Bitcoin’s [BTC] bottom is not in yet; should you go short in 2023?

![Bitcoin's [BTC] bottom is not in yet, should you go short in 2023?](https://ambcrypto.com/wp-content/uploads/2022/12/jievani-weerasinghe-NHRM1u4GD_A-unsplash-1.jpg.webp)

- Any further rally and subsequent drop in BTC’s hashrate will pull down its price.

- BTC market is not yet in the accumulation zone.

Currently trading at its December 2020 price level, holders of the leading coin Bitcoin [BTC], might not be in the clear yet as on-chain assessments suggest a further decline in BTC’s price as we gear up to commence the 2023 trading year.

A 0.45X decrease if BTC falls to Ethereum’s market cap?

While the persistent decline in BTC’s hashrate is no longer news, its negative impact on BTC’s price lingers. A decline in BTC’s hashrate often indicates that miners on the BTC network have stopped mining as it is no longer financially profitable to do so.

CryptoQuant analyst Crypto sunmoon assessed the historical performance of BTC’s hashrate and found that each time the hash rate on a 30-day moving average (30 EMA) reached a high before declining, BTC’s price followed suit.

Recently, after a prolonged decline in BTC’s hashrate, it peaked at 260 MH/s on 5 November. This led to a rally in BTC’s price as the king coin traded momentarily above the $20,000 price mark.

However, the rapid decline in hash rate and the FTX debacle culminated in a significant decrease in BTC’s price as it closed the trading month at a price low of $17,000.

According to Crypto sunmoon, “in the past, when the hash rate (30EMA) reached two peaks and decreased, bitcoin prices also decreased twice.” This suggested that the next rally in BTC’s hashrate, which is followed by a decline, would also lead to a further decline in BTC’s price.

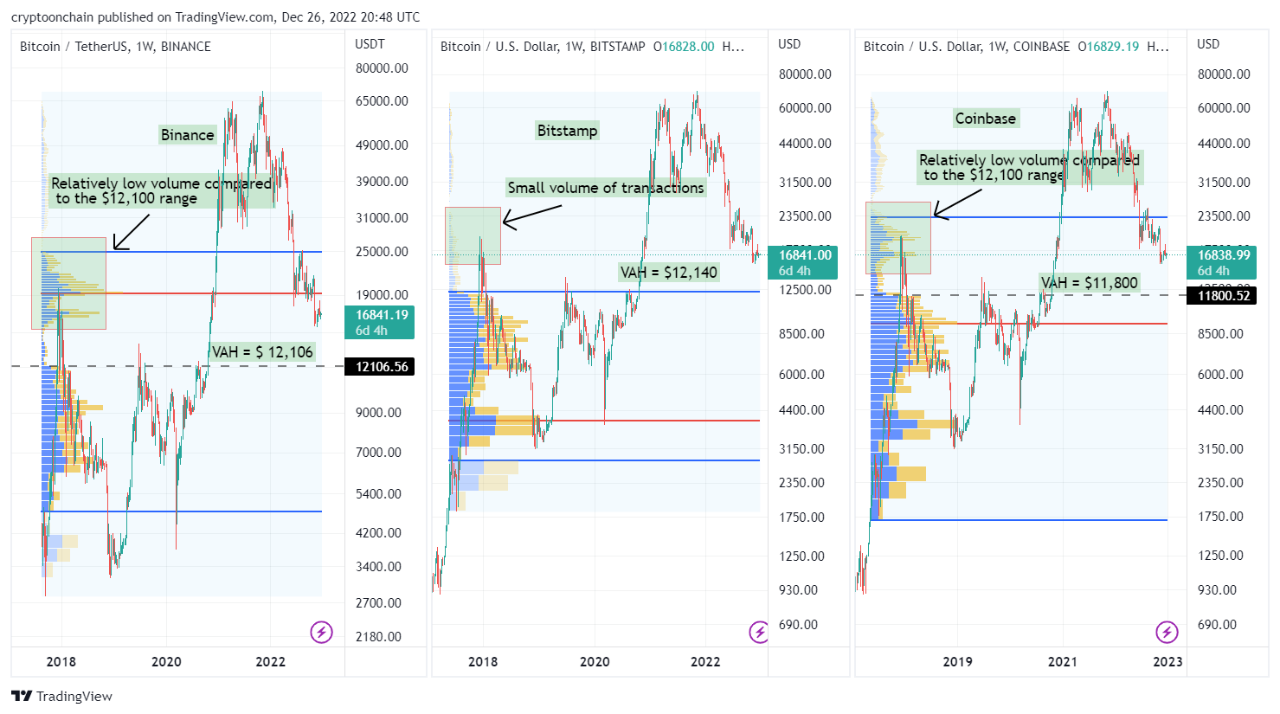

Sharing a similar view, another CryptoQuant analyst Ghoddusifar assessed BTC’s volume profile and accumulation trend and concluded that a further decline in the king coin’s value was imminent.

According to Ghoddusifar, crypto assets see increased transaction volume when buying activity is high. However, “examining the current price range does not show a high transaction volume in the exchanges,” Ghoddusifar said.

Read Bitcoin’s [BTC] Price Prediction 2023-2024

He added further:

“If we do not see an increase in the volume of transactions in this range, we should consider the possibility that we have not yet reached the Accumulation range.”

This meant that at its current price level, BTC transaction volume remained minimal, suggesting that the market still needed to reach an accumulation point where buyers would typically drive out the sellers.