What crypto market and S&P 500’s tandem skydive from ATHs means for traders

Losses in cryptocurrencies deepened on 10 June and affected everything from Bitcoin [BTC] to the Altcoins. This led to tokens either setting or approaching their lowest levels of 2022. After the US announced the latest record-setting CPI data, BTC dumped below $30,000 and registered a two-week low.

The altcoins are in an even worse shape, with ETH plummeting to its lowest price level since March 2021. With the tokens at their worst…

…What’s next?

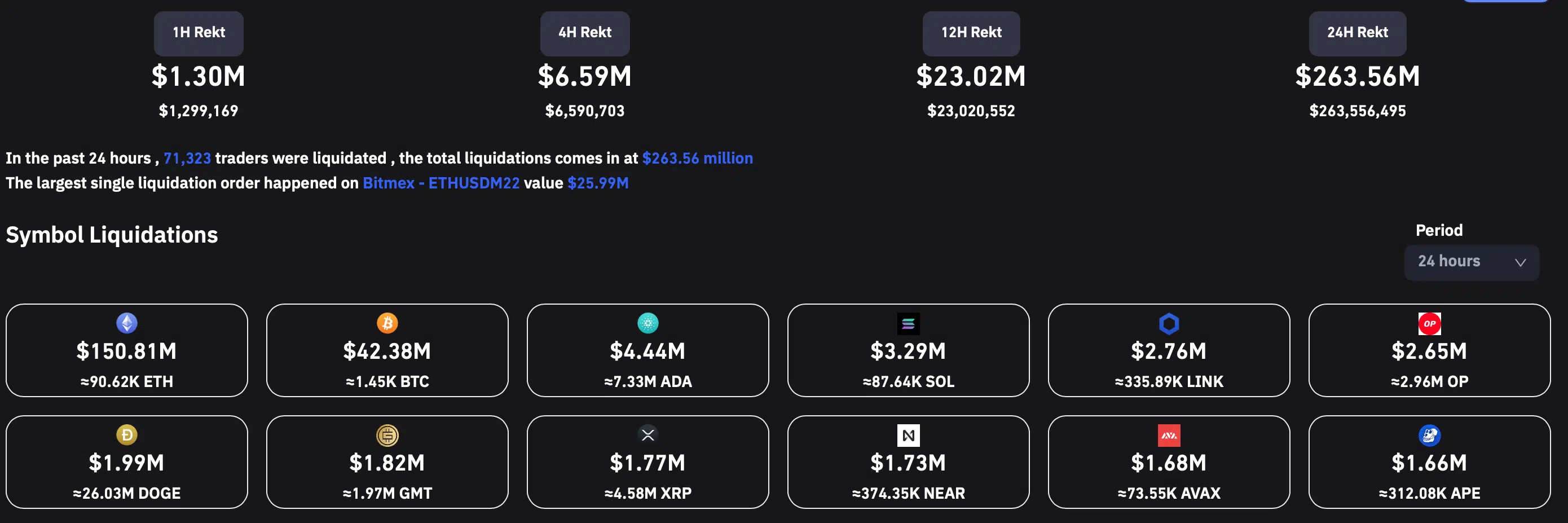

Total liquidations spiked on 10 June as the broader market reacted to the latest US inflation numbers. According to Coinglass, 24-hour liquidations stood at $263.31 million, up from $103.50 million on 9 June. More significantly, liquidations over 12 hours stood at $239.70 million, taking 24-hour liquidations to levels seen last week.

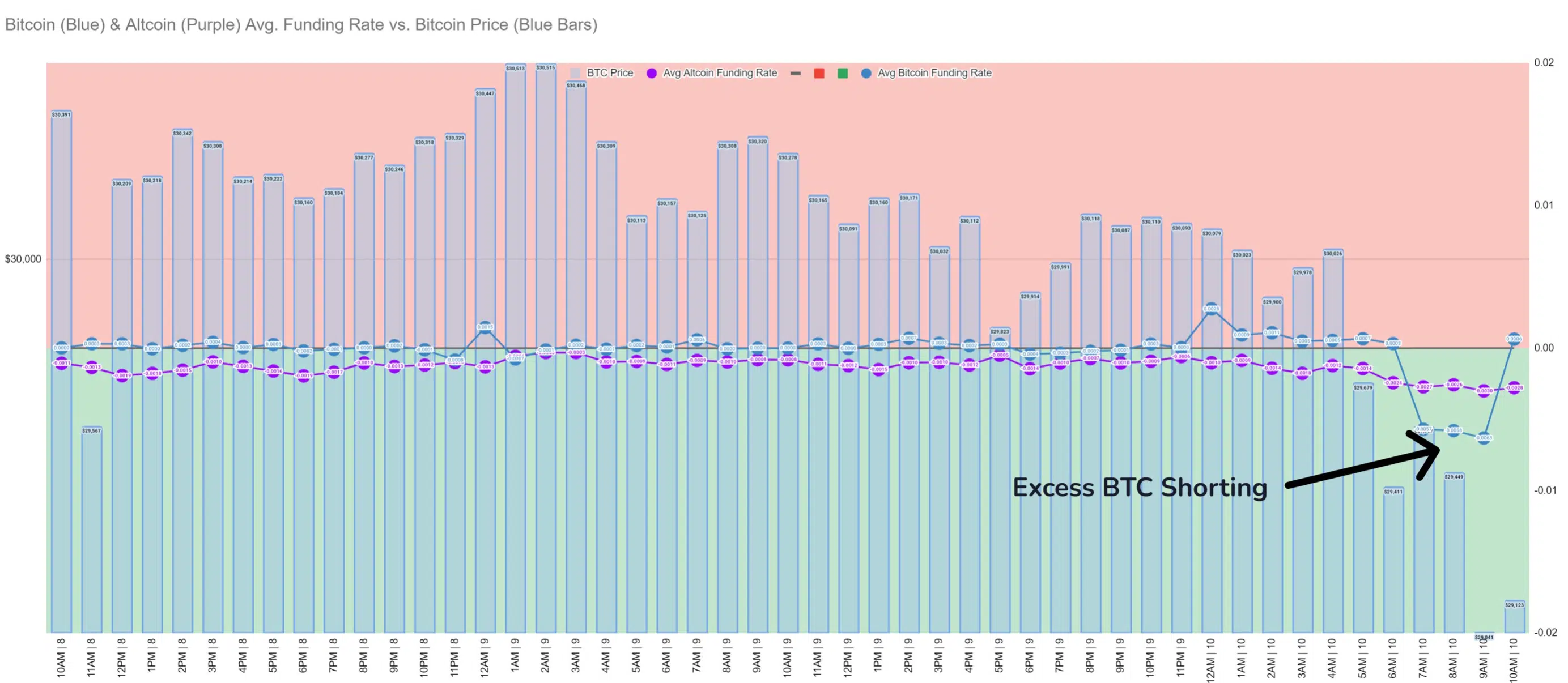

Needless to say, even the condition, traded started to short the markets to offset any further risks and indeed take advantage. With crypto markets falling once again in tandem with the S&P 500 bleeding, funding rates on exchanges have turned into short-central. Both Bitcoin and altcoins have seen major shorts turn up at the highest rates in a month.

There are different reasons that might have played a role in this demise. Several factors such as rising inflation, debt, etc. Furthermore, crypto community concerns related to debt and inflation also spiked to the highest levels in the last three months. Here’s a graphical representation.

In a 11 June tweet, Santiment explained:

? When prices fall below resistance, like $ETh & #alts did Friday, the community looks for explanations. The predominant accepted reason is the ongoing #inflation and #debt concerns. Previous 3 spikes in this subject's interest all marked local bottoms. https://t.co/mPXSRtqvis pic.twitter.com/foWyuwrd82

— Santiment (@santimentfeed) June 11, 2022

Well to add to this, the Terra fiasco just fueled the fire to reach an aggravated state.

Anything else in store?

The recent euphoria in cryptocurrencies morphed into a severe sell-off. Likewise, if too much FUD appears, this can cause a bounce. This is the case at the moment. The cryptocurrency market, at the time of writing, suffered a fresh 3.5% correction. Any uptick from here could help the bleeding patient.