Avalanche [AVAX] investors on tenterhooks as trend reversal looms

![Avalanche [AVAX] investors on tenterhooks as trend reversal looms](https://ambcrypto.com/wp-content/uploads/2023/02/avax-ben-pexels.jpg)

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- AVAX’s price action chalked a rising channel and an RSI divergence.

- AVAX’s Funding Rate and development activity declined.

Thanks to its January rally, Avalanche’s [AVAX] value doubled from $10 to over $20. At press time, AVAX was trading at $21.14 and seemed determined to continue with its surge.

Read Avalanche’s [AVAX] Price Prediction 2023-24

However, a key metric indicated an increasing divergence, which could suggest a possible reversal in the next few days/weeks.

AVAX recorded an RSI divergence: Is a price reversal likely?

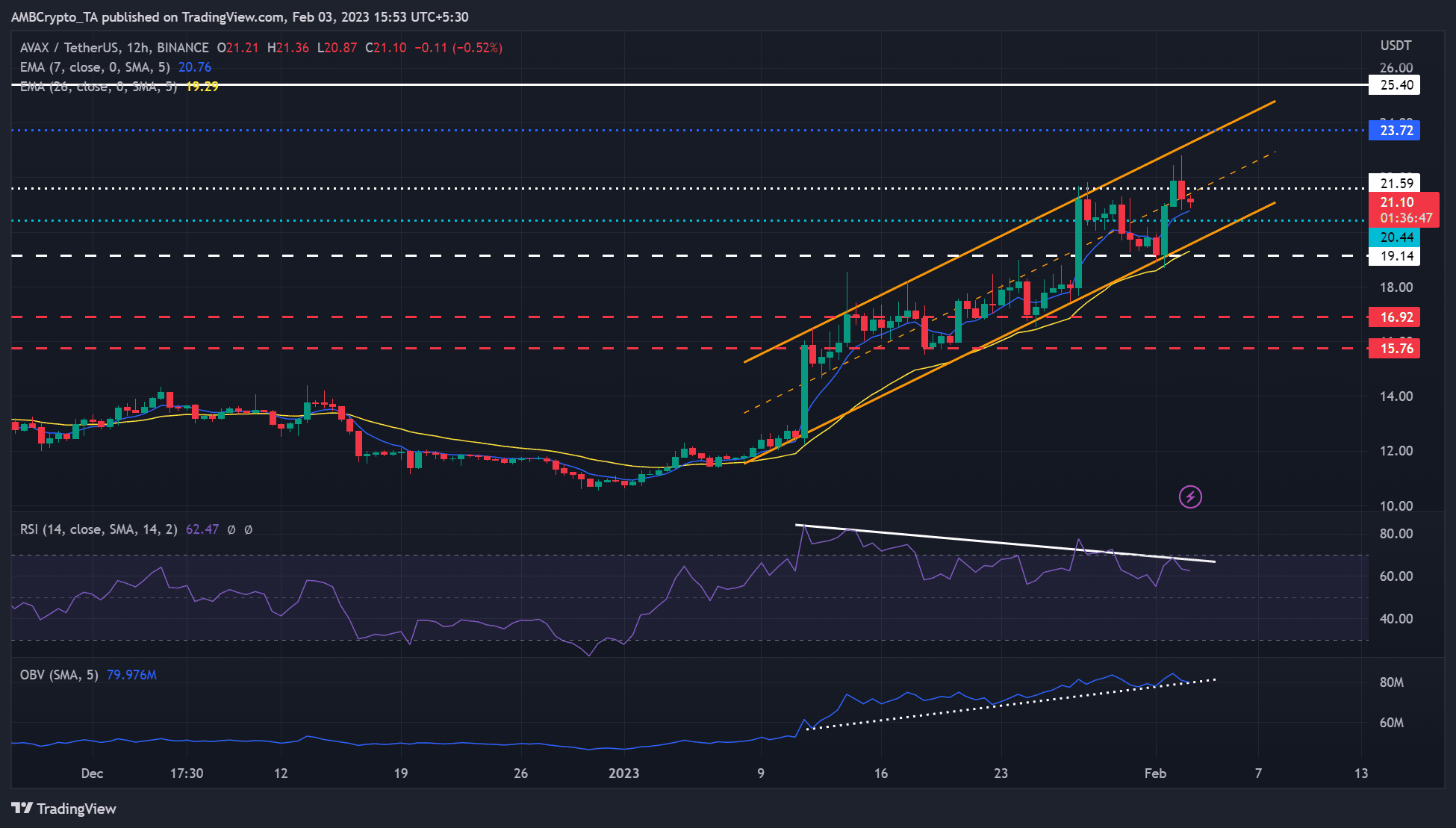

On the 12-hour chart, AVAX’s price action chalked a rising channel pattern since mid-January. Similarly, the On Balance Volume (OBV) made higher lows, indicating that trading volumes and demand for AVAX increased in the same period.

However, the Relative Strength Index (RSI) declined in the same period, indicating a divergence that could point to a likely reversal in a few days or weeks. In such a case, AVAX could drop below the rising channel to the support range of $15.76 – $16.92.

But the drop could first be stopped by the channel’s lower boundary or by the 26-period EMA before hitting the range support.

However, the above bias would be invalidated if AVAX sustained its price action in the rising channel in the next few weeks. It could set AVAX to reclaim the $25.40 zone, a key price level in July 2022.

AVAX’s Funding Rates and development activity declined

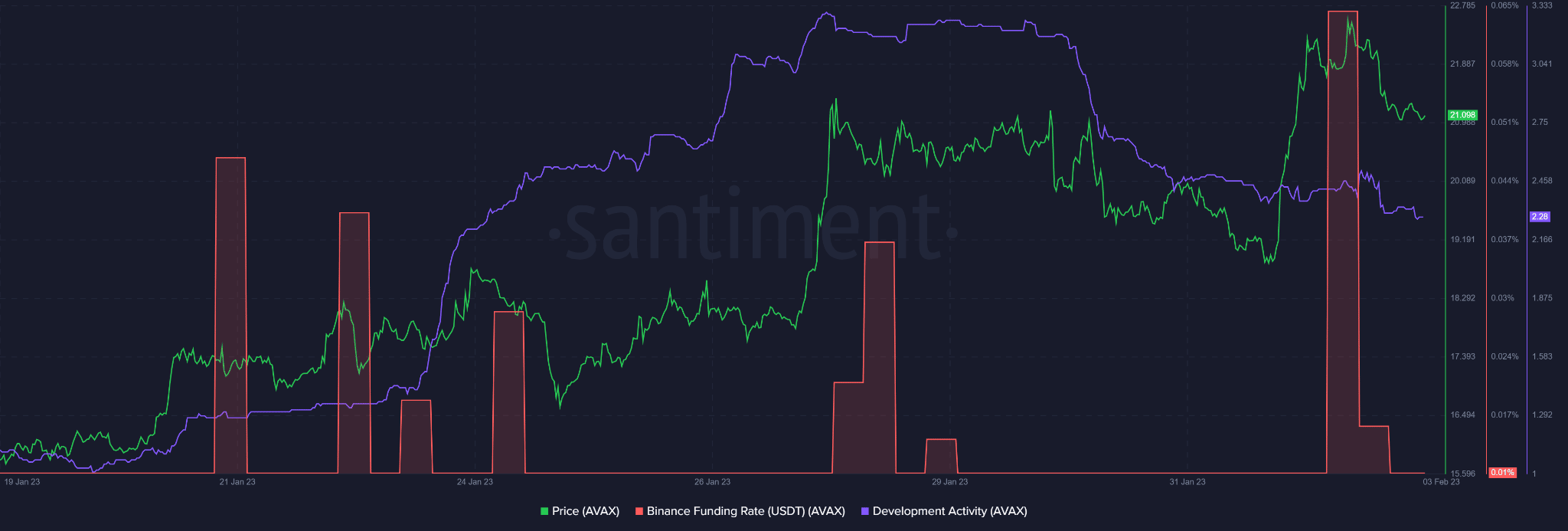

As per Santiment, AVAX’s development activity declined after peaking at the end of January 2023. The drop could undermine investors’ assurance and confidence in the asset, which could negatively affect the token’s value in the long run.

Similarly, AVAX’s Funding Rate dropped sharply by the end of last month, suggesting a decline in demand for the asset in the derivatives market. The metric could undermine a strong uptrend momentum, which could tip bears to gain leverage.

How much is 1,10,100 AVAXs worth today?

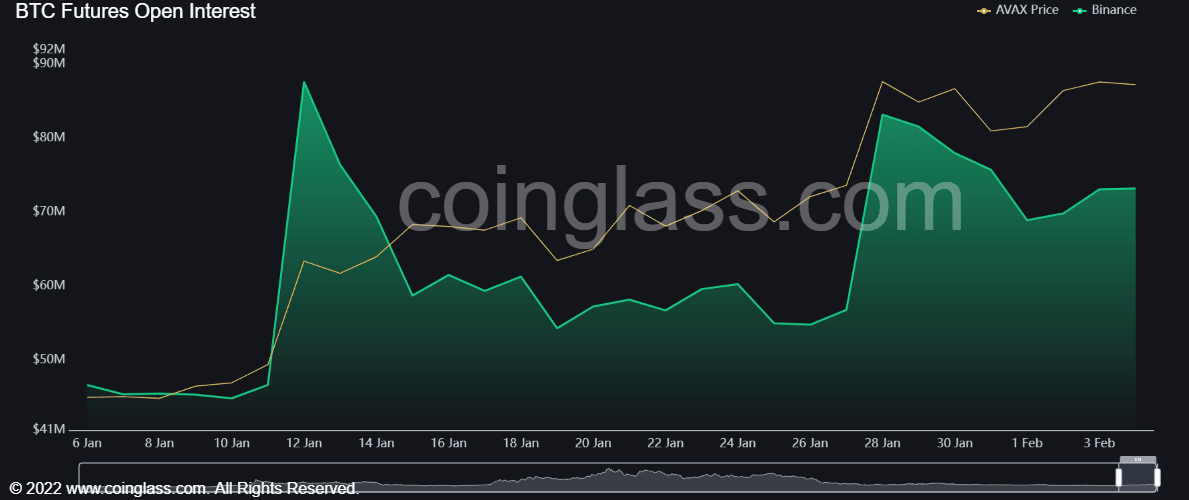

AVAX’s Open Interest (OI) rates reinforce the above trend. As per Coinglass’ data, AVAX’s Open Interest rate has been gradually increasing since February 1, indicating that more money flowed into AVAX’s futures market. But the increasing OI momentum slowed by press time, which could further undermine a strong uptrend.

But if Bitcoin [BTC] surges above $23.5k in the next few days/weeks, AVAX could aim at the $25 zone, invalidating the above bearish bias.

![Three days ago, Uniswap [UNI] attempted a breakout from a parallel channel, surging to hit a local high of $7.6. However, the altcoin faced strong rejection.](https://ambcrypto.com/wp-content/uploads/2025/06/Gladys-83-400x240.jpg)