Dogecoin [DOGE] and the probability of trend exhaustion coming its way

Dogecoin’s ‘incy wincy spider’ approach on the price chart is well-known to the community. Even though DOGE is 89.50% down from its all-time high (ATH), the token is 12.78% up from its cycle low of $0.07. Clearly, undeterred by the moist setback.

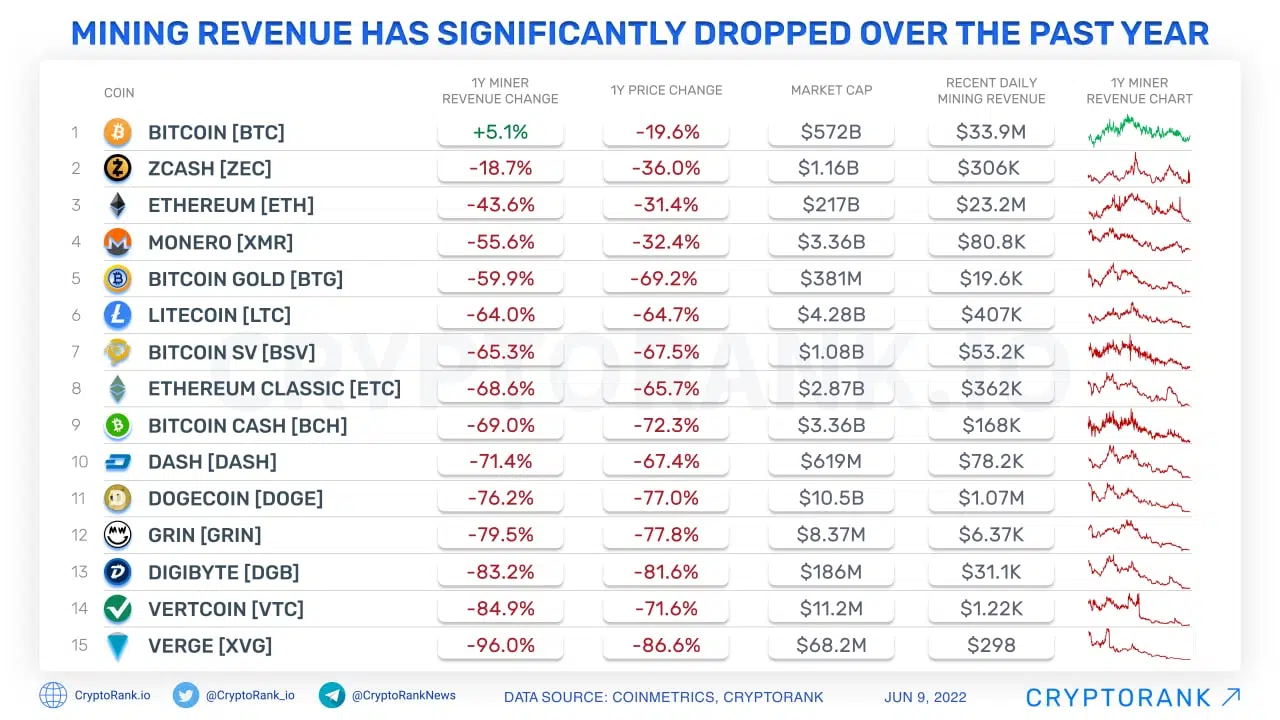

However, a recently published report by the crypto market data aggregation and analytics platform CryptoRank may not impress long-term investors. As per the report, Dogecoin’s mining revenue has massively dropped in the last year. One-year miner revenue change for DOGE stood at -76.2%. This puts the meme token into the first spot among the top five most unprofitable mining options.

A more than 70% drop in Dogecoin’s mining profitability is certainly not making miners carefree. On that note, you may ask if investors are happy with their DOGE investment. Well, the factor of ‘trend exhaustion’ can answer the question.

Exhaustion in sight?

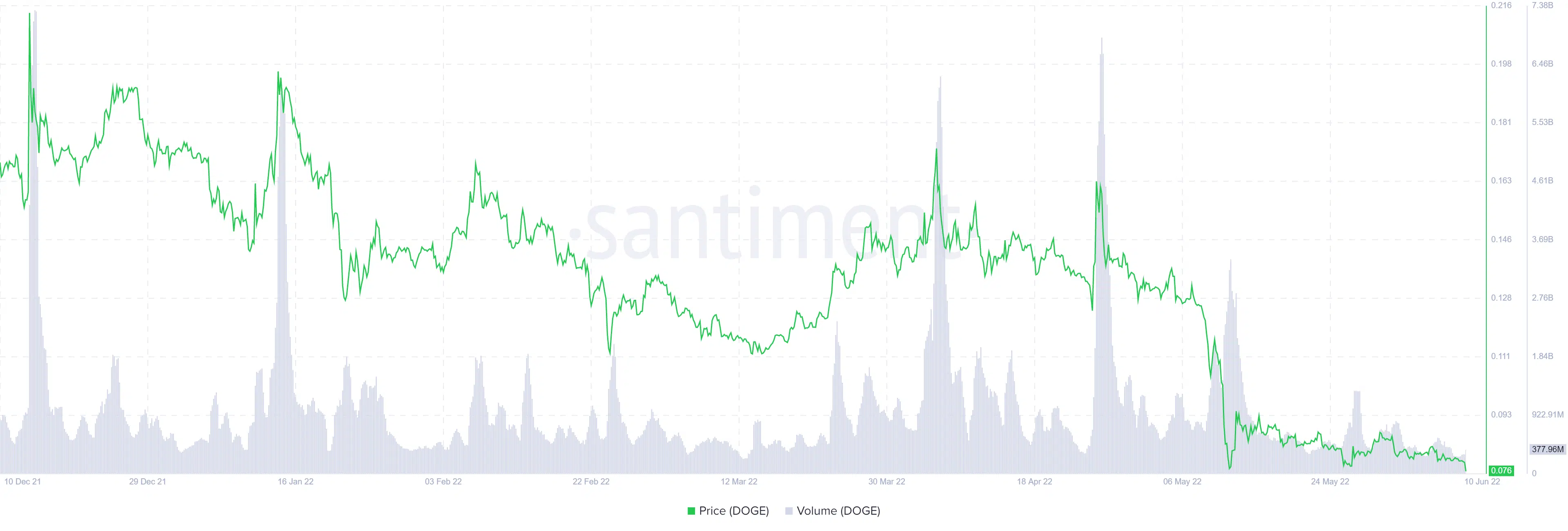

At the time of this analysis, DOGE was changing wallets at $0.077, down by about 3.48% over the last seven days. Importantly, after a sharp drop on 11 May, the token has been majorly trading in a tight range. On zooming out, it shows that DOGE was forming a plateau after 3 December 2021 unless it broke down the $0.081 mark on 9 May 2022. In fact, after 11 May, the volume has been diminishing. Unless enough demand kicks in, we can’t expect the token to test its $0.0775 ceiling, let alone $0.2020.

Leading indicators look pretty upfront with their bearish price indication. RSI, after 4 May has been below the neutral mark. In fact, it looked southbound at press time. The volume oscillator too has been painting a grim picture. At the time of this writing, it stood at -23.44% with no signs of recovery. On the other hand, the width of the Bollinger Bands (BB) after 30 May looks squeezed, not hinting at the volatility marathon for the coming few days. However, DOGE’s volatility in the last 30 days has mainly hovered around 88.28%.

All this audibly points to the fact that the question of trend exhaustion is nowhere in sight, at least for the coming weeks.

Now, at this point, a wise investor may want to take a look at the key on-chain metrics to understand if long bets can be taken anytime soon. In that context, taking a mystique look at volume can reveal a lot of profound information. After 26 April, there seems to be a clear downfall in the volume. This goes to assert that the activity of buying and selling was low. Peradventure, DOGE has someway been unable to retain investors’ interest of late.

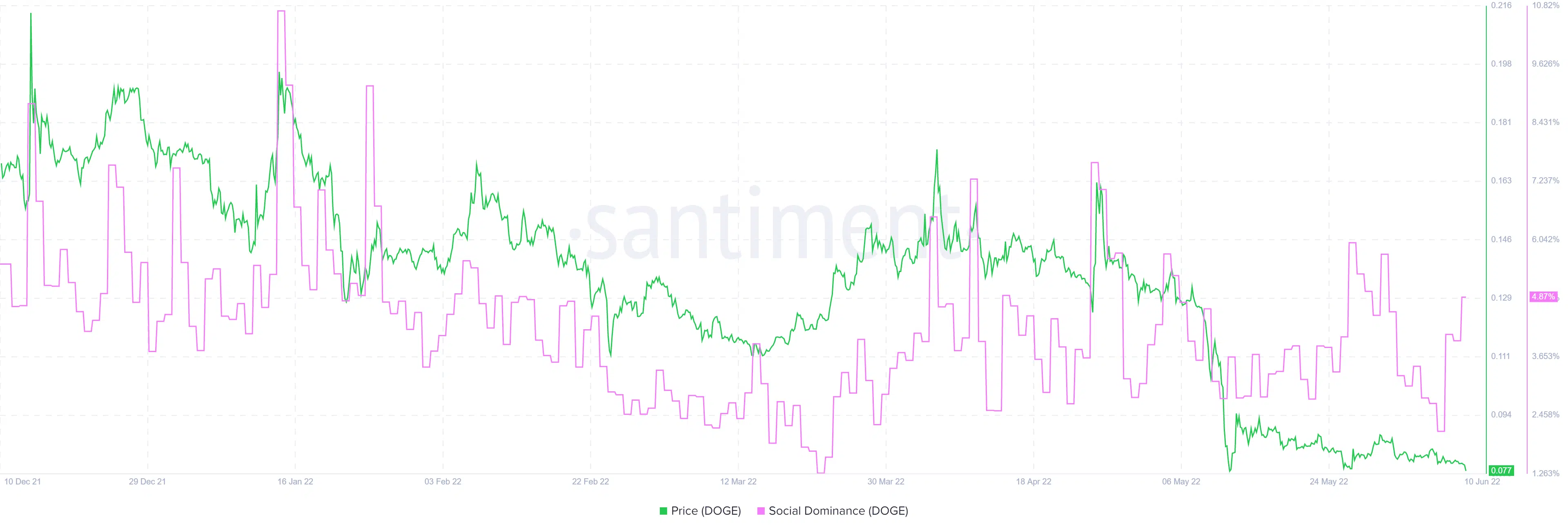

Even so, its social dominance metric stood at 4.88% during press time. Thus, indicating that share of voice across all social media data has not been diminishing. In fact, it is showing that people are interestingly discussing the meme token even during this crypto winter.

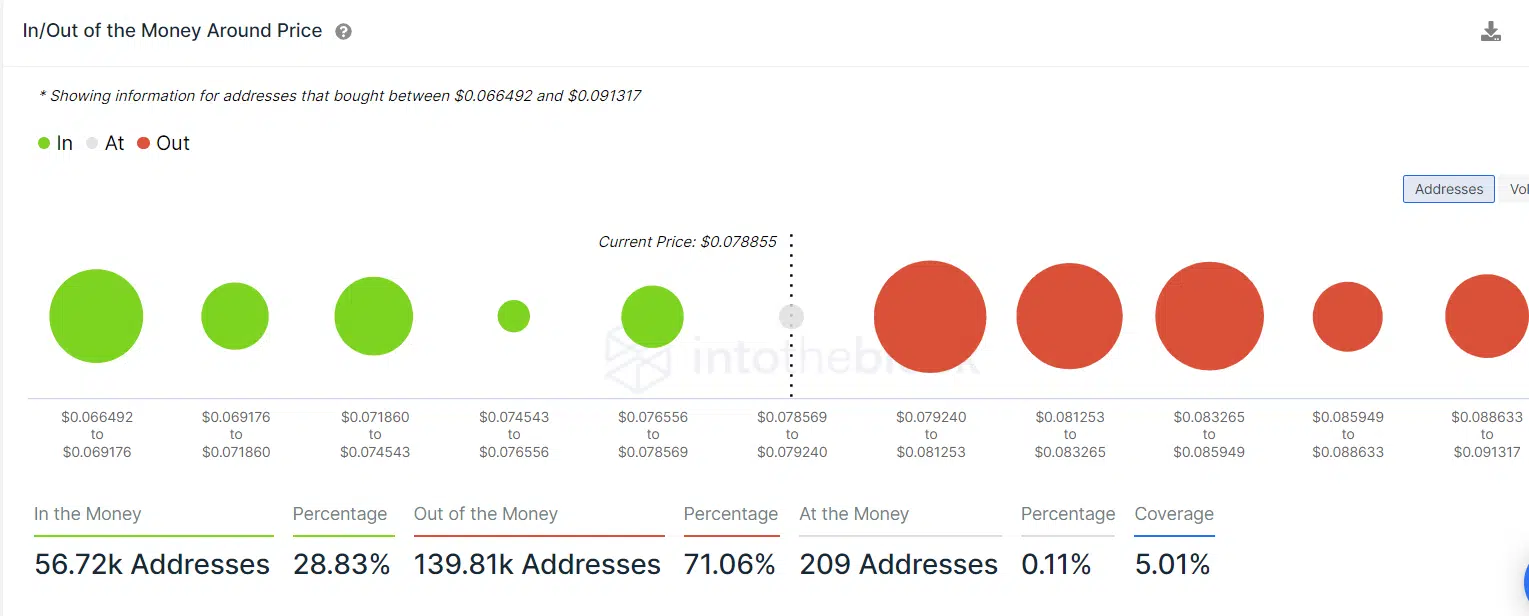

It is here to be noted that 56.72k addresses were in the money at the current market price of DOGE. However, 139.81K addresses were out of the money at press time.

Given all the above-mentioned factors, opening a long position, in the current market structure doesn’t seem to be a promising bet.