Analyzing how Bitcoin may shape the future according to this expert

The performance of the King coin hasn’t been in the best of spirits lately, especially given its position of extreme volatility in the last few weeks. However, despite the constant state of war that Bitcoin (BTC) has been in, Dan Morehead, CEO of Pantera Capital, felt otherwise.

In a recent episode of the Bankless podcast, he stated,

“I think we’re done with the bear market. The next six to 12 months are likely to see massive rallies investors flee stocks, bonds, and real estate for blockchain.”

Is the bear cycle becoming weak?

At the time of writing, BTC was trading at a value of $38,015 as per data from CoinGecko. The token was -1.6% down in the last 24 hours and was approximately lower by -3.9% in the last seven days. At press time, the Relative Strength Index (RSI) was fluctuating below neutral 50 at a score of 39.19. The Awesome Oscillator (AO) further substantiated the bearish movement of the token at press time.

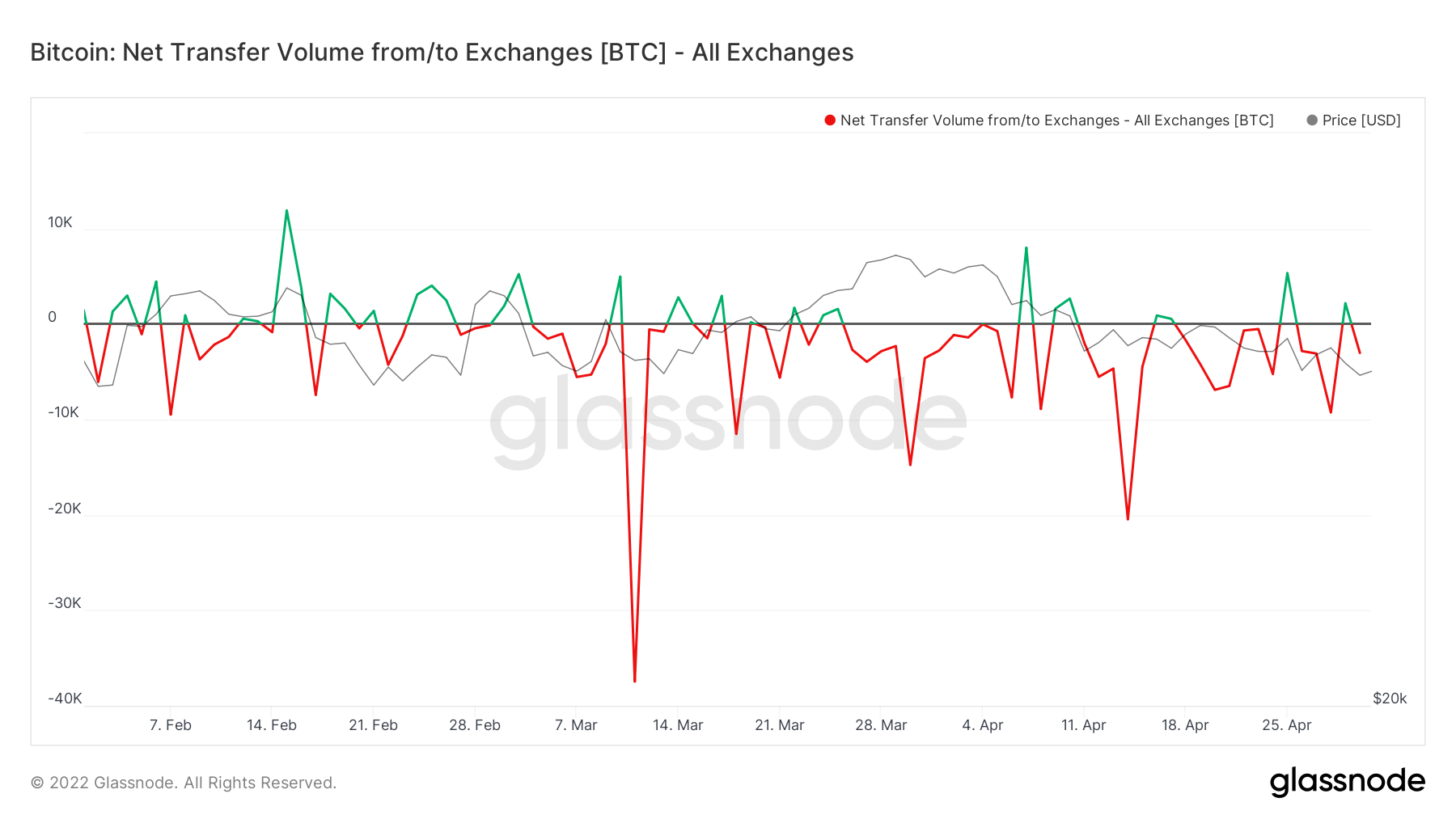

Furthermore, as of 1 May 2022, the Bitcoin Fear & Greed Index also stood at a score of 22, indicating a sentiment of “extreme fear” with regard to the token. However, data from Glassnode justifies the statements made by Dan Morehead.

According to the data chart given below, the “Net Transfer Volume to/from Exchanges” stands at -3,012.95 BTC at the time of writing. The negative volume indicates that token investors are willing to hold onto their investments and not get pressurized by the bear cycle just yet.

The future is “Bull”

Commenting on the performance of BTC and the overall cryptocurrency market, Dan Morehead expressed his astonishment at the ongoing state of all the cryptocurrencies. He also addressed the reasons for the ongoing bear market and the correlation between macro news and the cryptocurrency market.

“Bear markets are half as long as bull markets. With the Russian invasion of Ukraine and all of the policy responses, it’s hard to know how everything is going to play out but when the dust settles, it’s going to make a lot of people use crypto”, he stated.

Amid the ongoing bear run of the king token, Willy Woo, a BTC analyst, also shared a tweet supporting the bullish outlook of the market.

BTC price holding up well while equities tank and USD Index moons is testament to the unprecedented spot buying happening right now.

In other words: Investors already see BTC as a safehaven, it will take time for price to reflect. Wait for the futures sells to run out of ammo.

— Willy Woo (@woonomic) April 30, 2022

Is BTC the future then? Most likely not…

The Berkshire Hathaway Annual Shareholder meeting took place on 30 April 2020, where Warren Buffet, yet again, expressed his views on how cryptocurrencies are of no value to him. Commenting on the volatility of the current market, he stated,

“Whether it goes up or down in the next year, or five or 10 years, I don’t know. But the one thing I’m pretty sure of is that it doesn’t produce anything.”

Holding a $20 bill in his hand, he also stated,

“Assets, to have value, have to deliver something to somebody. We can put up Berkshire coins… but in the end, this is money. And there’s no reason in the world why the United States government… is going to let Berkshire money replace theirs.”