USDC and USDT: The changing demography of stablecoins

TerraUSD’s depegging and eventual collapse sent shockwaves across the crypto market, and in the wake of its crash, other major stablecoins such as Tether (USDT) and USD Coin (USDC), and DAI witnessed changes as well.

Tether loses ground

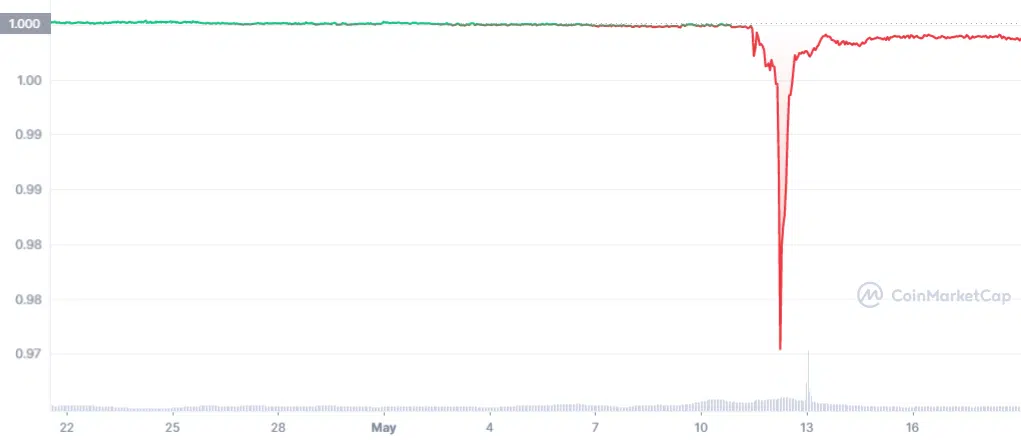

As UST began losing its peg on 9 May, holders began dumping it, and the fear of instability in stablecoins reached Tether as well.

Being the biggest stablecoin in the market, it was bound to take a hit in a crash, and it did, except the impact was a bit more powerful than expected.

Between 9 May and the time of writing, USDT lost $11 billion in market cap as holders began swapping the stablecoin for USD along with UST.

Tether market cap | Source: CoinMarketCap

As a result, USDT for a while lost its $1 peg and slipped to $0.974 before recovering. But even to date, the peg hasn’t returned to its normal status of trading at a premium and is instead fluctuating at around $0.998.

Tether price | Source: CoinMarketCap

However, amidst this chaos, USDC found interest from investors in the market, and within the same duration, USDC’s supply shot up by 12.5%, and its overall market cap touched $54 billion at press time.

USD Coin market cap | Source: CoinMarketCap

Now, while these new inflows were the result of deviation from USDT, it wasn’t growth for USDC but mere recovery.

This is because back in January, USDC’s total circulating value was already above $53 billion, but it faced a consistent downfall for the next five months, and as a result, the market cap hit $48 billion.

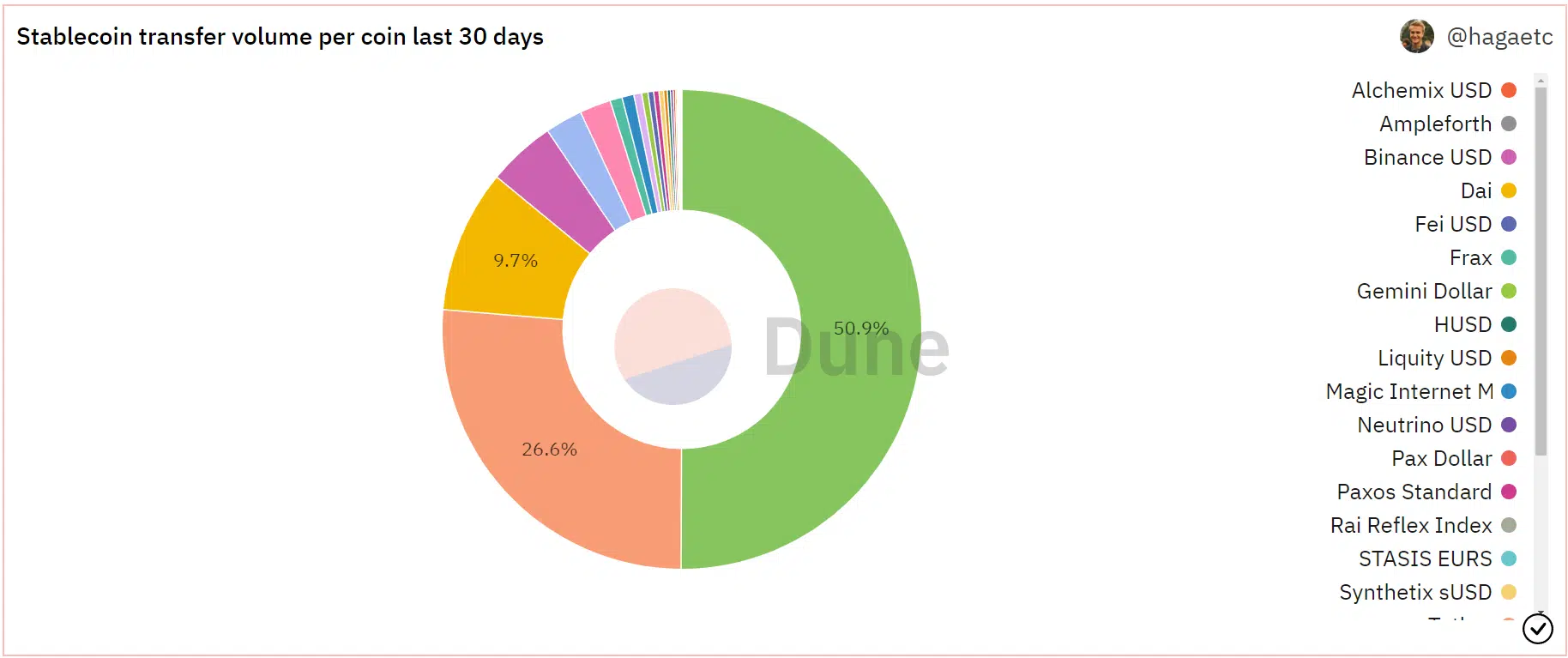

Today USDC is also the most used stablecoin of all when it comes to transferring volume holding a 50.9% domination on this front.

On the other hand, Tether and DAI only have a 26.6% and 9.7% domination, respectively.

Stablecoin transfer volume distribution | Source: Dune – AMBCrypto

But Tether isn’t throwing in the towel just yet. Just a few days ago, the stablecoin was announced to be launched on Polygon to provide liquidity to more than 19,000 Dapps on the network while also providing Tether users with much lesser transfer fees.

Being exposed to so many new users could kickstart Tether’s recovery and help it regain the lost market share.