Lido Finance TVL’s supremacy and everything you need to know about LDO

- Lido Finance TVL has remained in the second position despite the fall of the overall DeFi protocol

- The price action showed that buying and selling momentum was in contention for relevance

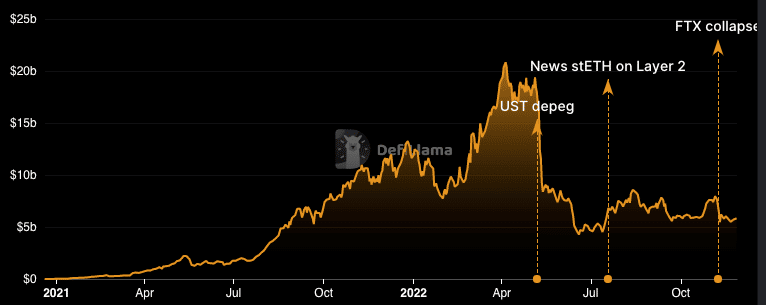

Lido Finance’s [LDO] Total Value Locked [TVL] has kept the liquid staking protocol among the top DeFi ecosystems. This has happened despite the massive drop in the wider DeFi market.

At press time, the Lido DeFi TVL was $5.88 billion. According to DeFi Llama, Lido had maintained its second position, only behind MakerDAO [MKR]. The performance of the protocol over the last 30 days had declined by 33%. This implied that deposits into the Lido protocol were not impressive, despite the increased incentives with its Ethereum [ETH] staking.

Read Lido Finance’s Price Prediction for 2023-2024

Lido Finance: Developments and volume surge

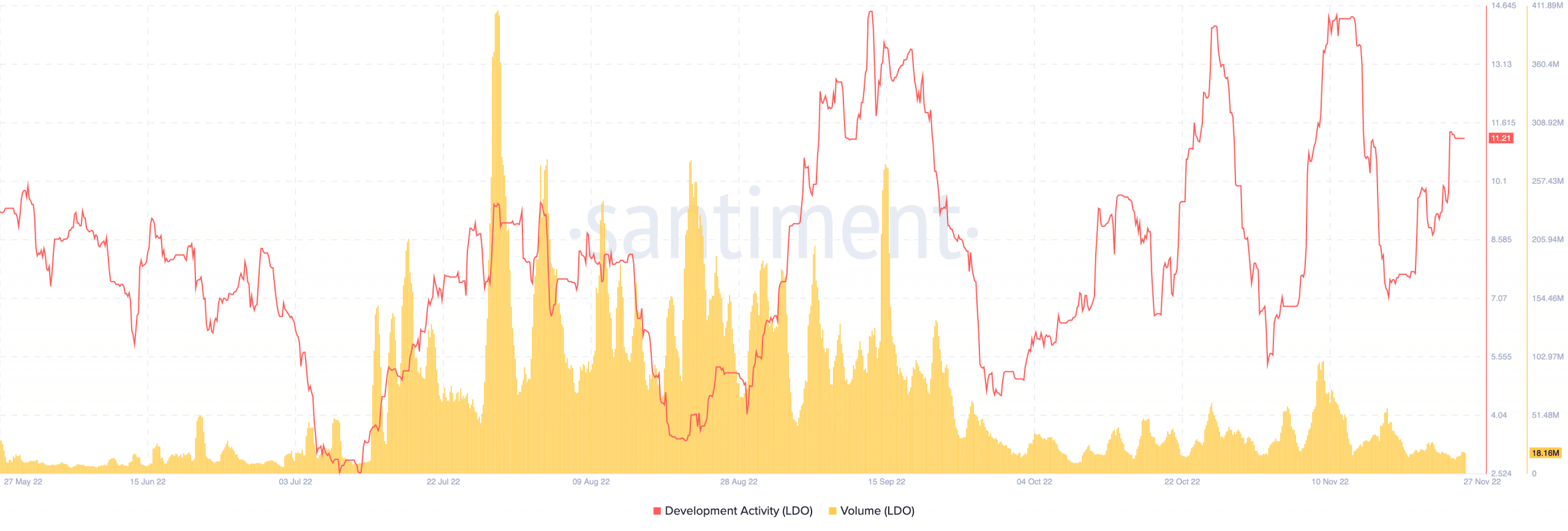

Even though there were decreases, it was not evident in Lido’s development activity. Data by Santiment showed that the development activity, which dropped on 23 November, had revived to a value of 11.21 at press time. This meant that the team was continually polishing and refining upgrades in its protocol.

Another hike that seemed a little significant was its volume. As of this writing, the 24-hour volume was $18.16 million. This represented a 20.83% increase from the previous day. So, there have been a relatively good number of transactions that have passed through the Lido chain lately.

Of price and what’s coming

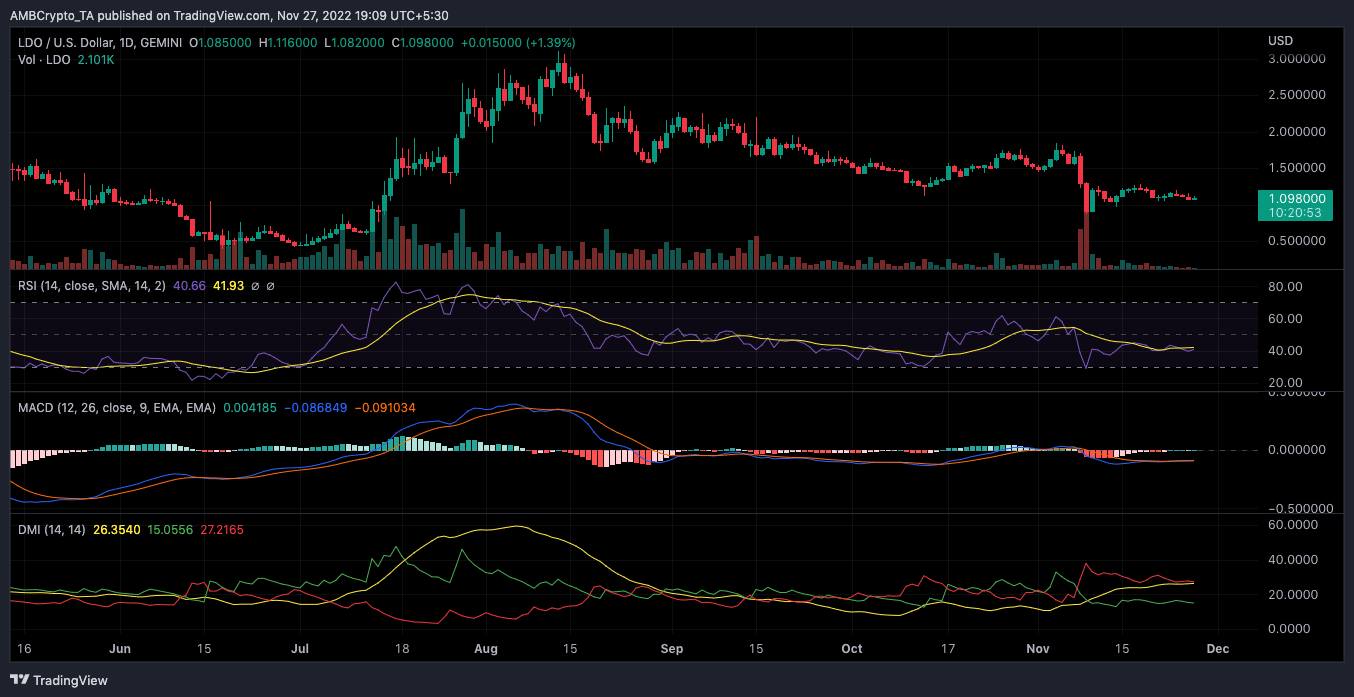

As for the price, LDO was trading at $1.10, according to CoinMarketCap. Although it was a minimal increase from the last 24 hours, the four-hour chart showed that there could be potential for a recovery.

This was because the Relative Strength Index (RSI) showed some attempt for buying power at 40.66. Thus, the bearish experience could become bullish, but there was no strong signal to signify the same.

However, the Moving Average Convergence Divergence (MACD) indicated a battle for buying and selling strength. At press time, the MACD showed that the bearish momentum was not all gone.

This was because buying strength (blue) and the sellers (red) were at almost the same point. Nonetheless, the MACD seemed to reflect more of a drawdown than an uptick.

As for its direction, it might be challenging for LDO to exit its bearish state. This was because of the position of the Directional Movement Index (DMI). At press time, the positive DMI (green) was 15.05 and the negative DMI (red) was 27.21. Since this was not a close call, LDO might lose hold of the $1.10 region

Furthermore, the stance of the Average Directional Index (ADX) showed an upward directional strength. With the ADX (yellow) at 26.35, there was more support for LDO to succumb to the red control.