Cosmos to roll out native USDC through Interchain- ATOMic details inside

Cosmos concluded September with an announcement that might set the pace for an interesting future. The blockchain network plans to roll out USDC natively on its interchain platform.

1/

Native #USDC is coming to the Interchain in January 2023, leveraging @cosmoshub’s Interchain Security!https://t.co/aurx2EQN3G pic.twitter.com/FGgoWQa5ZD— Cosmos – Internet of Blockchains ⚛️ (@cosmos) September 29, 2022

Cosmos revealed that the development was part of its plan to expand the Interchain ecosystem. According to the update, the USDC rollout natively on the Interchain will take advantage of Interchain Security.

Cosmos further stated that it expects the rollout to facilitate an easier transfer of value within its interconnected ecosystem.

As per the announcement, operating USDC natively on Interchain will enable dapps to operate more efficiently. The network also expects the stablecoin rollout to drive migration into Interchain and facilitate favorable liquidity flow.

This might translate to more utility and demand for the network and for the ATOM cryptocurrency.

A nudge for ATOM bulls?

USDC’s native rollout on Cosmos may yield a positive long-term impact on ATOM. Furthermore, it may also have a short-term positive impact considering ATOM’s current position and that 2023 is just a few weeks away.

At press time, ATOM was trading at $13.0 and was down by 0.12% in the last 24 hours.

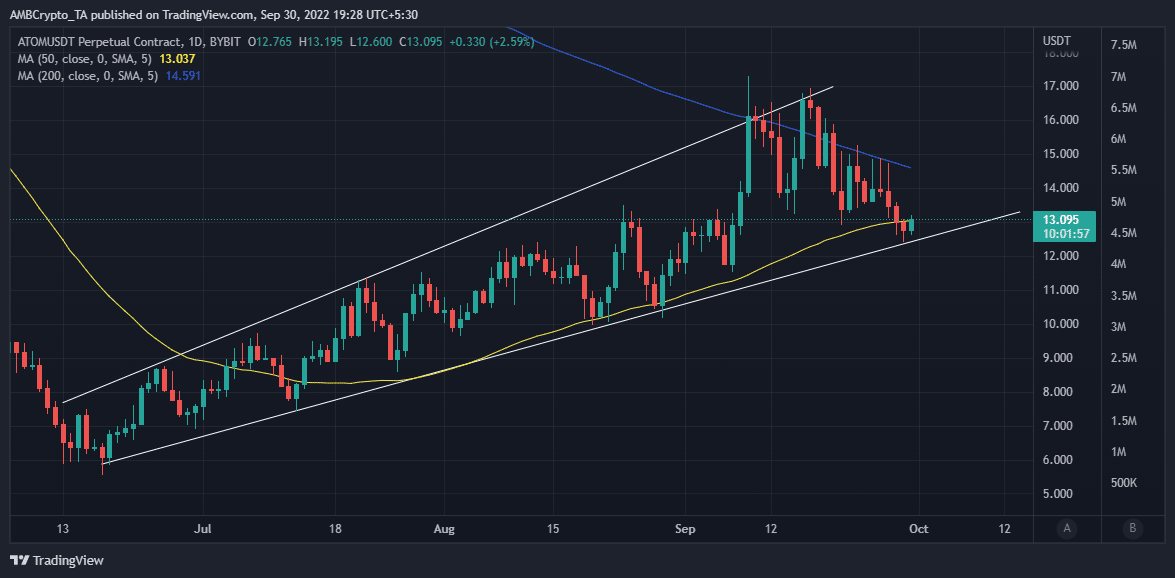

However, the chart from 30 September showed that ATOM was within an ascending price channel since mid-June and it just retested its current support.

Furthermore, ATOM’s $13.09 price on 30 September also indicated that investors were accumulating after the support retest. There were additional factors that pointed towards an upside ahead as part of its relief rally.

Such an outcome could be considered highly probable after ATOM’s bearish performance in the last two weeks.

Additionally, numerous on-chain metrics supported the bullish outlook as Q3 came to an end. ATOM’s weighted sentiment metric registered a sharp uptick from 26 September to its highest monthly level on 30 September.

The weighted sentiment confirmed that most investors were bullish on ATOM’s price action after the support retest.

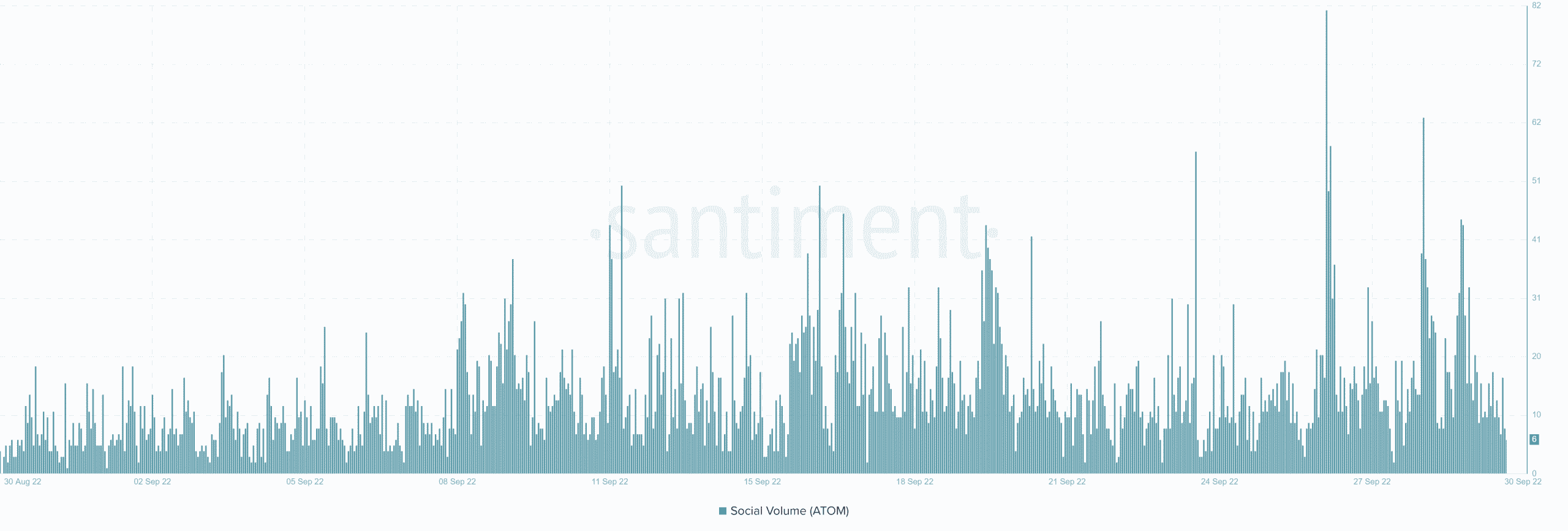

Social volume was already catching on given the above observations, as well as the USDC announcement.

Cosmos’ social volume metric recorded a sharp uptick on 26 June, the same day that the weighted sentiment pivoted. The volume metric maintained elevated activity between 27 September and 30 September. These factors collectively demonstrated positive changes in ATOM’s on-chain demand.

It is currently unclear how big of a recovery rally ATOM will achieve after the support retest. A strong rally would require robust demand not just from the spot market but also from the derivatives market.

Fortunately, the current conditions in the derivatives market align with the previously mentioned observations.

Notably, ATOM’s Binance and FTX funding rates both dropped from their four-week highs in the second week of September. They retested their lower monthly range earlier this week but have both pivoted since then. This outcome confirmed demand recovery in the derivatives market.

The above combination of factors increased the odds of a bullish recovery especially if the bullish volumes follow through. However, investors should keep watch on the overall market outlook in the first week of October.

Unexpected market events may trigger a negative outcome, causing another sentiment shift in favor of the bears.