Does Polkadot’s decentralization offer more incentive than profits

A significant feature of any blockchain is its decentralized nature. The miners and validators in the decentralized world play an important role.

Not to forget, the capability of a chain to prevent any attack is of utmost importance. And, Polkadot seems to be leading in that space.

Polkadot – the safest chain?

Calling Polkadot the safest chain would require detailed analysis. But it certainly does have one of the most distributed validator counts of some of the most significant DeFi chains.

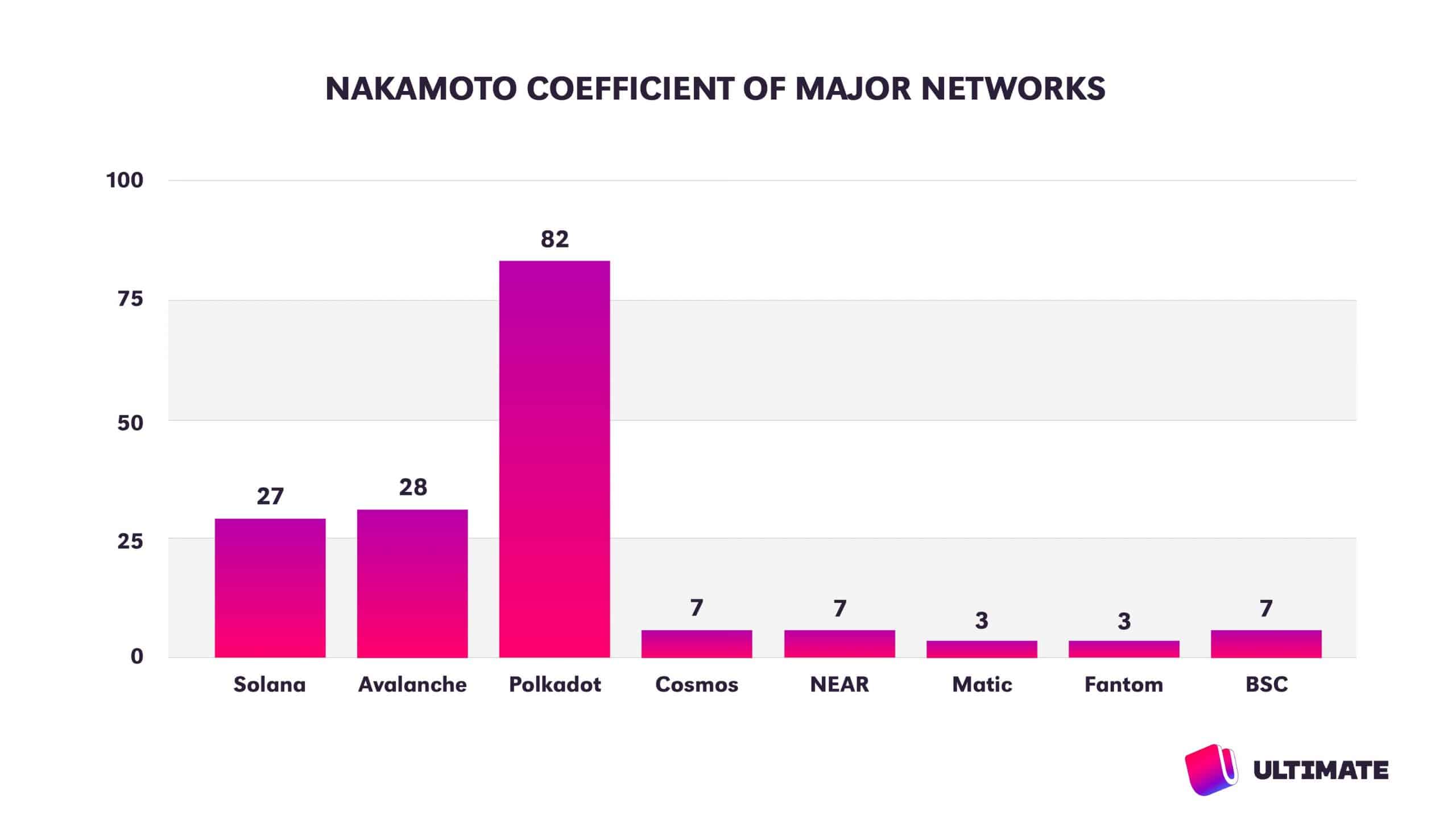

According to a Solana analysis from Unstoppable Finance, when it comes to the Nakamoto Coefficient, Polkadot has the upper hand.

This metric basically represents the total number of validators or nodes that would have to collude together in order to slow down or block any blockchain from functioning properly and successfully.

In the case of Solana, this figure stands at 27 as the top 27 validators are responsible for 33% of the total staked tokens.

While in the case of Polkadot, the same number is 82. Even Avalanche, one of the most rapidly growing DeFi chains from 2021, stood at 28.

Nakamoto Coefficient of Polkadot | Source: Unstoppable Finance

Thus, Polkadot surely might be the better option in this case. But the same cannot be said from a long-term profit-seeking investors’ point of view.

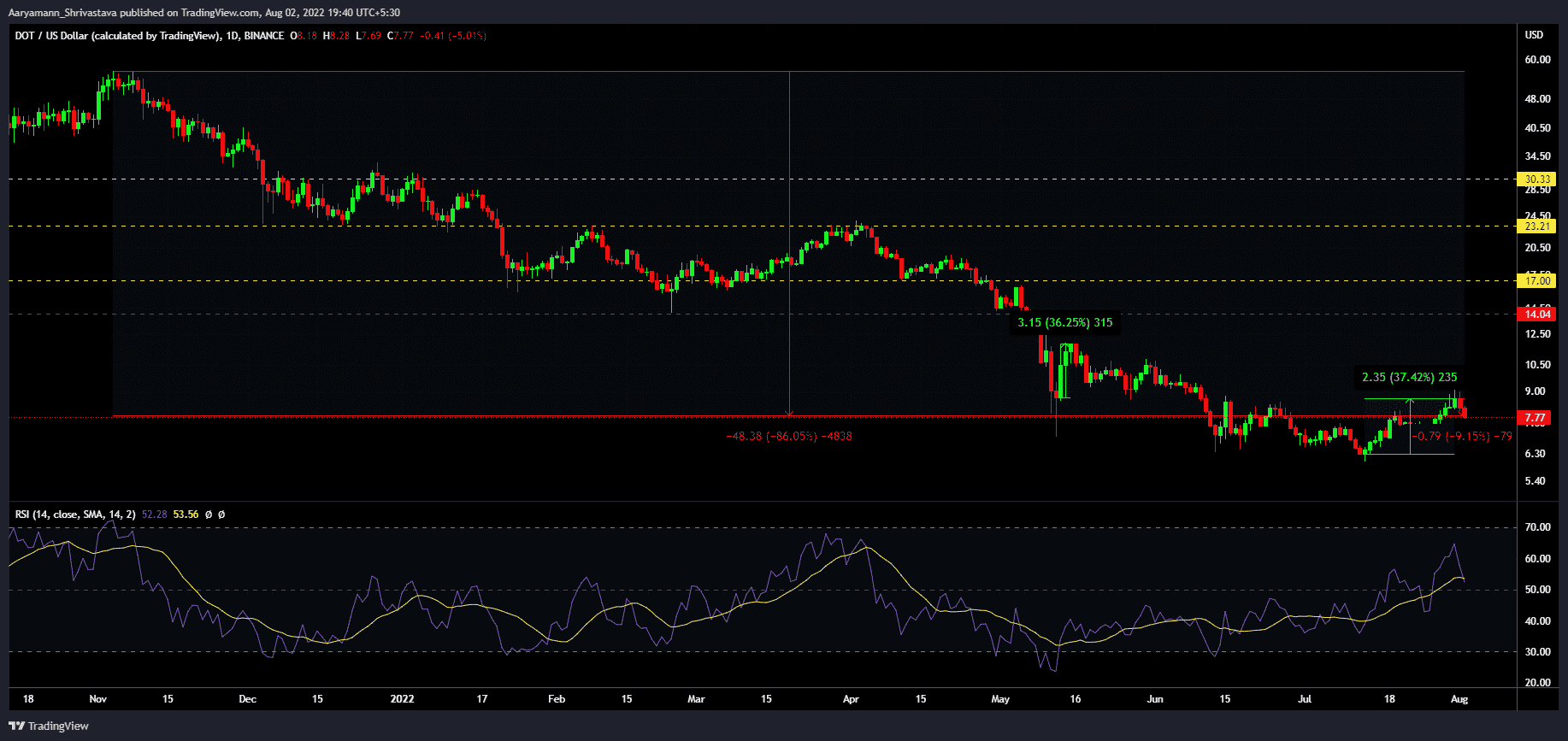

Between November 2021 and press time, Polkadot has noted excessive drawdown of 86.05% as the price of DOT fell from $56 to $7.84.

In the previous couple of days, the altcoin showed signs of recovery. DOT increased by 17% in the last seven days.

Polkadot price action | Source: TradingView – AMBCrypto

This implies that investors who have been a part of the network since last year are at an absolute loss at the moment.

However, for short-term investors, this may be a good opportunity as DOT is just rising from its lows.

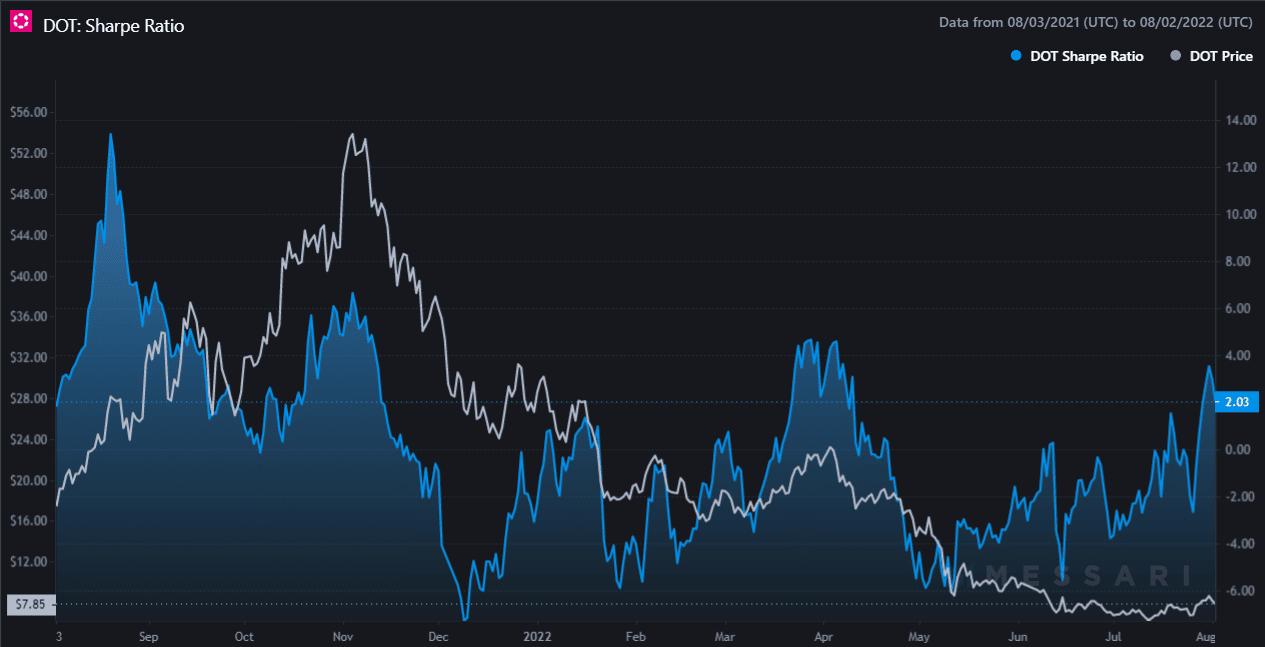

The risk-adjusted return on the asset represented as the Sharpe Ratio was also showing satisfactory readings at press time. The metric was sitting at a four-month high of 2.03.

Polkadot risk-adjusted returns | Source: Messari – AMBCrypto

Furthermore, at press time, the Relative Strength Index (RSI) was also sustaining its bullish rise

This underlines the fact that going forward, price falls will be minimal. (ref. Polkadot price action image).