Aggressive XRP traders looking for short-term profits can turn to these levels

Disclaimer: The findings of the following analysis are the sole opinions of the writer and should not be considered investment advice

- The short-term market structure was bearish for XRP

- The indicators showed sellers had the upper hand, but only by a small margin

XRP fell beneath a bullish order block and flipped it to a bearish breaker. Both buyers and sellers were likely to encounter risky conditions over the next day or two. At the time of writing, sellers had the upper hand, and will likely have a good defense set up at the $0.384 area.

Read XRP’s Price Prediction 2023-2024

Bitcoin also saw losses on 5 December, when it dropped from $17.3k to $16.9k. It retained its bullish structure on the four-hour and 12-hour timeframes but faces stern resistance at the $17.8k-$18k area.

XRP rejected at resistance once more and slips beneath a bullish order block

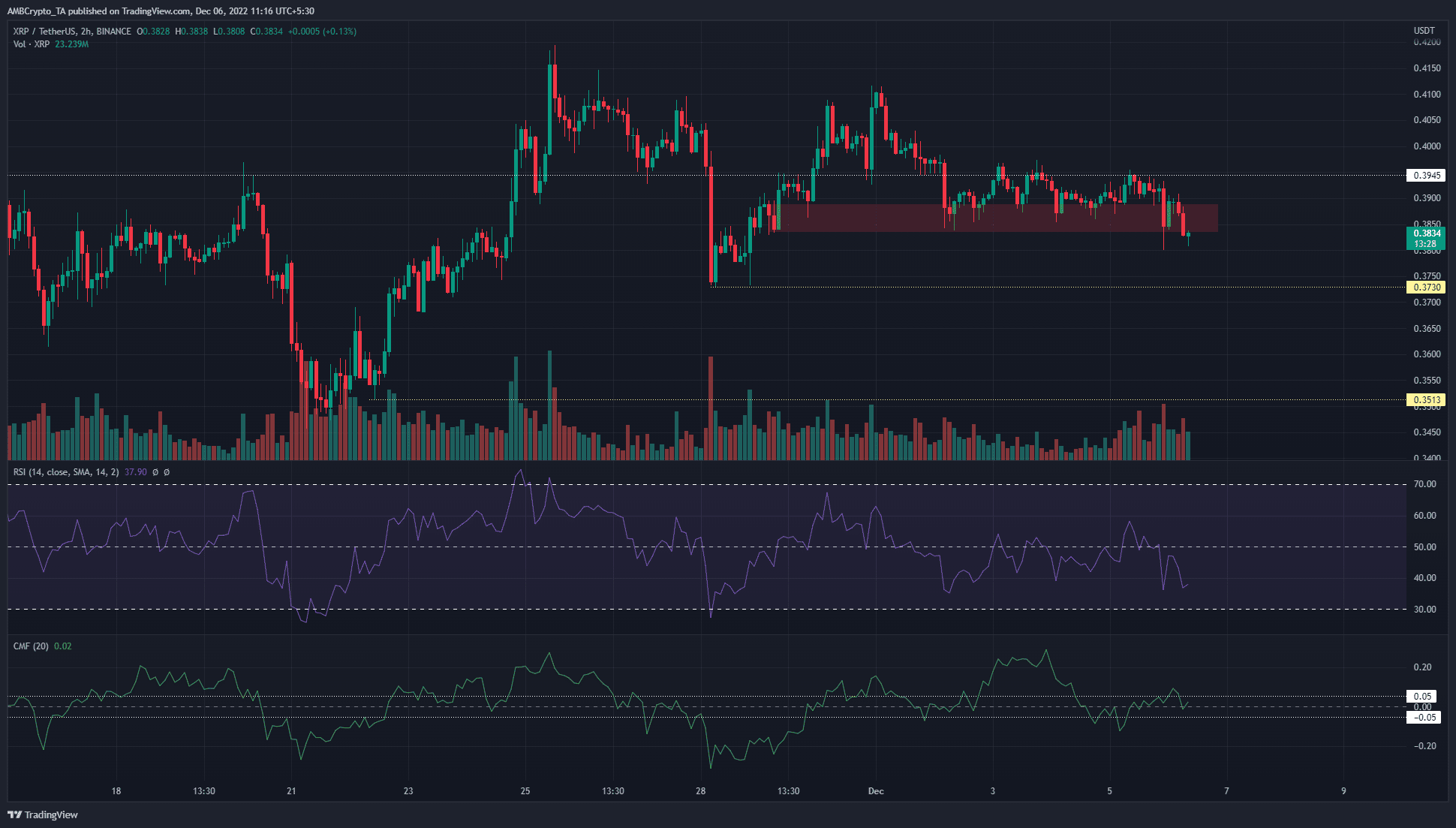

The red box highlighted a bullish order block that XRP formed on 29 November in the four-hour timeframe. Immediately after the dip to $0.384 on that day, XRP began to pivot away and climb higher to reach $0.41.

This showed the $0.384 region was a good demand zone. However, since then, this bullish order block has been tested several times. In recent hours, the price saw an hourly session close beneath this zone. Therefore, the former bullish order block had become a bearish breaker.

The Relative Strength Index (RSI) also fell beneath neutral 50 to show that momentum was firmly pointed downward. However, capital flow did not support this notion. The Chaikin Money Flow (CMF) dipped beneath +0.05 and did not indicate significant capital flow into or out of the market at press time.

The $0.3945 level of resistance above it had been flipped to resistance a few days before the time of writing. The $0.382-$0.384 has been significant on lower timeframes in the past two weeks. The formation of this order block near this level gave it significance.

At press time, XRP faced resistance at this breaker. It would need to beat the $0.389 mark and flip it to support before short-term bullish ideas can be entertained.

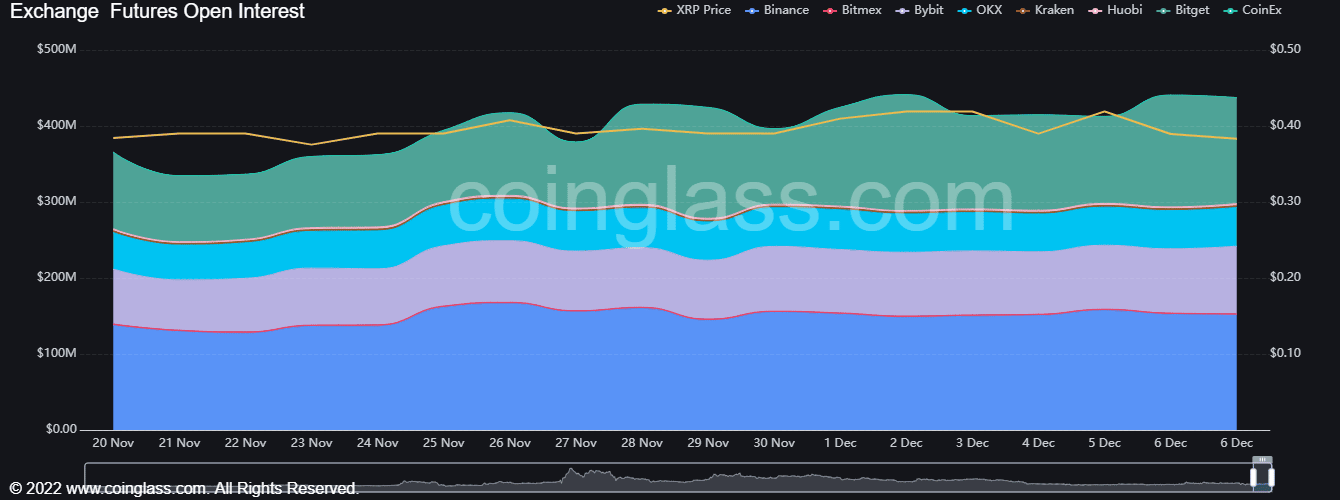

The slowly rising OI suggested tentative bullish sentiment but it could soon be reversed

Source: Coinglass

Since 21 November, the Open Interest has slowly increased from $334 million to $441 million across the most popular exchanges. During this time XRP rallied from $0.352 to $0.41. However, at the time of writing, the lower timeframe market structure was bearish.

Therefore, market participants who had previously been bullishly positioned could be forced to puke should XRP see a sharp plunge. This would add further fuel to selling pressure. Contradicting this notion, the past few hours of trading saw BTC retest the $16.8k region and bounce. Therefore, it was also possible that the drop of 5 December was a grab for liquidity before a push higher.

In summary, aggressive traders can look for short entries in the $0.386 region for XRP with a tight stop-loss at $0.39. Yet, a move above $0.39 was also possible, which would necessitate traders flipping their biases to short-term bullish.