Bitcoin reaches lowest point since Dec 2020; here’s what to expect

On 12 May, BTC dropped to its lowest valuation of $26,350 since December 2020. There is an uncanny resemblance between this crash with the mid-season crypto breakdown in May-June 2021.

In both crashes, the price of BTC dropped below the all-important support level of $30,000. Back in June 2021, it reversed back from $29,800 but this time around it has dropped further to around $26,300.

Again, in both instances, there were several macroeconomic factors at play that decided Bitcoin’s fate. In the spring of 2021, Chinese banks forbid crypto services by financial institutions in the country. Elon Musk caused further trouble after ‘reversing’ his decision to use Bitcoin for Tesla payments. These factors were coupled with the peak of the COVID-19 pandemic in major economies thereby plummeting BTC prices.

The current crash is also the result of larger macroeconomic and geopolitical headwinds. The Russian invasion of Ukraine, and regulation issues in a period of global inflation puts the crypto market in turmoil. Fed regulations and legal ambiguity of crypto assets in major economies further put Bitcoin’s prices in a downward projectile.

Stat-Alert

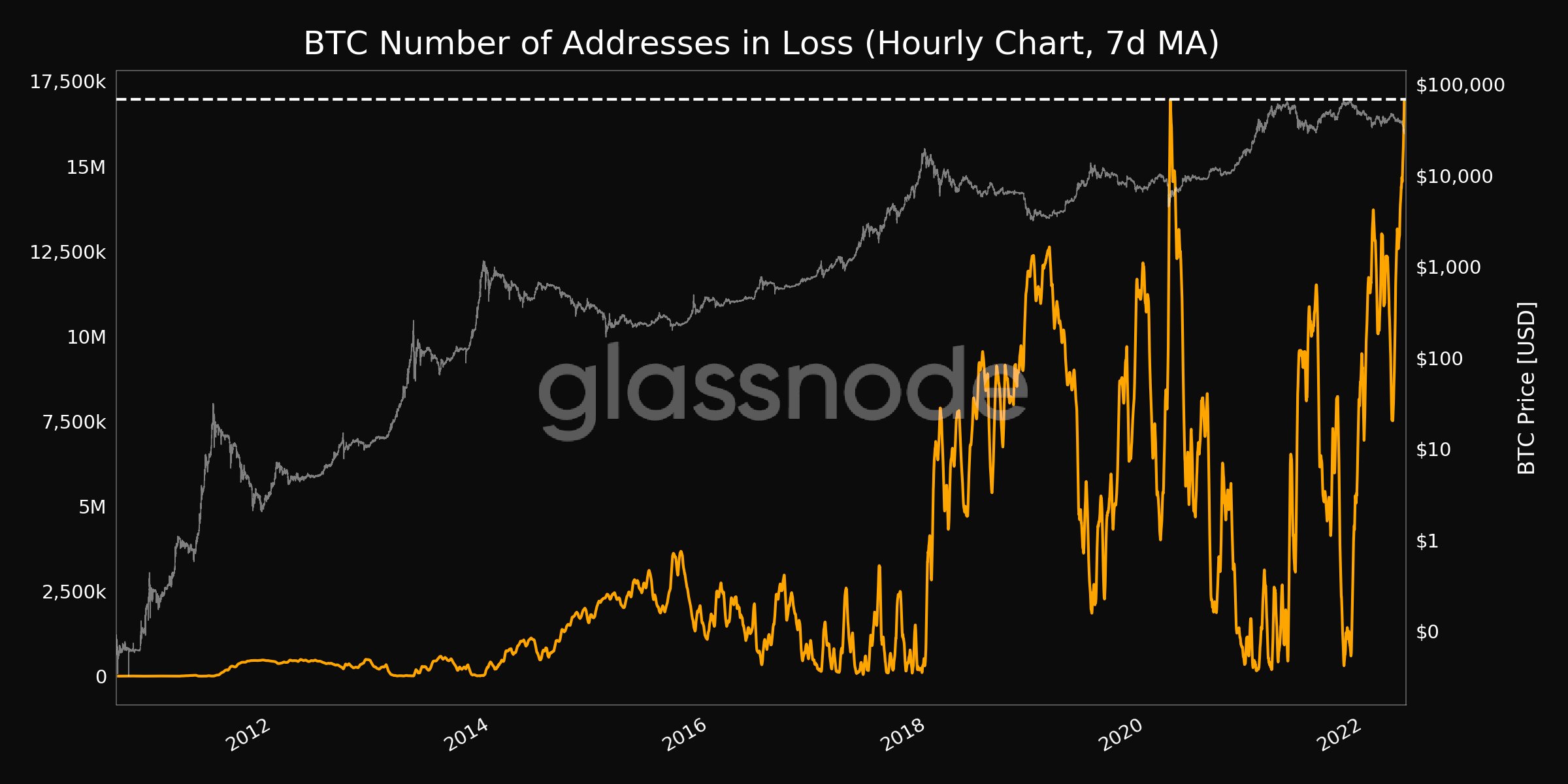

After the recent crash, investors have been rushing to exit their holdings through exchanges with many holding on to their losses. The number of addresses in loss stands at an all-time high of 16,967,726. Such a peak was earlier observed more than two years ago on 19 March 2020.

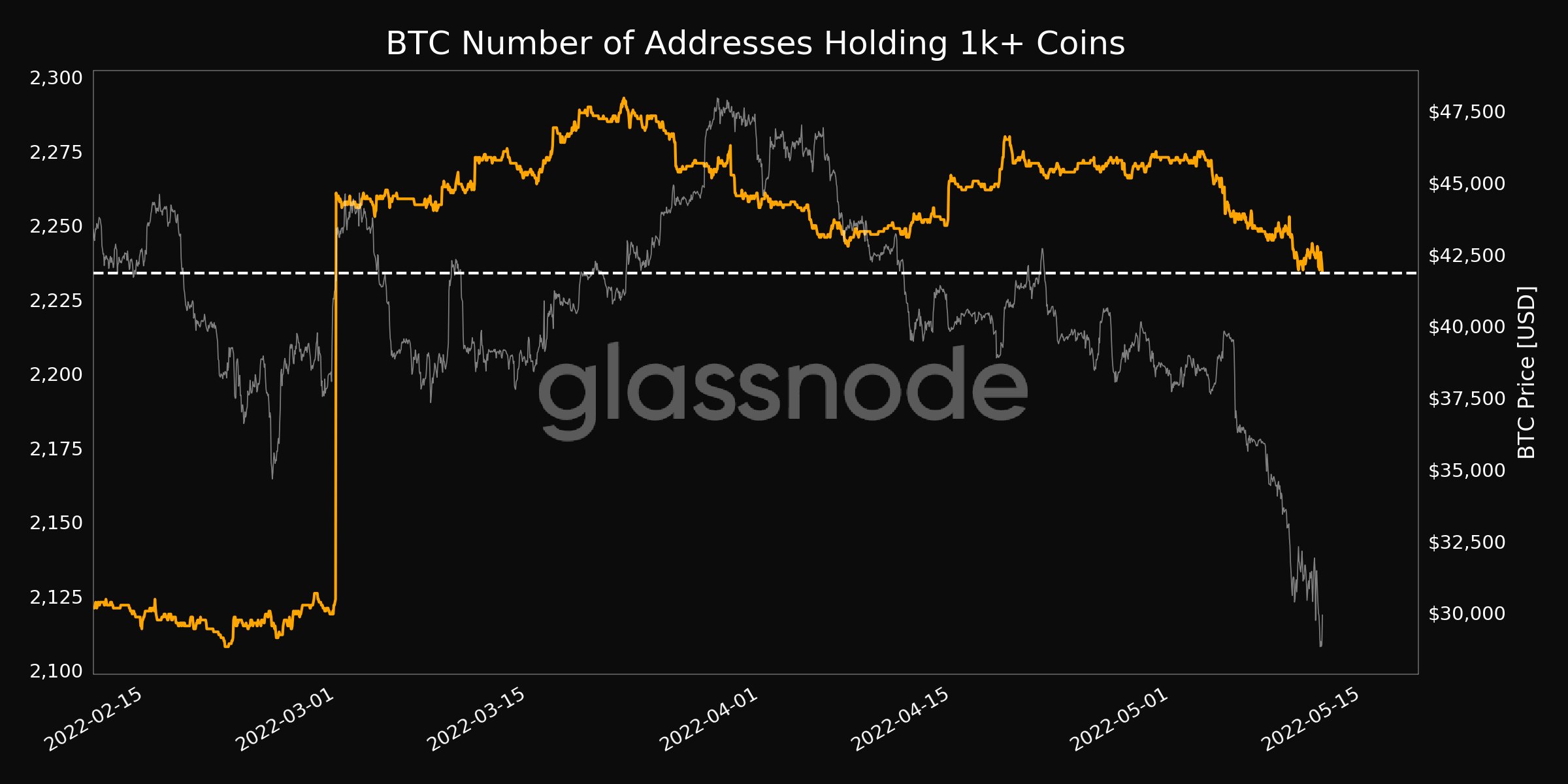

Investors are being encouraged from market situations to shrug off their assets and liquidate them. This has resulted in a drop in the following metric. The number of addresses holding 1k+ coins reached a one-month low of 2,234. What’s more interesting is that such a low was recorded on May 11 only.

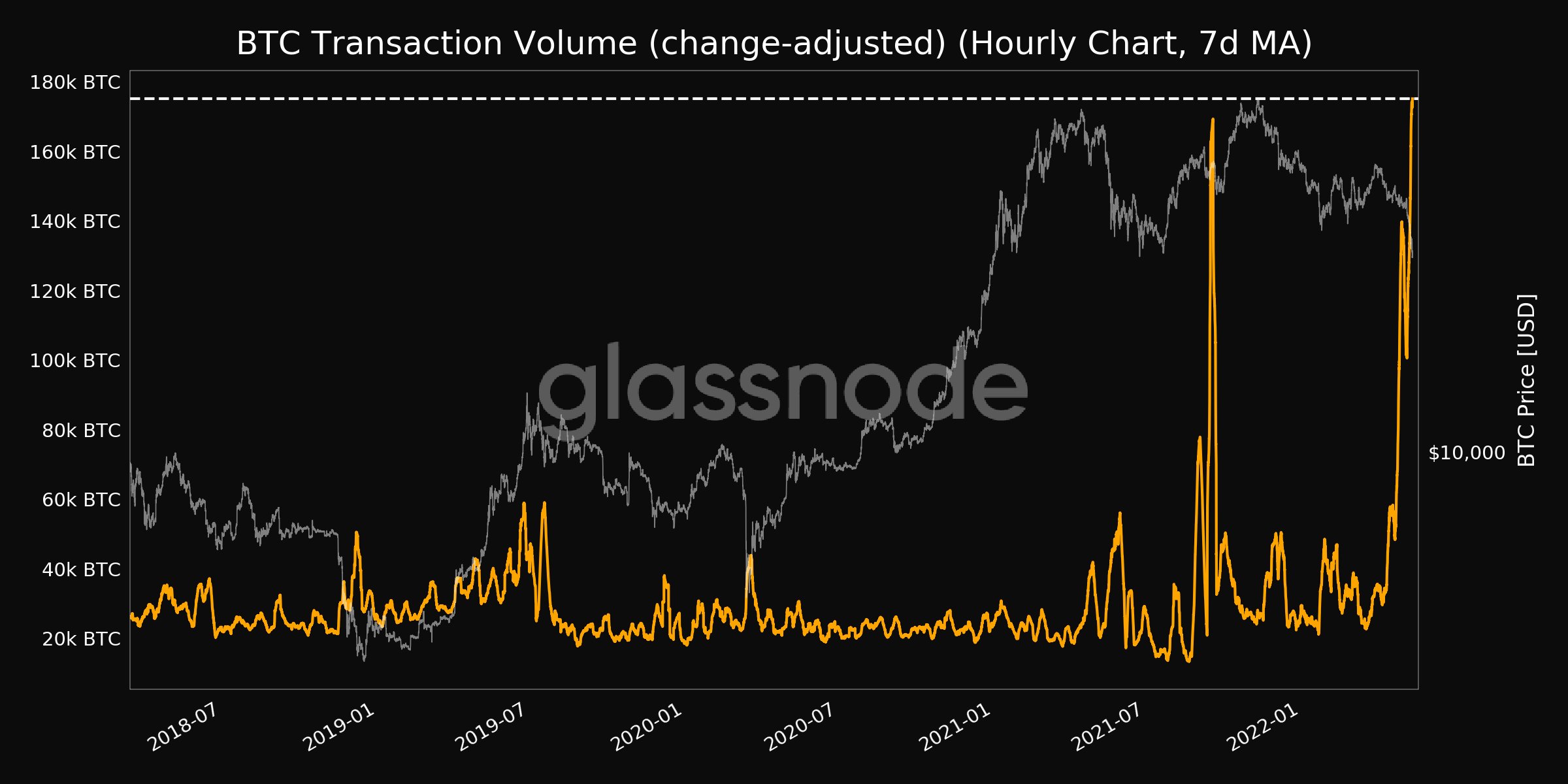

The exit rush spiked the transaction volume on the Bitcoin network. The transaction volume here reached a new 4-year high of 175,146.8 BTC. It eclipsed the previous high, again, set on 11 May.

Meanwhile, Scott Melker, the host of The Wolf of All Streets Podcast, spoke about the significant impact of the bear market, stating that “the entire market is reeling.” He said,

“I think that markets are in a full irrational panic. The pendulum has swung to extreme fear, as it always does. This causes people to sell assets at or near the bottom.”