CAKE buyers can leverage this breakout to optimize their risk to reward

Disclaimer: The findings of the following analysis are the sole opinions of the writer and should not be considered investment advice.

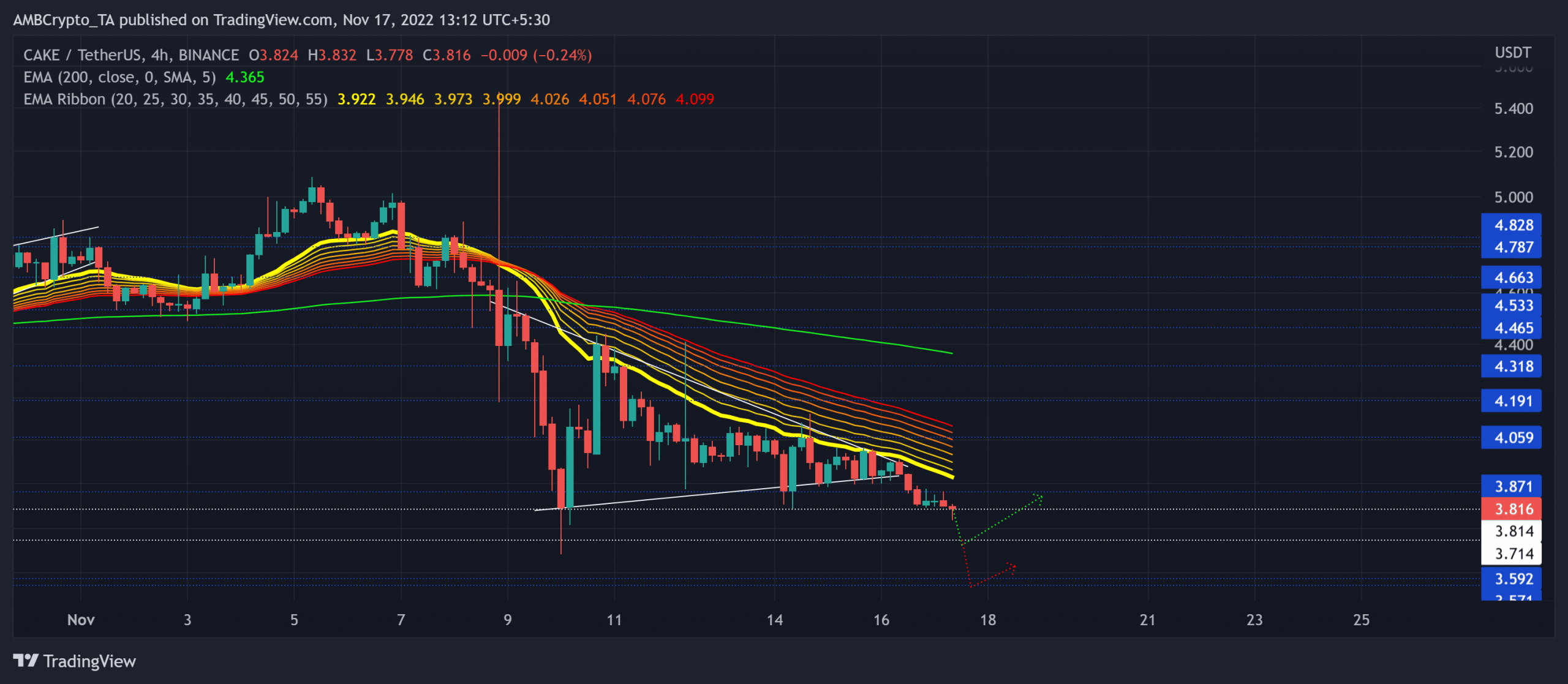

- CAKE’s recent bearish pull chalked out a symmetrical triangle over the last few days.

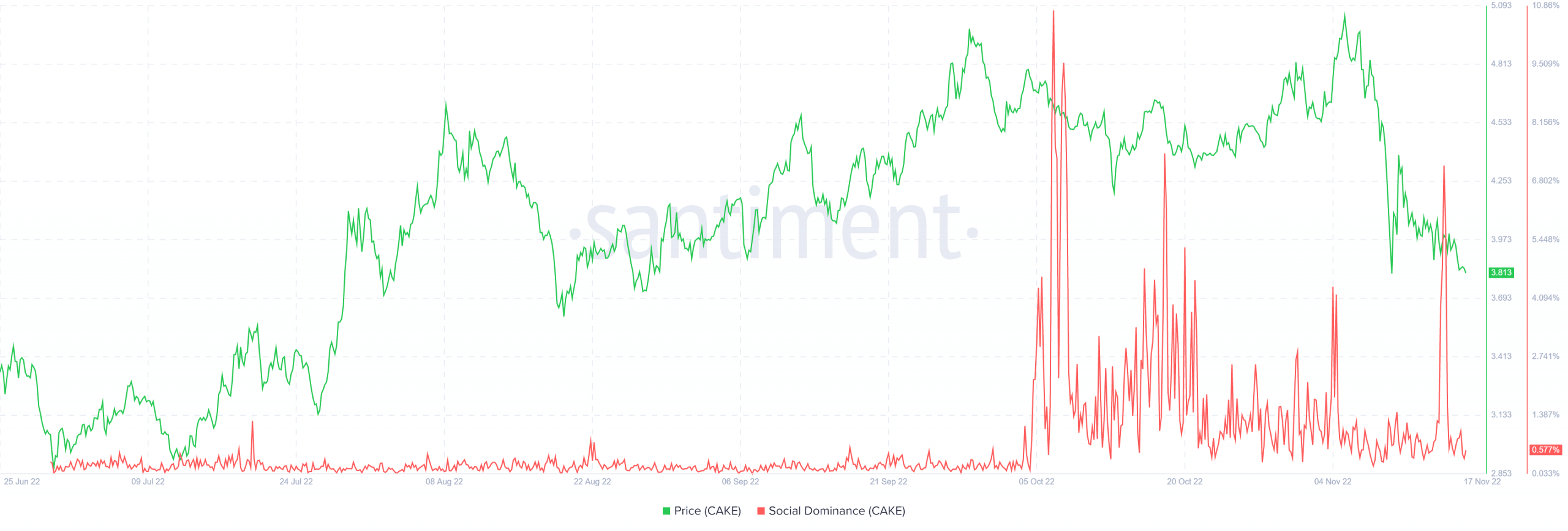

- The crypto’s social dominance marked a spike while the price action kept declining.

The ongoing selling efforts pulled PancakeSwap [CAKE] below the EMA ribbons, while the 20 EMA offered strong resistance over the last few days.

Read PancakeSwap’s price prediction 2023-2024

Its recent price movements entailed a patterned breakout in the four-hour chart. A sustained close below the EMA ribbons could aid the sellers in maintaining their near-term edge. At press time, CAKE was trading at $3.816, down by 3.48% in the last 24 hours.

Can the buyers induce a convincing rebound?

After taking a U-turn from the $5 region on 5 November, the alt witnessed a solid pullback as the sellers re-entered the market. Nonetheless, the $3.7-$3.8 range cushioned this decline while inducing a bullish reversal.

The resulting buying comeback propelled near-term gains. But the EMA ribbons continued to constrict the buying efforts over the last ten days. With the EMA ribbons declining below the 200 EMA, the sellers could look to reclaim their long-term edge.

A continued decline from the immediate support could find resting grounds at the $3.7-mark. A potential/ immediate reversal from this support could present buying chances. The first major resistance would lie in the $4.05 zone. Any close above this ceiling could create conditions for extended growth.

An extended decline below the immediate support could invalidate the near-term bullish inclinations by testing the $3.5 support.

The Relative Strength Index (RSI) reaffirmed a bearish inclination as it dropped below the midline. The buyers should look for a recovery toward or above this level before placing calls.

A spike in Social Dominance

According to data from Santiment, CAKE saw a major spike in its Social Dominance on 15 November. Since then, however, the price action continued its downturn, especially given the market-wide uncertainties.

Should the price action account for this spike, CAKE could see a near-term revival in the coming sessions.

Potential targets would remain the same as discussed. Finally, keeping a watch on the king coin’s movement could help make a profitable bet.