Bitcoin investors may need futures traders for an “Uptober”—Here’s why

Bitcoin’s [BTC] fall from $22,000 to $19,000 was not void of the activities of the king coin futures traders. According to CryptoQuant analyst, Greatest_Trader, funding rates in the derivatives market have a great impact on the BTC price. The crypto analyst noted that BTC started its trip to its current $19,250 price since the funding rates turned negative. He said,

“The funding rates have turned negative once again as the price has dropped from the $22K level and is consolidating at the $19K support. However, the metric’s values are significantly low compared to the 2019-2021 period.”

Here’s AMBCrypto’s Price Prediction for Bitcoin [BTC] for 2022-2023

Who is coming to BTC’s rescue?

According to Greatest_Trader, the current funding rates had not reversed to positive, and if not revived, could lead to a further BTC decline. As such, the talk of an “Uptober” may well be in the drain. A look at the funding rate on some exchanges revealed that the analyst concerns could be valid.

Santiment, the on-chain analytics tool, showed that the finding rate on Binance was neutral at 0%. The metric on the DyDx exchange was not also different at 0.0001%. The implication of this was a reduced demand considering the BTC consolidation lately.

Hence, BTC short-term investors may need a hike in futures activities to trigger a considerable rally. However, it didn’t seem like traders were ready to get back in the fray.

This was due to the futures open interest as revealed by Coinglass. According to the derivatives information portal, open interest across almost all exchanges was mostly negative in the last 24 hours. For those which were positive, the rate was considerably negligible. Thus, the possibility of a funding rate revival was less likely.

To stop the downward spiral or not

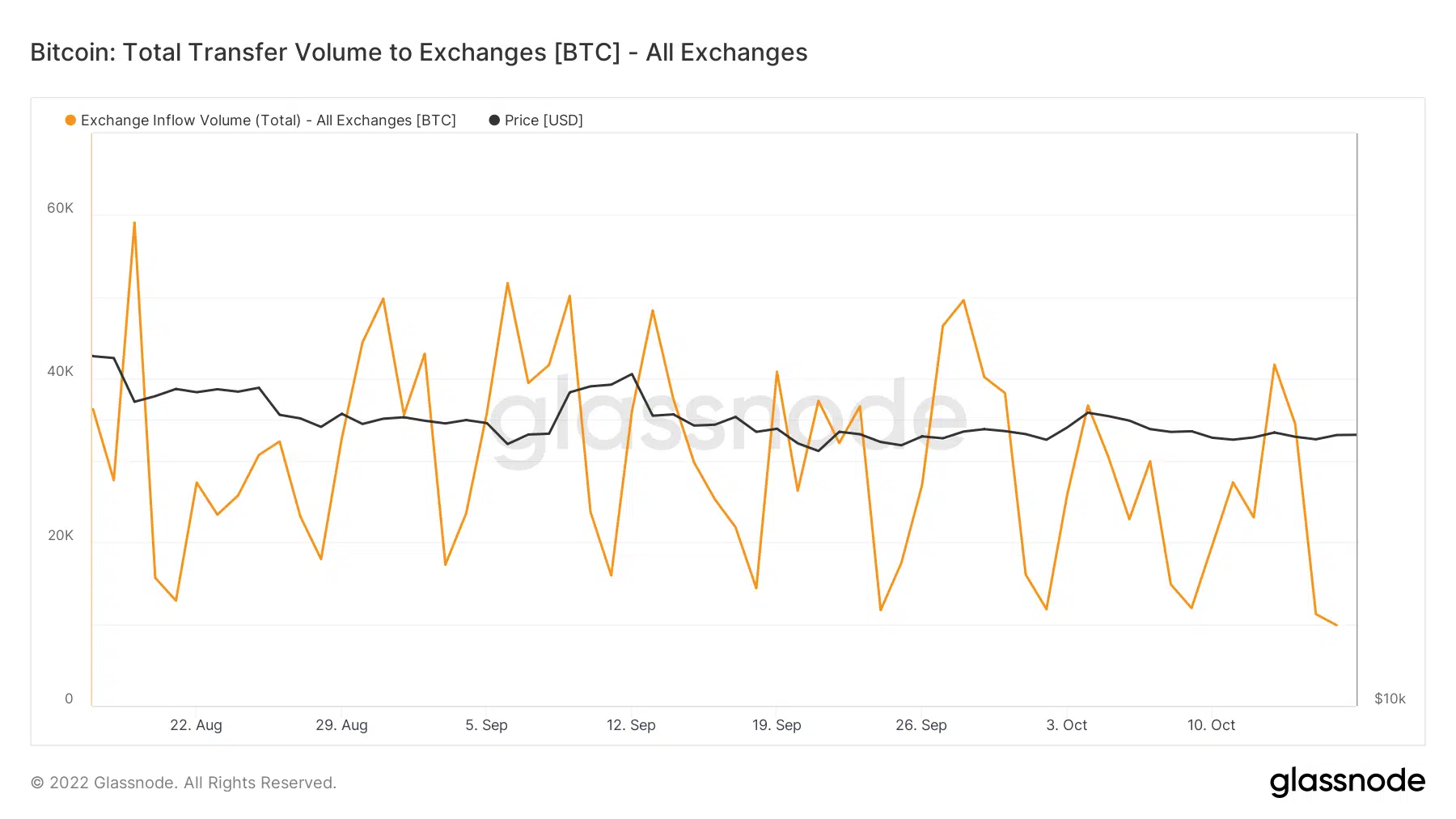

Besides the funding rate, and open interest, BTC might require a substantial increase in exchange inflows to effect a bullish momentum. The reason for this is that futures trades do not happen on decentralized exchanges.

Unfortunately, the trend according to Glassnode might not fall to investors’s expectation. Based on data available from the platforms, BTC exchange inflow had been going on a downward trend since 13 October. At press time, the total exchange inflow volume was 9,859.80. This was a big decline from 41.727.07 on the date mentioned above. Hence, it could be difficult to expect a BTC rally in the short term.

Per the four-hour chart, the BTC On-Balance-Volume (OBV) closed lower than the previous 24 hours. As of this writing, the OBV was 794,355. Compared to the value for most of the previous week, there has been high selling pressure.

Furthermore, the Directional Movement Index (DMI) showed that selling strength (red) was higher than the buying (green). Although close, the Average Directional Index (ADX) in yellow indicated that the selling pressure was not above board at 23.04. So, BTC investors might see some respite in the coming days if the ADX goes further low. If not, the coin could lose its hold on $19,000.