The Lido Finance [LDO] talk post ETH Merge is worth listening to

The most anticipated event in blockchain history this year – the Ethereum Merge – has come and gone successfully. Following the Merge, the price of Ethereum-linked cryptocurrency assets such as Ethereum Classic [ETC] and the LDO, the governance token of ETH liquid staking platform, Lido Finance, rallied significantly.

According to data from CoinMarketCap, the price per ETC coin rallied by 11% moments after the Merge. With the final transition of the Ethereum mainnet into a proof-of-stake consensus mechanism, dispensing with the need for miners, Ethereum Classic logged a significant uptick in mining activity as former Ethereum miners scamper for new proof-of-work networks to work on.

Data from 2miners.com showed that the Ethereum Classic chain had set a new hashrate all-time high following the Merge.

In fact, LDO registered an 18% growth in its price, minutes after Merge. However, data from CoinMarketCap showed that the token exchanged hands at $1.75 at press time. Thus, indicating that the governance token was back to its pre-Merge price range.

LDO – king of ups and downs

Prior to the Merge, LDO traded at $1.77. However, a few moments after the merge was announced a success, the price per LDO traded as high as $2.155. This rally was, however, short-lived as the bears took over and initiated a price movement southward.

At press time, an LDO token could be obtained for $1.75. Data from CoinMarketCap revealed a 2% decline in the asset’s price in the last 24 hours.

However, within the same period, the asset’s trading volume was up 107%. With the lack of a corresponding asset price growth, the surge in trading volume indicated buyers’ exhaustion, and a further decline in the price of LDO should be expected.

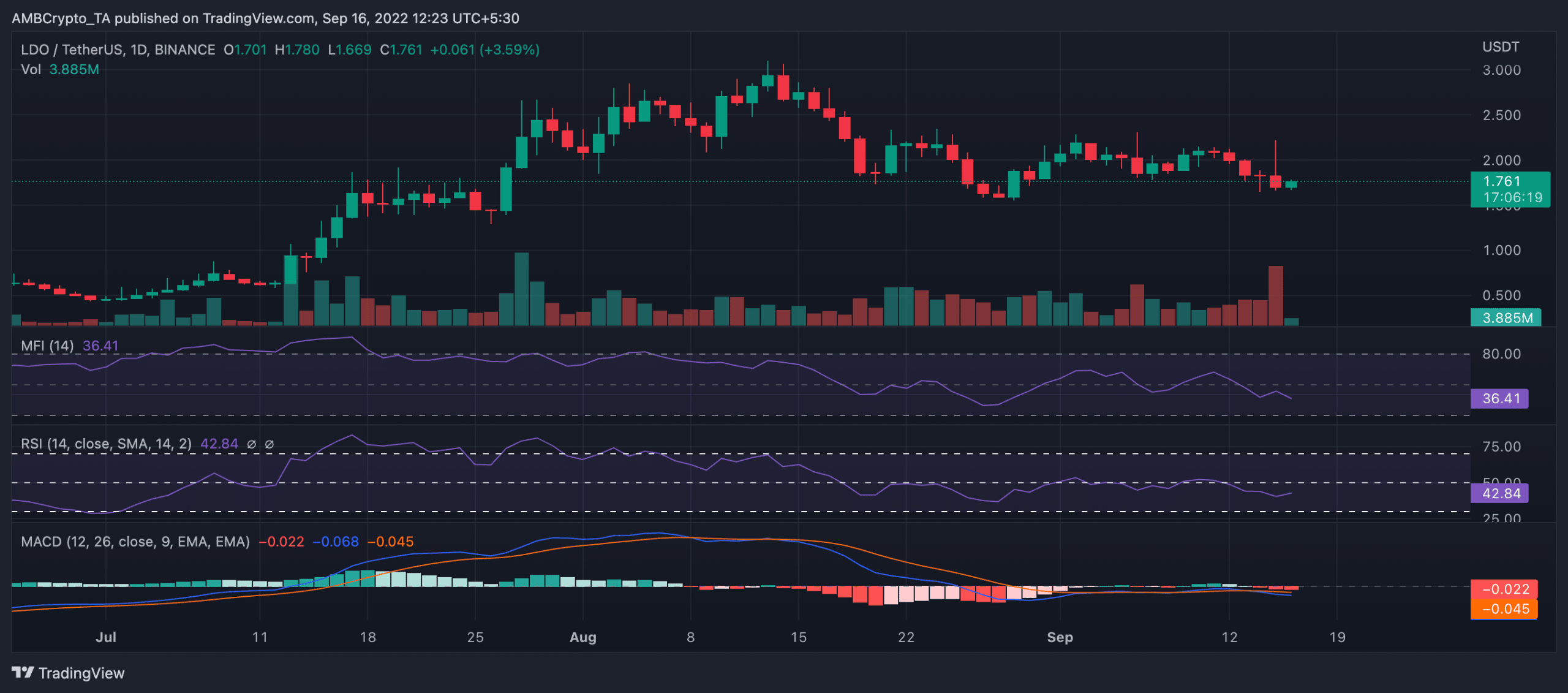

On a daily chart, buying pressure for LDO has declined consistently since the beginning of the month. As a result, its Relative Strength Index (RSI) and Money Flow Index (MFI) have dropped below their respective neutral regions since the month started.

As of this writing, LDO’s RSI was 36, while its MFI was spotted at 41.

A look at the asset’s Moving average convergence divergence (MACD) revealed a downward intersection of the MACD line with the trend line on 13 September. Thereby, indicating the commencement of a new bear run.

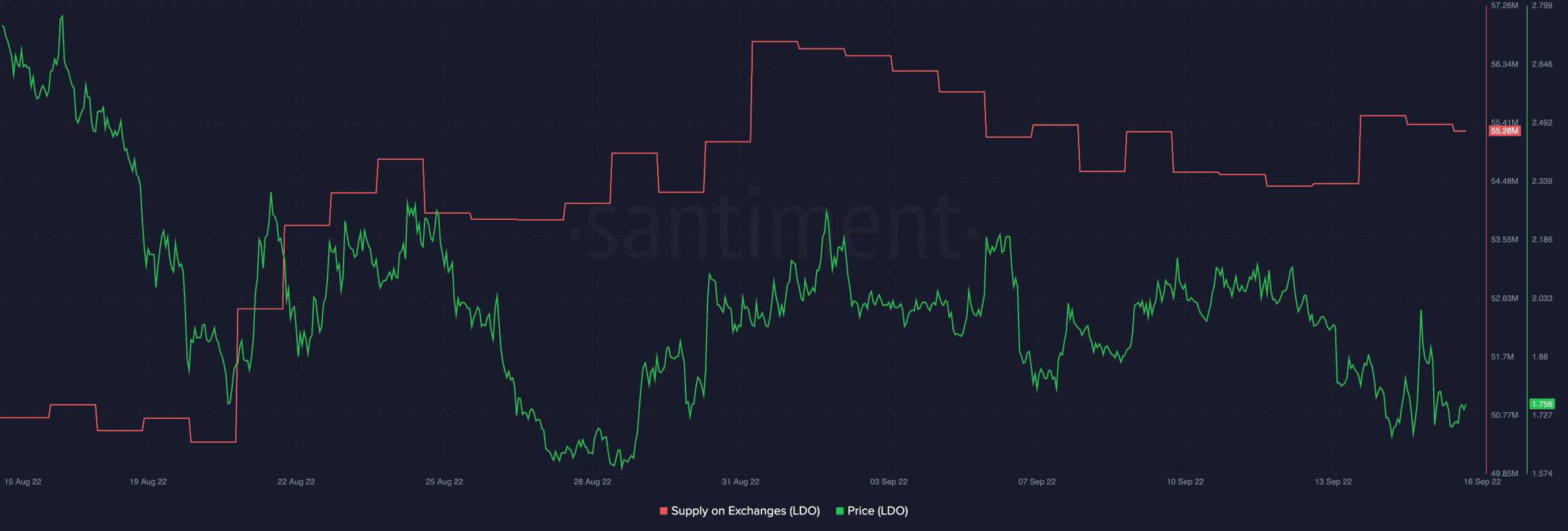

Moreover, data from Santiment revealed a rally in LDO’s supply on exchanges in the last month. Spikes in this metric usually indicate a rise in short-term sell pressure for a cryptocurrency asset. Hence, we have a bear-controlled market.

In spite of the seemingly gloomy price performance in the coming days, a look at the weighted sentiment revealed that LDO holders remain positive.