Will Bitcoin mark 23% rally to $28k- assessing the odds

Bitcoin leads the crypto market. And, every time it makes a move, it reflects onto the performance of every other altcoin.

Naturally, in the current market structure, investors are looking for profit-making opportunities. Moreover, the on-chain analysis of the BTC network reveals that $28k could be a significant level for all investors.

Why does Bitcoin need $28k?

The short-term holder (STH) cost basis, an important indicator in showing the investors’ conviction, is currently treading an inch below the ideal level.

Acting as a resistance against the price action, the STH cost basis needs to flip its position into support. That will help Bitcoin recover from its recent losses.

Bitcoin STH cost basis | Source: Glassnode – AMBCrypto

In a declining market, the STH cost basis must not be against resistance as it intensifies the bearishness. Thus, leading to further drawdown.

Back in 2018, when the king coin was experiencing a similar situation, the downtrend continued for more than a year up until BTC dropped from more than $10k to around $5k.

At press time, Bitcoin was trading near the $22k mark- the lowest price point since January 2021. Thus, making it highly susceptible to further depreciation if the indicator does not flip its position.

The same can happen only when BTC is able to rally by around 23.8% and cross the $28k mark, which coincides with the STH cost basis.

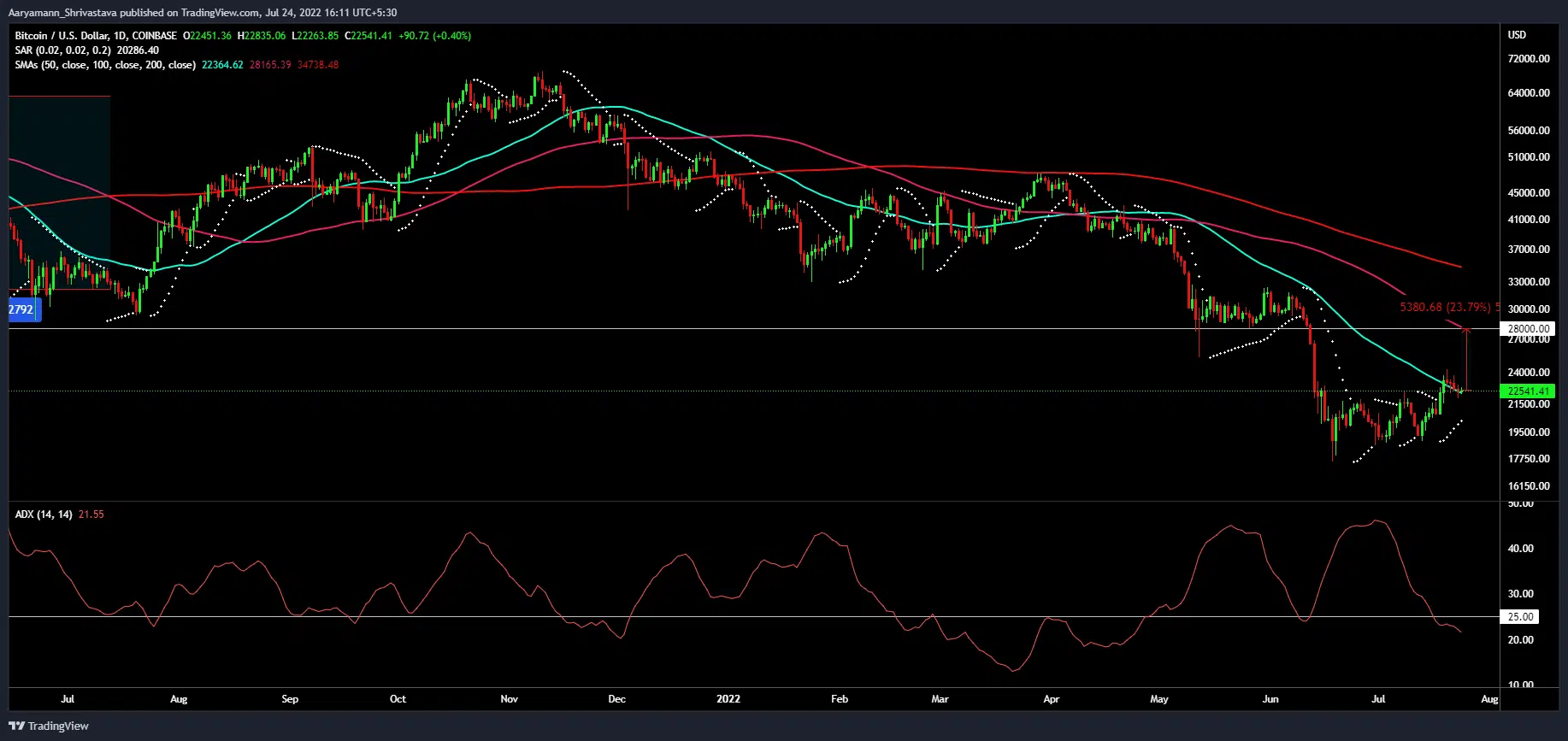

Bitcoin price action | Source: TradingView – AMBCrypto

The chances of Bitcoin rallying to that point are slim since the uptrend, which has been active for the last two weeks, is losing its strength. And, this is verified by the drop of the Average Directional Index (ADX) indicator below the 25.0 threshold.

The king coin has been maintaining the 50-day Simple Moving Average (SMA) (blue) line as support. But it might lose the same since the buying pressure has subsided significantly.

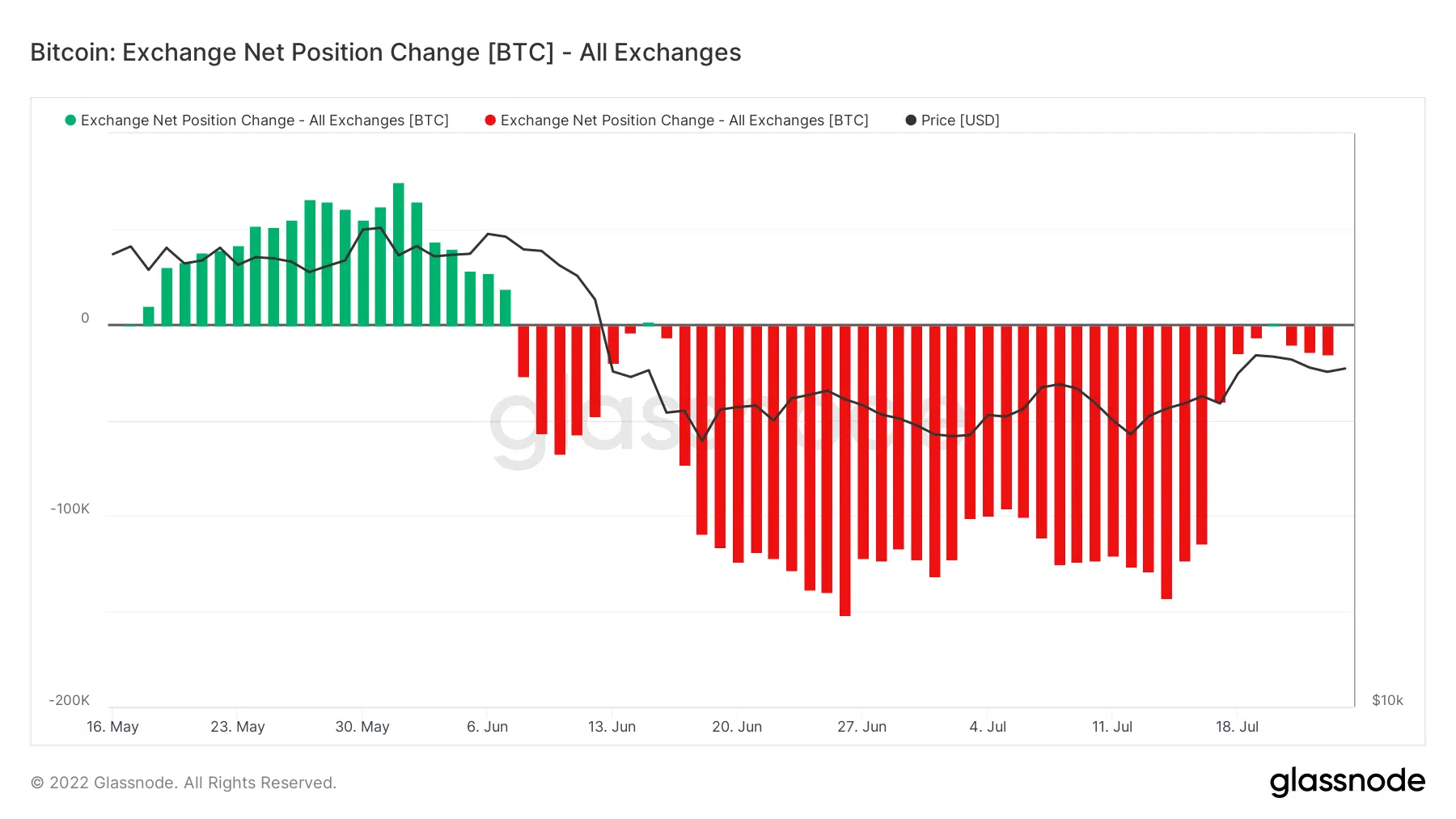

As visible on the chart, the day-on-day accumulation has been reduced by a great margin. This could make it further difficult for Bitcoin to reclaim $28k.

Bitcoin exchange outflows reducing | Source: Glassnode – AMBCrypto