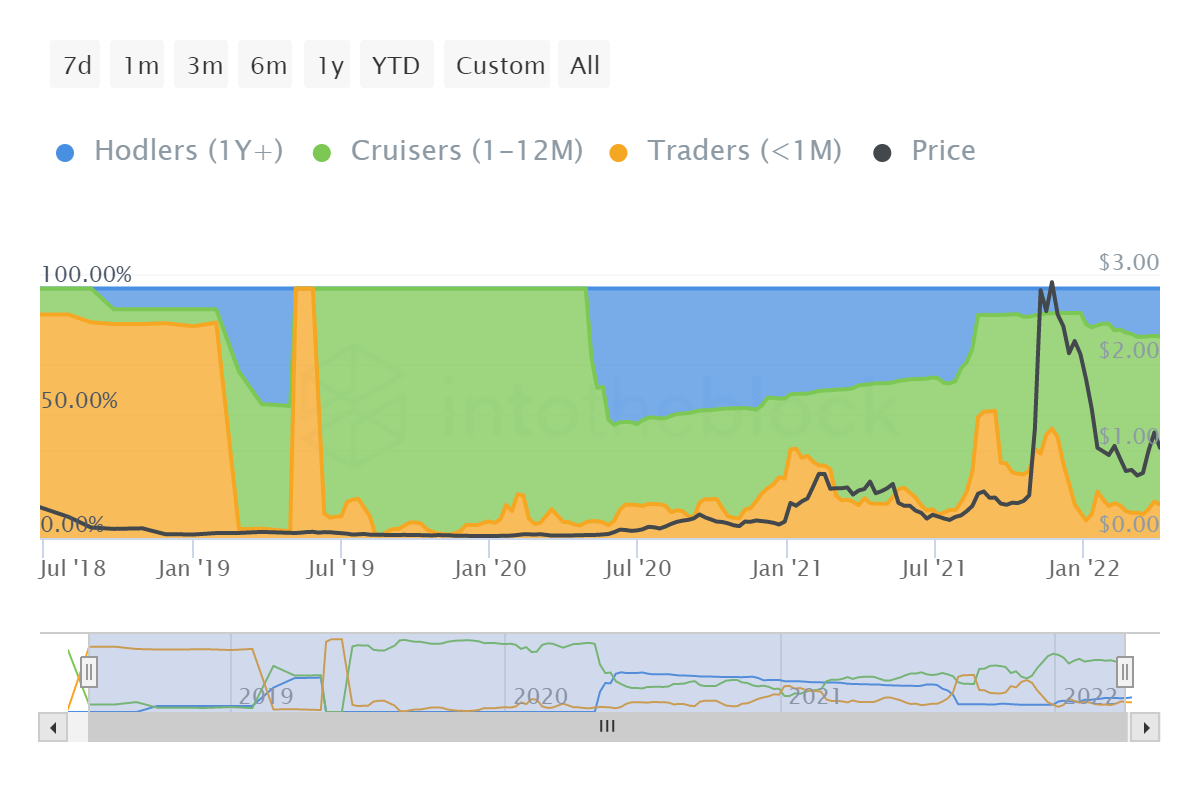

In the same duration, the rate at which LRC changes hands has declined as well, which means that investors are positively holding on to their supply until they can find a profitable level to sell it at.

Loopring velocity | Source: Santiment – AMBCrypto

This is also verified by the fact that more than 86% (1.188 billion LRC) of the supply has been held by investors for more than a month now.

Loopring supply distribution | Source: Intotheblock – AMBCrypto

Thus, going forward, until Loopring can create another local top by closing above $1.28, the market can see some apprehension at the hands of investors.