Bitcoin [BTC] short-traders ravage the market as whales intensify accumulation

![Bitcoin [BTC] short-traders ravage the market as whales intensify accumulation](https://ambcrypto.com/wp-content/uploads/2022/11/btc-4.jpg.webp)

- In spite of persistent price decline, Bitcoin whales continue to accumulate.

- However, on-chain data suggested that most might be accumulating to short the king coin

Currently trading at a two-year low, Bitcoin [BTC] whales have ramped up the accumulation, on-chain data showed.

Read Bitcoin’s [BTC] price prediction 2022-2023

According to CryptoQuant analyst Dan Lim, as BTC’s price suffers under the impact of the general market downturn caused by the sudden collapse of cryptocurrency exchange FTX, “whales are accumulating BTC for a long time.”

Dan Lim argued that the BTC market outlook did not look favorable in the short-term and the mid-term. Therefore, the only rational explanation for ongoing whale accumulation was to HODLing in the long term. Lim said,

“Although the crypto market and economic conditions are not good, from the long term perspective, Accumulating from knee to ultimate bottom through DCA or split purchase(accumulation) might be a sagacious way.”

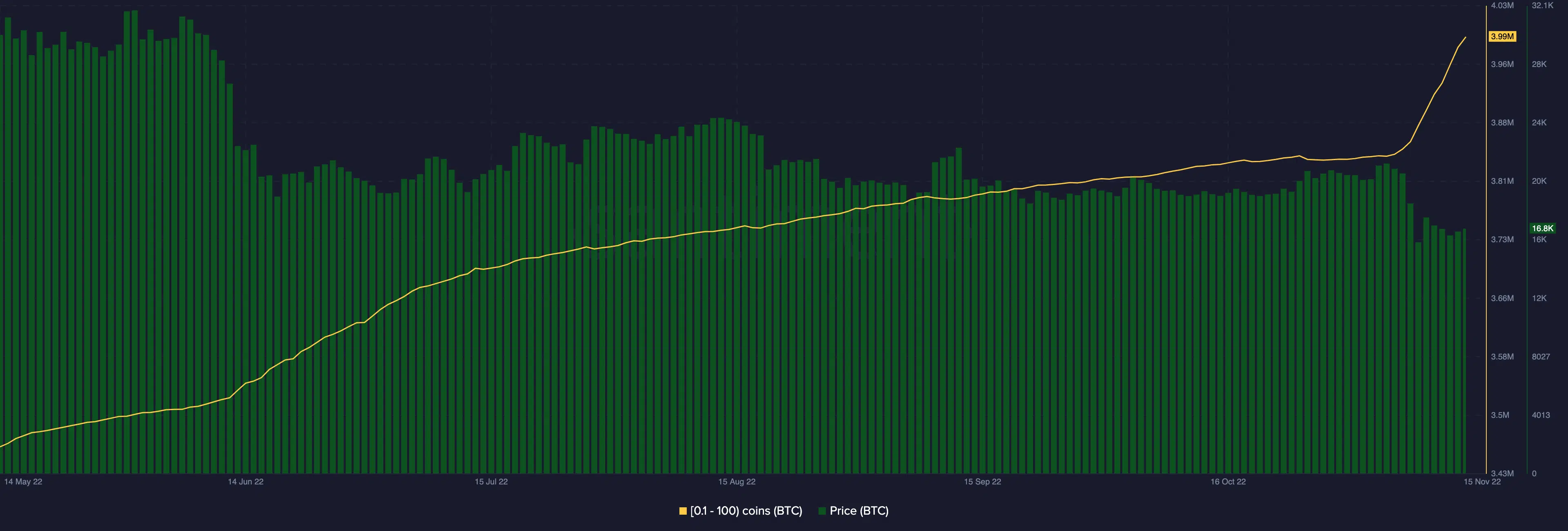

Data from the on-chain analytics platform Santiment further corroborated this position. According to Santiment, since the FTX fiasco started, BTC has recorded a large increase in the number of addresses holding between 0.1 to 100 BTC.

Since 7 November, the count of these addresses has grown by 9%, with over 125,000 addresses sized between 0.1 to 100 BTC created since then. At press time, this cohort of BTC addresses totaled 3.99 million.

Further, on-chain data revealed that this category of holders had accumulated an additional +0.6% of BTC’s total supply since 7 November.

There is a catch

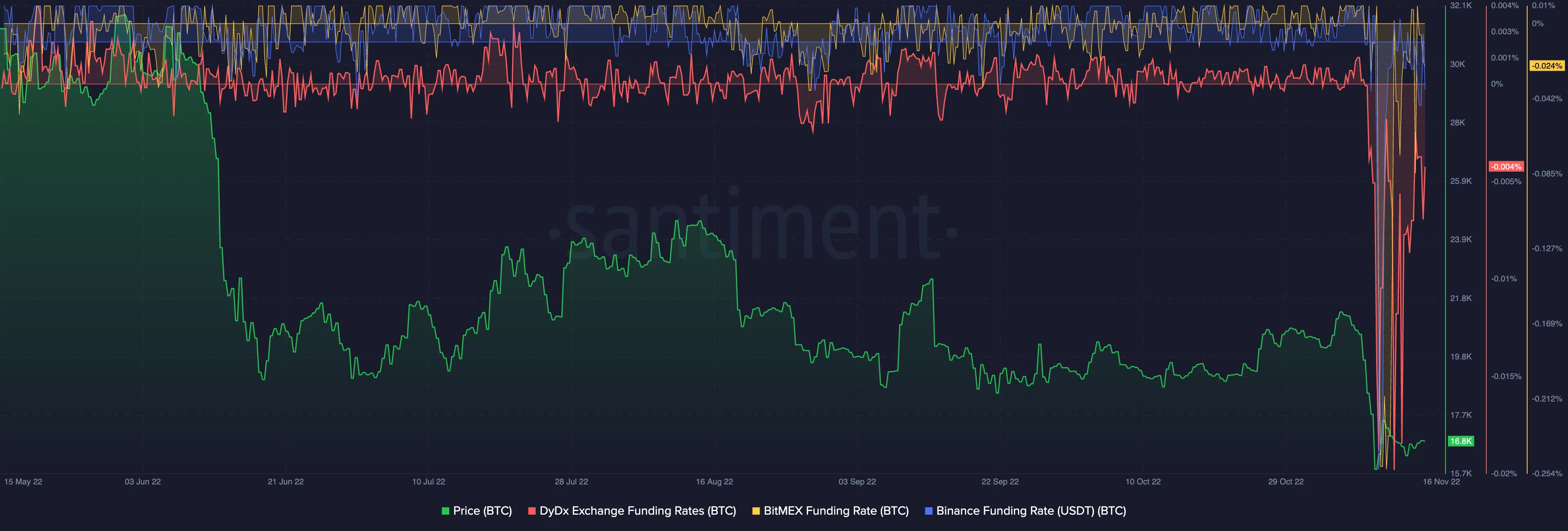

While whales might have taken to coin accumulation in the last week, a closer look at BTC’s performance on the chain showed that traders’ sentiment has fallen into a major negative bias.

This is attributable to the loss of trust in centralized exchanges following the collapse of FTX. It has led to a severe decline in funding rates on exchanges like Binance, BitMEX, and dYdX as investors bet on the continued decline in the price of the king coin.

At press time, funding rates on these leading exchanges were at their lowest in the last six months. This might suggest that contrary to Lim’s position, the whales accumulating might be doing so in expectation of a further price decline.

Moreso, on a daily chart, sellers were spotted in control of the BTC market as buying momentum began to fall.

As of this writing, the leading coin’s key indicators rested below their neutral points. For example, BTC’s Relative Strength Index (RSI) was 37, while its Money Flow Index (MFI) was 39.

In addition, its Chaikin Money Flow posted a negative value of -0.12, showing further that buying pressure had waned despite an increment in whale accumulation in the last few days.