The Graph [GRT] market weakened – Can $0.1723 support hold?

![The Graph [GRT] market weakened - Can $0.1723 support hold?](https://ambcrypto.com/wp-content/uploads/2023/02/nicholas-cappello-Wb63zqJ5gnE-unsplash-1-scaled-e1675938568623.jpg)

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- GRT recorded a sharp drop as bears took control of the market.

- Short-term sell pressure was still high at press time.

The Graph [GRT] hit a crucial support level, but the prevailing sell pressure could undermine a strong recovery. GRT faced price rejection at $0.2321, ushering in bears. So far, GRT has fallen by over 25%, from $0.2321 to $0.1674.

Read The Graph [GRT] Price Prediction 2023-24

At press time, GRT traded at $0.1761 and exhibited a mild bullish momentum which could stifle given the low trading volumes and increasing short-term sell pressure.

Can the 50% Fib level of $0.1723 hold?

The recent drop hit the $0.1674 level but found a temporary hold at the 50% Fibonacci level of $0.1723. At press time, the decline in trading volumes weakened buying pressure and the market structure.

How much are 1,10,100 GRTs worth today?

Therefore, GRT could oscillate between 50% ($0.1723) and 61.8% ($0.1864) Fib levels in the next few hours. However, bulls must deal with the hurdle at $0.1776.

Notably, the Relative Strength Index (RSI) retreated but was still bullish at 57 units. But the Chaikin Money Flow (CMF) exhibited a sideways movement above the zero line, showing a battered but steady market that could enter a price consolidation.

Alternatively, the trading volumes could decline further, tipping bears to break below the 50% Fib level. Such a move would invalidate the bias described above. The downtrend could be kept in check by $0.1674, 38.2% or 23.60% Fib levels.

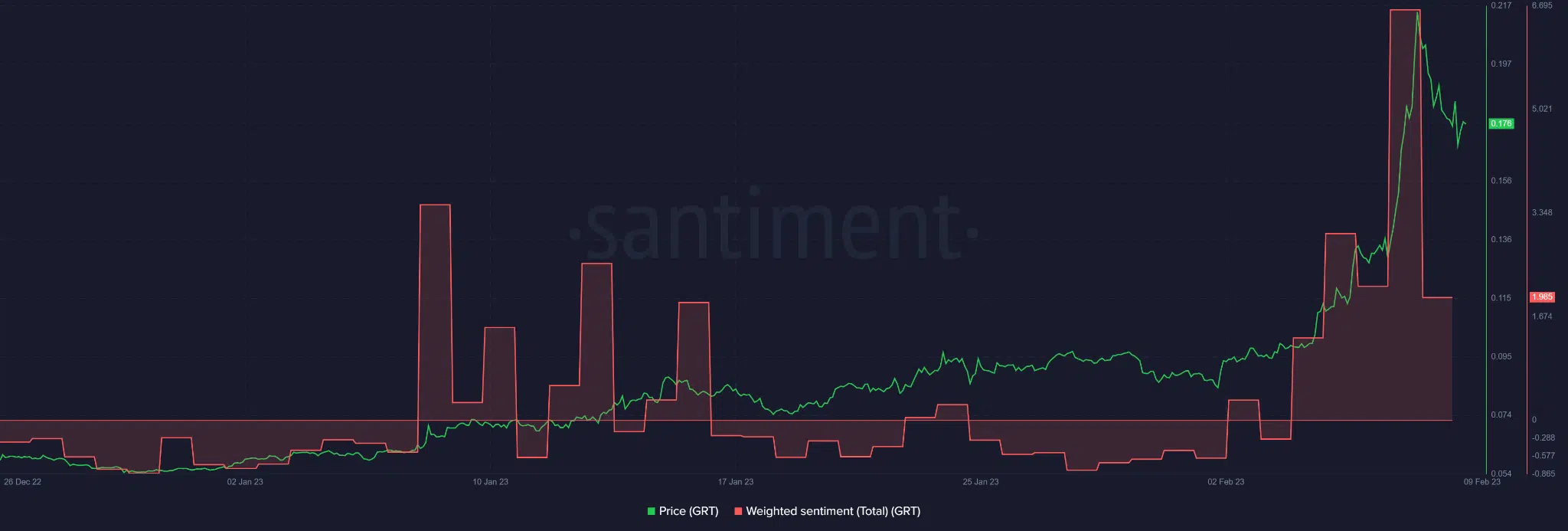

Sentiment dropped as GRT’s short-term selling pressure increased

As per Santiment, GRT saw a sharp drop in weighted sentiment, indicating waning confidence in the asset by investors. Nevertheless, the sentiment remained positive, further reiterating that GRT weakened but could attempt a recovery.

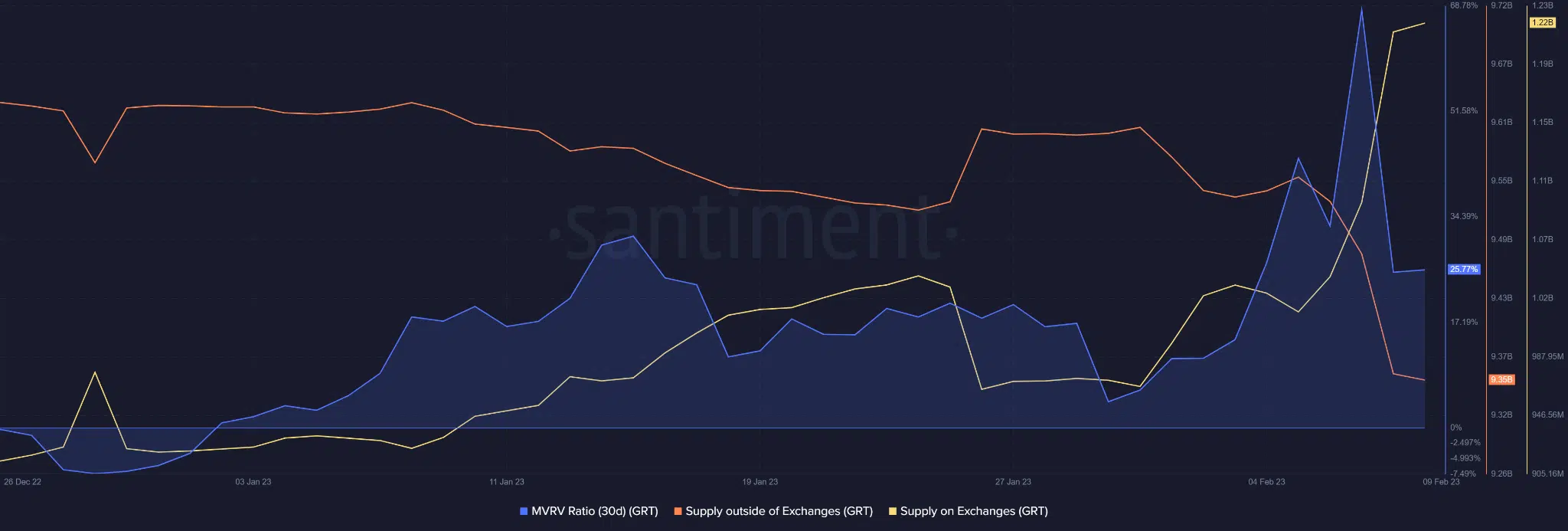

However, the recovery could be weak because of the short-term sell pressure witnessed at press time. Notably, GRT recorded a spike in supply on exchanges, indicating that more tokens were moved to exchanges for offloading, painting a short-term sell pressure.

On the other hand, Supply outside of exchanges declined, showing little demand for GRT at press time. As such, GRT’s possible recovery could be limited with a possibility of sideways trading. But a strong bullish or bearish BTC would invalidate the above bias as GRT will adopt a definite price direction based on the king coin’s movement.