The A to Z of why crypto funding numbers fell during H1 2022

As a crypto winter ravaged the entire cryptocurrency ecosystem in the first half of the year, Crunchbase, in its newly published report, found that in the last six months, there was a decline in investment in VC-backed crypto service providers.

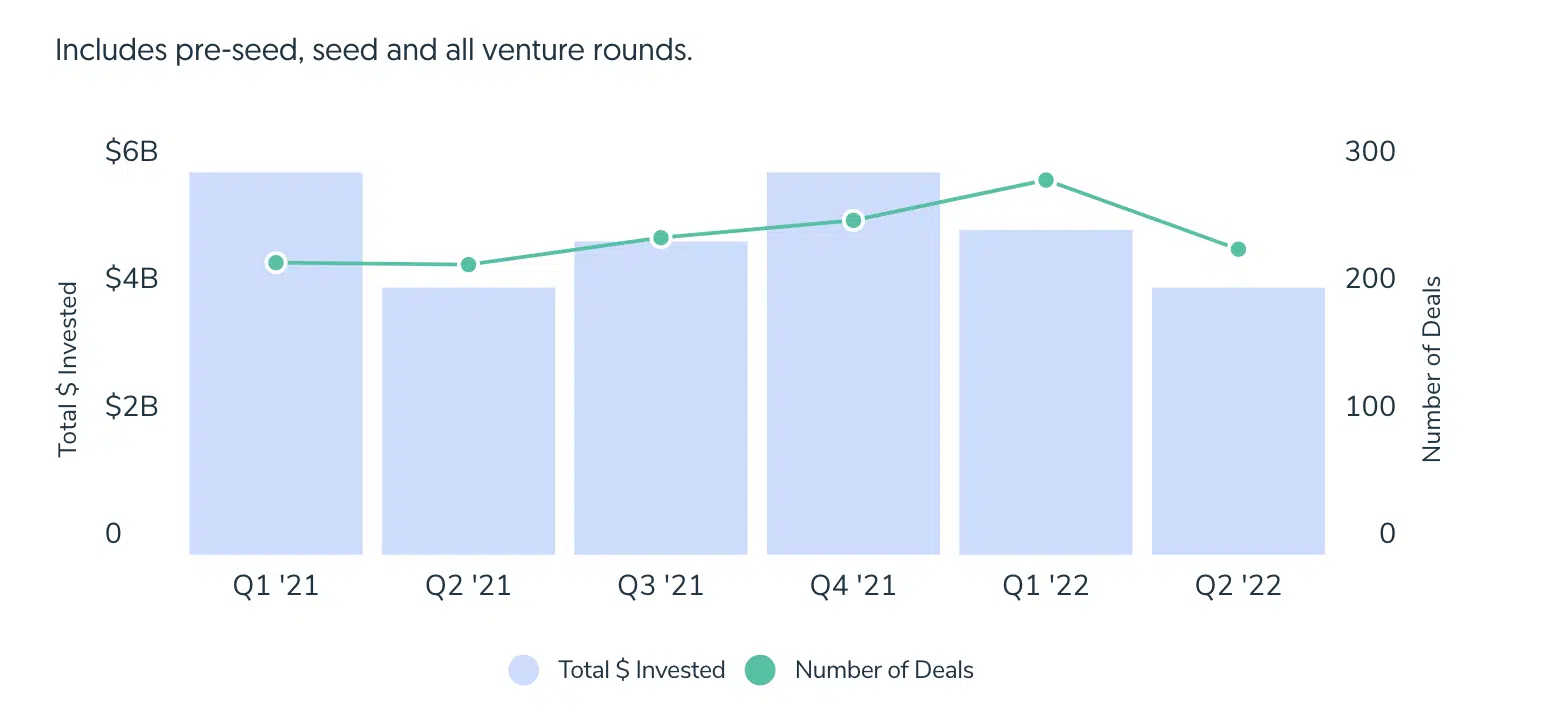

According to the report, with only $9.3 billion invested through the first six months of this year, a 25% decline was recorded from the $12.5 billion invested in the first six months of last year.

Interestingly, despite a decline in investment amount in the first half of 2022, Crunbase found that Deal Flow increased by 18%. In H1 (the first half of a calendar year) last year, only 456 VC funding deals were closed.

H1 was rough

According to Crunchbase, the main reason for the pullback recorded in VC funding in the first half of the year was the series of unfortunate events that plagued the cryptocurrency market within that period.

In the last six months, the price of Bitcoin, and that of the leading altcoin, Ethereum, took more than a 70% beating from their November highs. Also, the collapse of Terra and its stablecoin, UST, intensified the bearish cycle, which heightened the volatility rates of several crypto assets.

As noted by Crunchbase, the general decline in the cryptocurrency market and falling stock prices led many crypto service providers to suspend operations in the year’s first half. Crunchbase further added,

“Large lending platforms Babel Finance and Celsius Network suspended withdrawals and transfers due to market uncertainty and liquidity issues—leading Celsius to file for bankruptcy this week. Then to top off the quarter, notable crypto hedge fund Three Arrows Capital, also known as 3AC, collapsed after the downturn in digital currencies left it unable to meet obligations.”

Investors remain bullish

Despite the general decline that marked the cryptocurrency ecosystem in the last year, Crunchbase reported that investors remain undeterred.

As opposed to the common belief that the cryptocurrency space is all hype, Jordan Nof, a co-founder and managing partner at Tusk Venture Partners, told Crunchbase that,

“We’ve seen this story before. If you believe this is a fad, you probably are leaving the market, but we are not hearing that (people think that) anymore.”

Nof noted further that while the failure of some stablecoins in the first half of the year was a significant driver of the decline in the cryptocurrency market, the resulting increase in regulatory involvement is needed to protect consumers in the space.