Solana: From network outages to bear run, why is SOL having such a bad time

Touted as an “Ethereum killer” due to the transaction speed and the scalability it offers, the Solana Network has not lived up to its name. The series of outages that the blockchain has suffered in less than a year has brought its claims of reliability under scrutiny from members of the cryptocurrency community.

In less than six months, Solana has suffered over five significant outages. The series of downtimes on the Network has had a ripple effect on the price of its native token, SOL.

Following the outage suffered on 1 June, the price of the SOL token nosedived from $46 to $38.5 in less than 24 hours. The market capitalization of the token also suffered a drop down from $15.6 billion to $13.3 billion within the same window period.

As a result of the series of downtimes on the Solana Network and the bearish outlook of the crypto market so far this year, the SOL token has declined by over 75%.

Taking on a downward trend since last November, movements on price charts revealed that the SOL token currently trades dangerously close to the level of August last year.

Let’s take a look at the token’s performance since last November.

SOL-rowful figures

Launched in March 2020 by the Solana Foundation, the SOL token has struggled to find its footing in an ever competitive cryptocurrency market. Exchanging hands at $43.17 per SOL token at press time, the token currently trades at the lows it marked last July/August.

Price chart movements revealed that the SOL token had struggled with warding off the bears since around 16 November (yellow arrow). Attempting a bull run from 27 November till 2 December (pink arrow), the token has since suffered severely from the hands of bears.

From 2 December to date, the SOL token has posted an 81% loss in price.

In addition, within that window, the market capitalization of the SOL token has registered a 79% decline from $70.21 billion to the $14.69 which it stood at at press time.

No Place to Run to

With the promises of increased transaction speed and scalability that the Solana Network claims to offer, on-chain analysis revealed that in the past seven months, the development activity on the network has taken a nosedive.

Development activity is a key metric within the crypto ecosystem as it assures investors that a project is serious about its business proposition, will likely ship new features in the future and is less likely that the project is just an exit scam. In the last seven months, the development activity on the Solana Network has fallen by 48%.

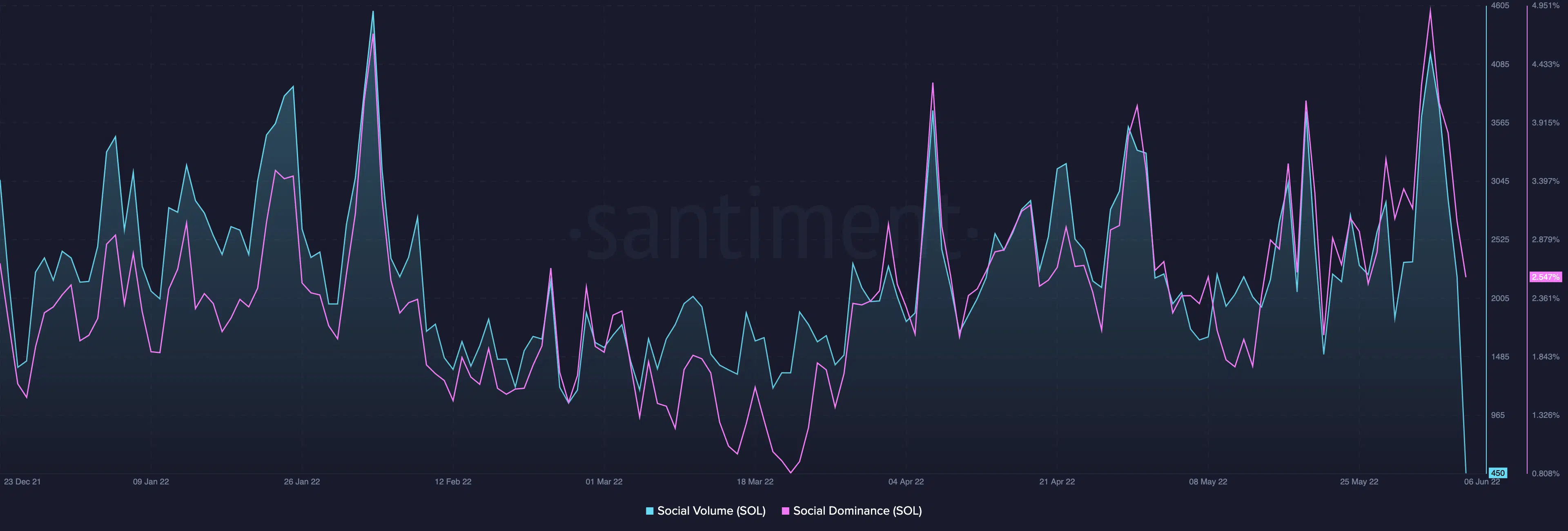

On a social front, a look at performance showed that the SOL token struggled in March. However since then, the social dominance and the social volume for the token have since taken on an uptrend with occasional beatdowns.

With the plethora of downtimes suffered, an easy explanation exists for this. At press time, the social dominance stood at 2.547% while the social volume was spotted at 450.

Posted Some Gains in the Last 24 Hours

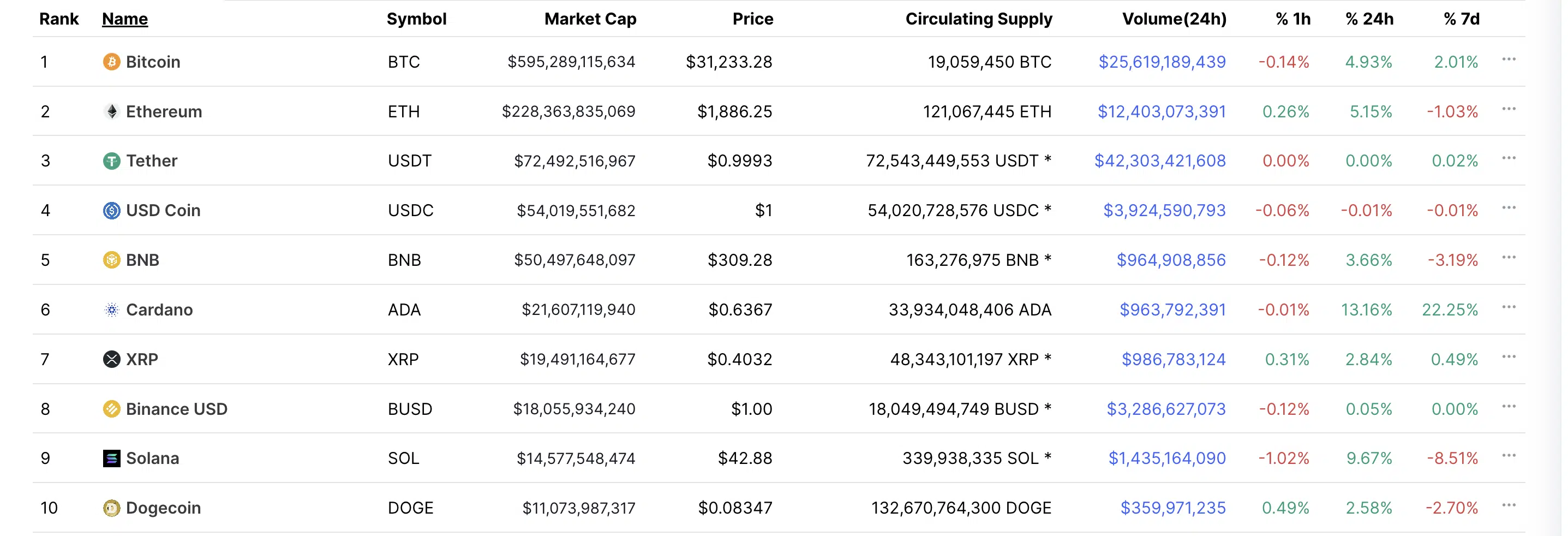

Although the SOL token has had a terrible year, it managed to register a 10% jump in price in the last 24 hours. According to data from Coinmarketcap, it currently ranks number nine on the list of largest cryptocurrencies by market capitalization.