Chainlink: Increasing whale accumulation does not mean much if…

- LINK has seen a surge in whale accumulation in the last eight months.

- On-chain assessments, however, revealed some dormancy that might make it hard for its price to grow.

Leading oracle Chainlink [LINK] has seen an increase in whale accumulation, Santiment revealed on 18 January. As of this writing, over 460 addresses held at least 100,000 LINK tokens. Interestingly, amid the severe bearishness that marked the 2022 trading year, whale accumulation intensified as the number of whale addresses grew to levels last observed in 2017.

?? #Chainlink is floating a bit ahead of the #altcoin pack today. There are 463 addresses that hold at least 100,000 $LINK, and they have ascended +26% since May, 2022. It is encouraging when an asset sees whale accumulation during corrections. https://t.co/QNKzhuU24g pic.twitter.com/9hBqsQR89J

— Santiment (@santimentfeed) January 17, 2023

Is your portfolio green? Check the Chainlink Profit Calculator

Since May 2022, the count of whale addresses holding at least 100,000 LINK tokens increased by over 26%. Typically, whale accumulation of this volume had a significant impact on the market, as the actions of these large holders can influence the price of a crypto asset to rally.

However, the downturn that plagued the general market in 2022 led to a consistent fall in LINK’s price within the 12-month winter period.

Flashes of red light?

Although the value of LINK has risen by 23% since the start of the year, reflecting the overall growth in the market, an analysis of the cryptocurrency’s on-chain performance has raised some concerns.

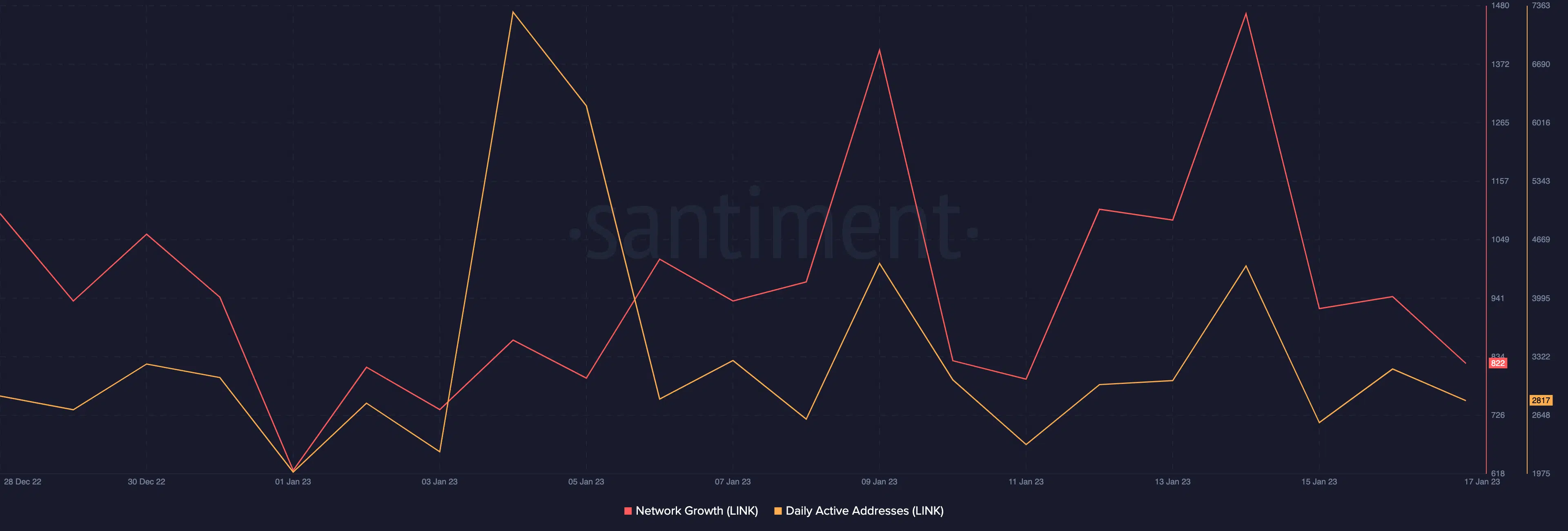

According to data from Santiment, since the start of the year, new demand for LINK grew by 51%. However, the count of unique addresses trading the alt daily fell by 56% since 4 January.

What do the metrics for Chainlink suggest?

Increasing new addresses for a crypto asset alongside a decline in daily active addresses could indicate that while more people were acquiring the cryptocurrency, they may not be actively using it or taking part in transactions on the network.

It could also mean that the new addresses were being created for speculative or long-term holding purposes, rather than for day-to-day use.

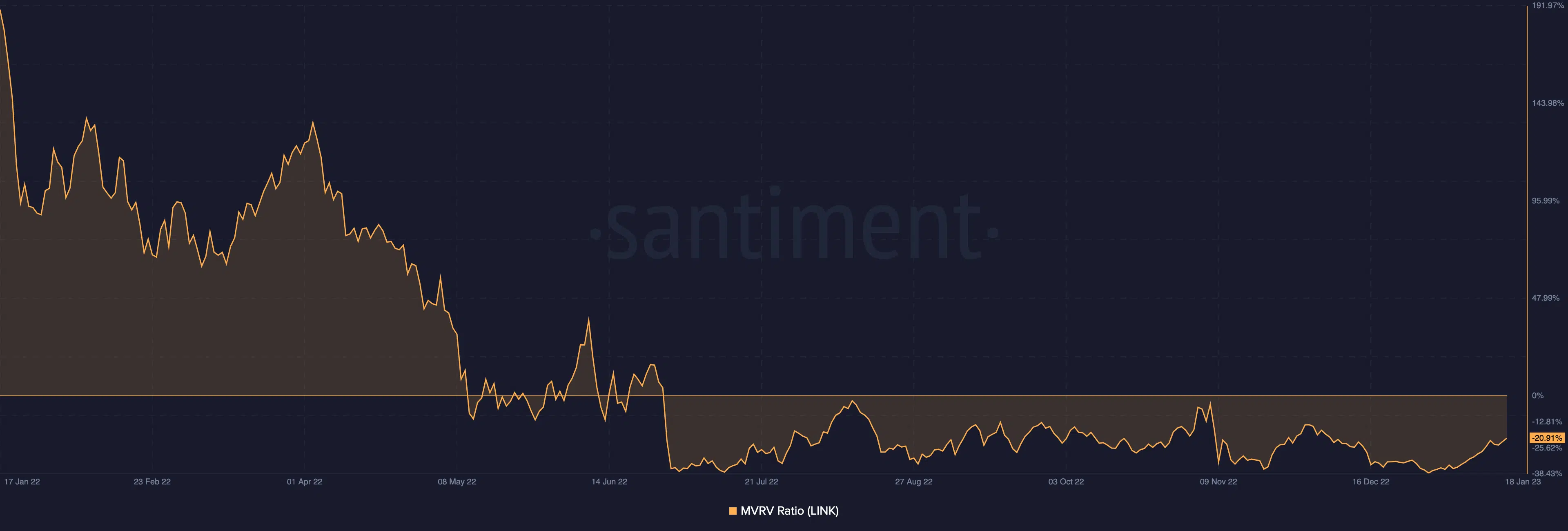

Also, despite the growth in price in the past two weeks, LINK continued to be undervalued since June 2022. According to Santiment, LINK’s MVRV has been negative since then.

How much are 1,10,100 LINKs worth today?

An MVRV value between 0 and one for a crypto asset implied that holders were likely to incur a loss if they sold their assets at the current price. This had been the case for LINK holders, as they have mostly sold at a loss since June 2022.

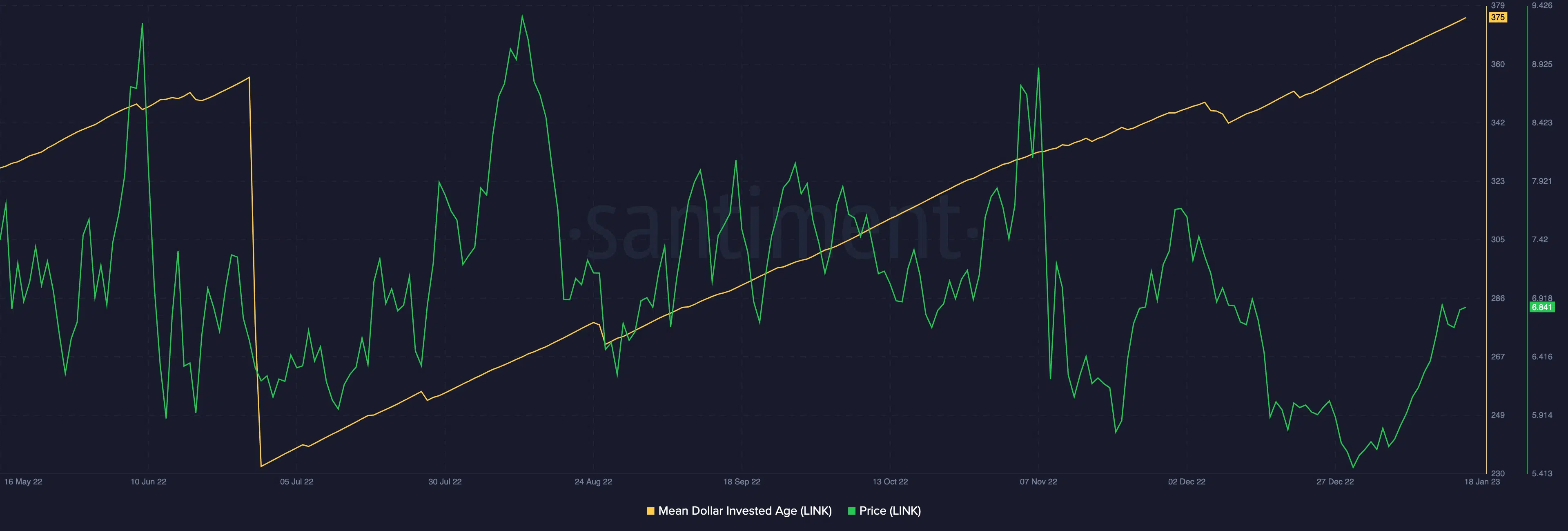

Lastly, some dormancy was also spotted on the Chainlink network, as confirmed by a look at the alt’s Mean Dollar Investment Age metric. Since the end of June 2022, this metric has embarked on an uptrend and has been on a prolonged stretch, meaning that long-held coins have failed to change hands.