Here’s the full state of Litecoin’s [LTC] market since the MW upgrade

The project behind the infamous MimbleWimble upgrade, Litecoin [LTC] recently saw its hashrate hit a new all-time high (ATH). According to data from OKLink, the hashrate ATH of 511.56 TH/s was logged on 22 September.

Trading at a price level that was 87% from its ATH, LTC’s press time price was representative of a decline seen since the summer. On a year-to-date basis, the price of LTC has dropped by 64% since the beginning of the year.

The last 24 days have been marked by a tussle between the bears and the bulls, leading LTC’s price to touch a few highs and lows on the charts. At the time of writing, the altcoin was trading at $54.21.

What did the last 24 days look like?

Following the 9% decline that forced LTC to close August at $54.38, September started on a positive note as the alt’s price quickly rallied by 12% in the first six days. By 6 September, LTC was at a local high of $61.93.

This uptrend, however, could not linger as sell-offs and profit-taking caused the price to plummet 24 hours later. Attempting a comeback, the six days that followed were marked by a significant bull run. By 13 September, LTC had regained the $66-price level.

Re-emerging to force a downtrend, the bears took over and forced the price to return to its 1 September-level. The downtrend formed a falling wedge on the daily chart, one which the #23 largest cryptocurrency broke out of in an upward direction.

With key indicators positioned below their respective neutral zones, selling pressure for LTC remained high at press time.

On-chain assessment

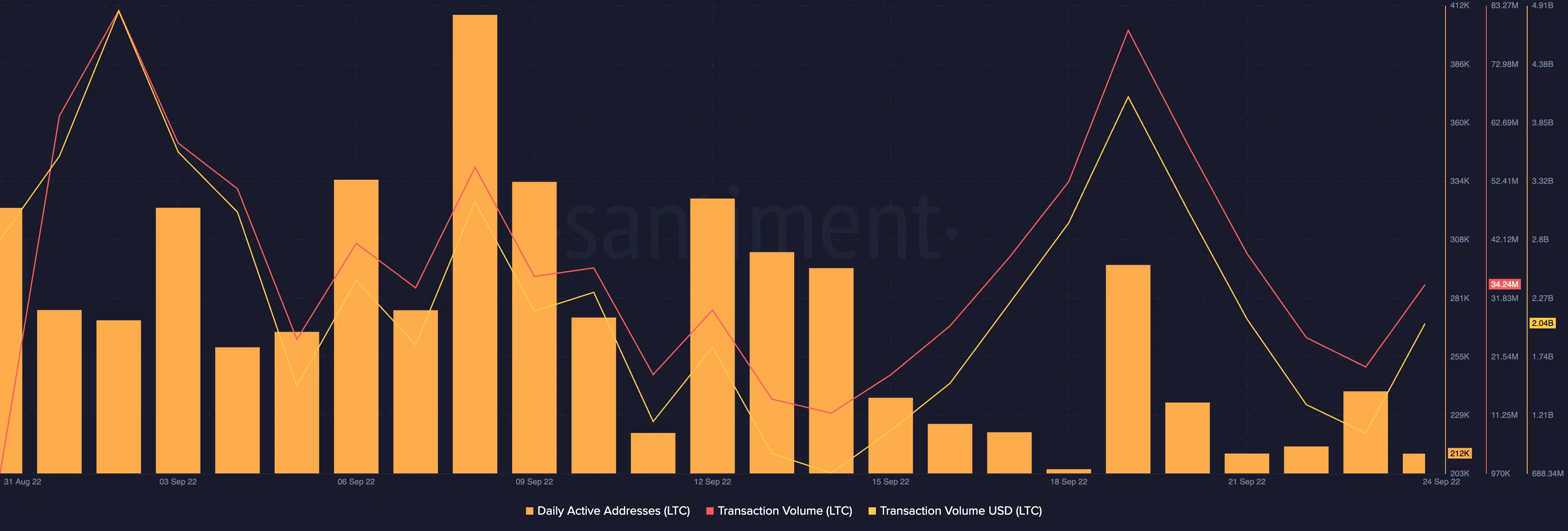

According to data from Santiment, the index of addresses that have traded LTC since the month started has declined steadily. At press time, daily active addresses on the LTC network stood at 212,000, dropping by 34% in the last 24 days.

With a fall in the number of addresses that traded the coin daily, the aggregate amount of LTC coins in all transactions completed so far this month has also fallen by 46%. In USD terms, this was a decline worth $3.55 billion to $2.04 billion in less than a month.

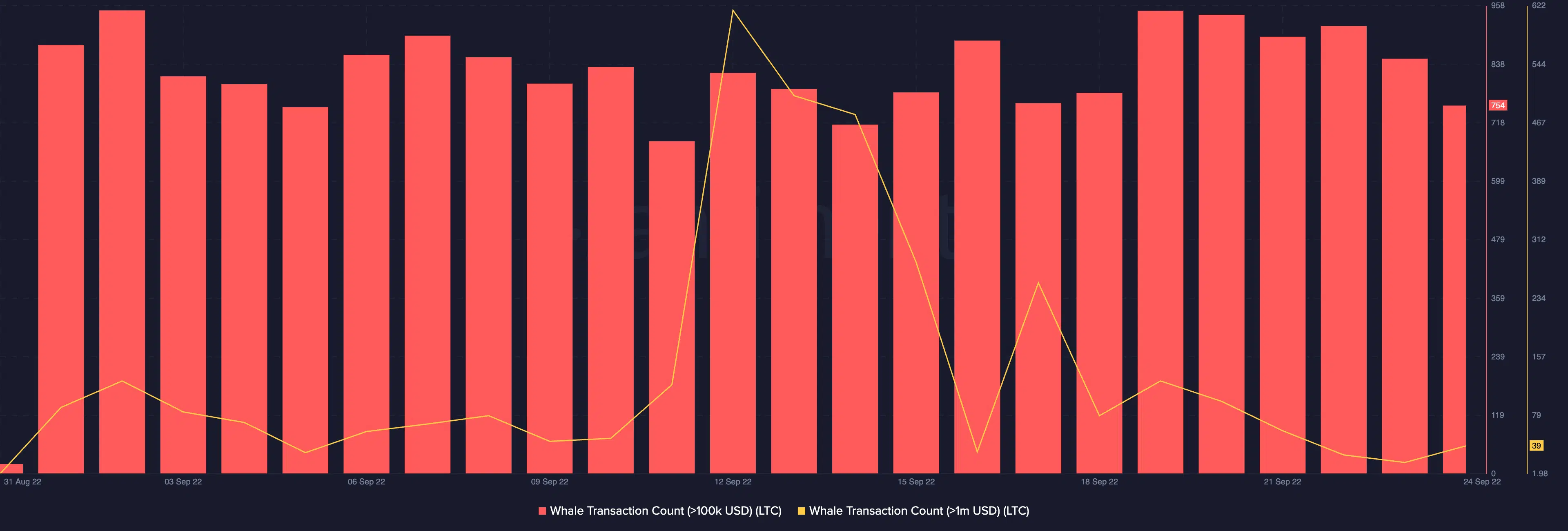

Since the month started, LTC has seen a rally in whale transactions above $100,000. Santiment also revealed that for transactions above $100,000, the lowest daily count logged by LTC within the period under review was 681 transactions on 11 September.

For whale transactions above $1 million, since the daily high of 616 transactions on 12 September, this metric has been on a decline.

Interestingly, in the last 24 days, the percentage of LTC’s circulating supply held by whales fell to 42.76% from the 43.05% it started the month at.

Litecoin post-MimbleWimble

On 19 May, Litecoin deployed the MimbleWimble upgrade – a feature that allows users to make confidential transactions on the Litecoin Network.

The upgrade has, however, been trailed by a series of unfortunate events. A few weeks after its implementation, five cryptocurrency exchanges in South Korea, namely, Upbit, Bithumb, Coinone, Korbit, and Gopax, delisted LTC citing regulatory concerns with the upgrade.

Binance, on 13 June, also announced the withdrawal of its support for deposits and withdrawals of LTC coins that used the MimbleWimble function.

Here, it’s worth pointing out that since the upgrade, LTC has fallen by 18% on the charts.