Bitcoin: Before you make your next trade in October, read this

The last four months have been marked by a “boring” price action from the leading coin, Bitcoin [BTC], data from on-chain intelligence platform Santiment revealed. In the past few weeks, BTC’s price oscillated strangely between the $19,000 price region and the psychological $20,000 price region.

Noticeably, the king coin has been increasingly less volatile in the past few weeks. Glassnode, in a recently published report, compared BTC’s performance with that of the broader financial markets. It found that,

“Recent weeks have seen an uncharacteristically low degree of volatility in Bitcoin prices, in stark contrast to equity, credit, and forex markets, where central bank rate hikes, inflation, and a strong US dollar continue to wreak havoc.”

According to Santiment, this decline in volatility could be attributed to “the lack of whale presence” in the BTC market. The count of BTC whale transactions that exceed $100,000 and $1 million also declined nearly to a two-year low, data from Santiment revealed.

?? As #Bitcoin's price action has become relatively "boring" the past four months, we see that the lack of whale presence has had a lot to do with this lower volatility. $BTC transactions valued at $100k+ and $1m+ have fallen to levels last seen in 2020. https://t.co/92ksM3jp7b pic.twitter.com/zjpyhoUi71

— Santiment (@santimentfeed) October 11, 2022

Are we near the bottom?

A persistent fall in BTC’s volatility has been partly induced by the lack of whale presence in the BTC market. This aimed to signify attempts by investors to establish a bear market floor. A look at the asset’s supply on exchanges supported this position.

According to data from Santiment, BTC’s supply on exchanges dropped by 13% in the past four months. The percentage of the coin’s total supply on exchanges fell from 10.10% to 8.72% between June and October.

The decline in BTC’s supply on exchanges was an indication that buying pressure for the asset rallied in the period under consideration.

While this ordinarily should aid a price uptick, the downtrodden nature of the broader financial markets made it impossible for the price of BTC to rise significantly.

While the fall in BTC’s supply on exchanges might have indicated a rally in buying pressure in the past four months, a look at the asset’s Mean Dollar Invested Age (MDIA) revealed that the BTC network was plagued by an increasing repository of dormant coins.

Data from Santiment also showed that BTC’s MDIA has been on a long stretch upward in the past four months showing stagnancy on the network.

However, for the king coin to see any significant price action, a fall in MDIA is required. This will mean that previously dormant coins have started to change hands.

An October to remember

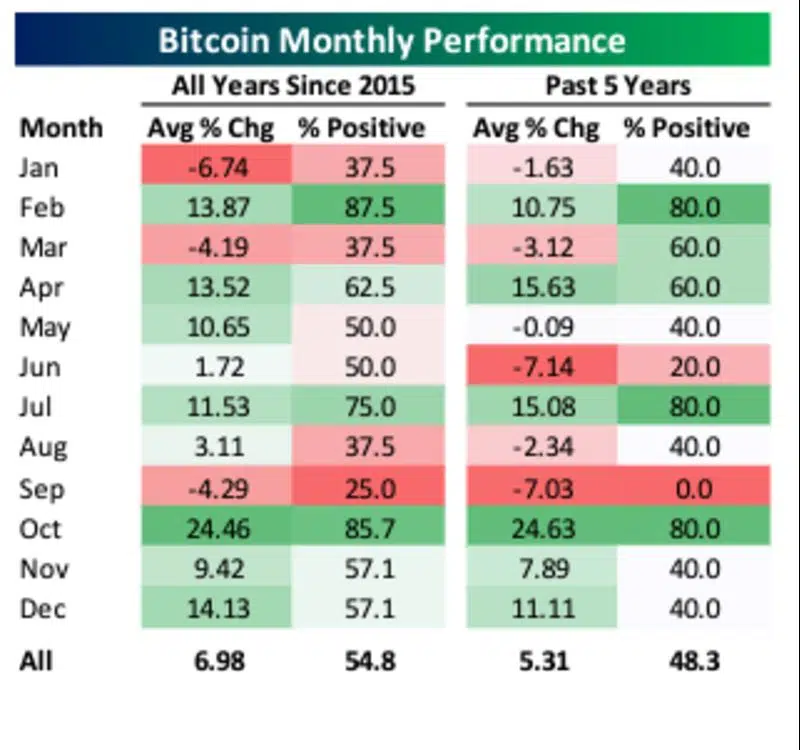

According to Bloomberg, October, historically, has been a good month for BTC.

“The virtual currency tends to rise roughly 25% in October and has, since 2015, advanced more than 85% of the time during it.”

Investors hoping for a respite may thus have something to rejoice about.