Polygon [MATIC]: A 15% potential rally is likely if this support is secured

![Polygon [MATIC]: A 15% potential rally is likely if this support is secured](https://ambcrypto.com/wp-content/uploads/2023/01/ochir-erdene-oyunmedeg-LmyPLbbUWhA-unsplash-e1674996780126.jpg)

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

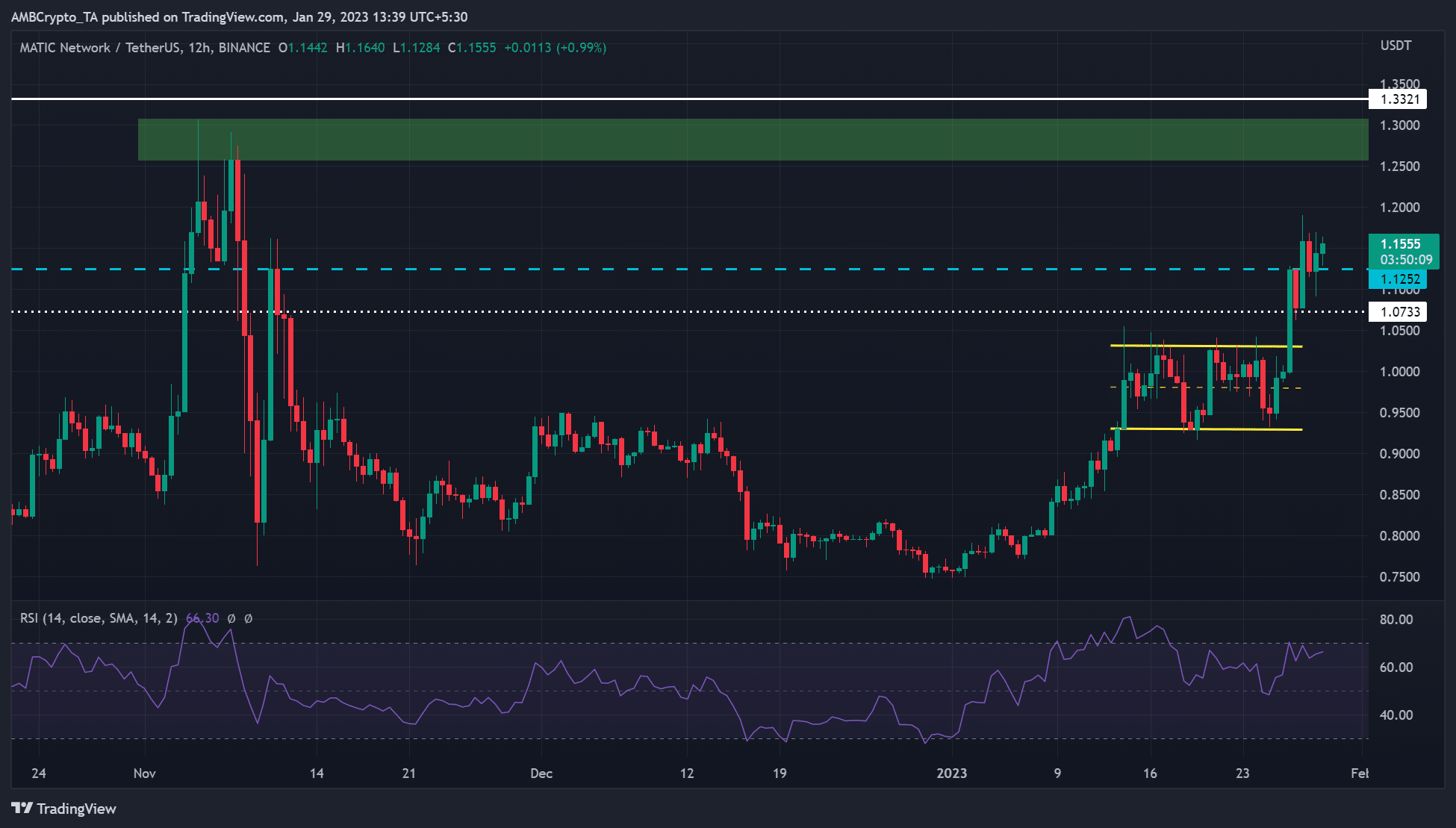

- MATIC was bullish on the 12-hour chart.

- Holders saw profits, and extra gains could be likely if a key support level is secured.

Polygon [MATIC] offered investors more gains into the weekend. It broke above its 12-day-long price consolidation range on Thursday, 26 January, offering a 15% gain.

Read Polygon [MATIC] Price Prediction 2023-24

But the rally slowed after hitting the overhead resistance of $1.1900. At press time, MATIC’s value was $1.1555.

The $1.1252 support level: Can it hold?

MATIC’s January rally was slowed to two weeks by a price consolation range of $0.9283 – $1.033. But the break above the range saw MATIC hit the bullish target of $1.1252.

The above target was flipped into an immediate support level. If the $1.1252 support level proves steady in the next few days, MATIC could target its November high of $1.300 – a potential 15% rally.

Is your portfolio green? Check out the MATIC Profit Calculator

The Relative Strength Index (RSI) on the 12-hour chart was 66, indicating a bullish MATIC. Therefore, the above bullish bias could be likely in the next few days.

But a drop below the $1.1252 support would invalidate the bias. Nevertheless, bulls could find another steady level at $1.0733 in such an event of a downtrend.

MATIC recorded whale count transactions, and holders enjoyed massive profits

As per Santiment data, there were a handful of whale transaction counts above $100K by press time. The historical pattern showed that some whale moves were associated with price surges. As such, we could expect another price rally.

In addition, long-term holders saw profits, especially after Thursday’s bullish break out of the price consolidation range. The above position is based on the rising 90-MVRV (Market Value to Realized Value).

Notably, the price consolidation period saw MVRV rest on the neutral line and even drop into the negative side, showing holders saw losses during the period. An extra rally could see holders pocket more gains.

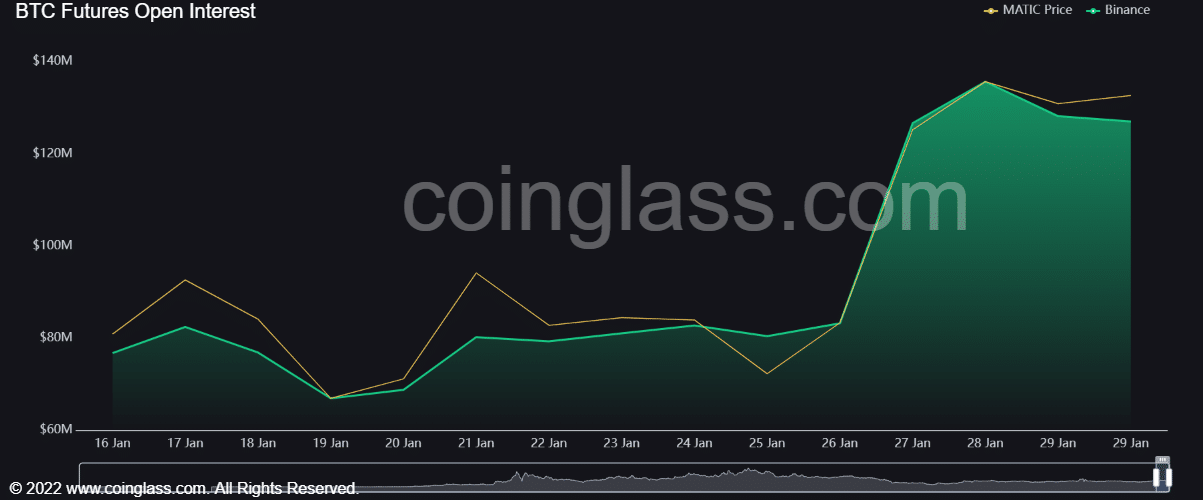

However, the price/open interest divergence at press time, as indicated by Coinglass, could delay a strong momentum in the short term. It shows money moved out of MATIC’s futures market despite the rising prices.